Intel reported Q1 2024 earnings back in April. We are late with this analysis but we wanted to get it out all the same. Revenue was inline with guidance and net income and earnings per share beat that guidance. Do we think Intel is a buy? Maybe even though we couldn’t find a great deal to be bullish on, their on-going investments in foundries suggest Intel may have bottomed out.

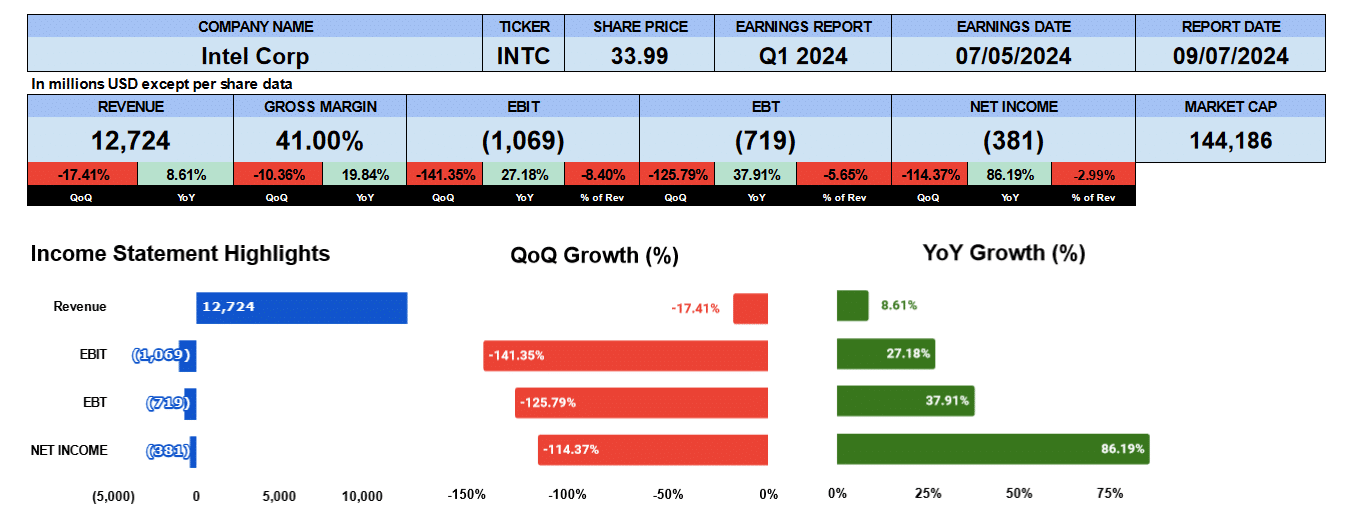

Revenue was $12.7 billion down 17.4% quarter over quarter, but it was up 8.6% year over year. Gross margins were 41% down 10% quarter over quarter, but up 20% year over year. Operating profit was negative $1 billion up 27% year over year with net income of $381 million dollars improved by 86% from Q1 2023. Intel’s market cap stands at $129 billion.

Intel Quarterly Revenue

Our income statement bar chart of the last nine quarters shows that year over year data was improved given that Q1 2023 was Intel’s poorest quarter in quite sometime losing nearly $2.8 billion. With sequential comparisons poorer, they reported $15.4 billion in revenue in Q4 2023. We can see that net revenue has been contracting by 4% since Q1 2022 where they earned $2 per share and had a gross margin of 50%. Gross profit is down by over 6%. Operating profits and net income growth is not meaning full as they went from a positive to a negative over the 9 quarters.

Intel Business Segment Revenue

Turning to the revenue by segment. Intel made changes to how it reports it’s business unit revenue to reflect it’s operating model so we didn’t include Foundry, Altera or Mobileye data. Intel’s client computing group continues to be the largest revenue generator reporting $7.5 billion or 63% of revenue, though that is down from 9.3 billion or 53% of revenue in Q1 2022. This business unit has been contracting by 2.3%. The Data Center and AI unit is down 7.4% in the last 9 quarters to $3 billion or 25% of revenue down from $6.1 billion or 35% revenue in Q1 2022. Intel is missing out on the AI boom. Networking and Edge came in at $1.4 billion or around 11.4%. contracting nearly 5%.

Intel Client Computing Group Revenue

Taking a closer look at the client computing group, their notebook business continues to dominate revenue, generating $4.7 billion last quarter, about 62% of revenue, contracting 2.6%. Desktop, earned $2.5 billion down by 78 basis points from Q12023. This is 33% of revenue. Intel is still very much a supplier to personal computers.

Intel Fundamental Valuations

Let’s look at some ratios. Shares outstanding were down by 18 million. Earnings per share was negative $0.09. Their Q4 2023 guidance was expecting a loss of $0.25. So believe it or not, this is better than expected. Sales per share were $3 down 17% sequentially but up 6.4% year over year. Cash per share is $1.63 slightly down sequentially but down by almost 18% from Q1 2023. Intel has $26 in book of value and it’s share price is just over $30. Giving us a P/B of 1.15. We should probably add a price to book value data point in the future. Earnings were negative, so the PE isn’t meaningful. Leverage ratios show the debt ratio at 0.25 and debt to equity at 0.43. Liquidity ratios look good. Current ratio at 1.6, quick ratio at 0.9 and cash at 0.25. Return on assets were negative 79 basis points and return on equity negative 1.38%. Return on capital employed was 0.3% and the return on invested capital data wasn’t meaningful.

The cash flow on the operating side was down 31% to negative $1.2 billion investing outflows were $2.6 billion, financing inflows were $3.6 billion primarily from long-term debt issuance and free cash flow to the firm standing at $7 billion. It’s still a strong number though down 16% over a year. Intel does pay a dividend of $0.05 which has a yield of 70 basis points though it hasn’t been growing. The enterprise value of Intel is $170 billion which is a 3.3 times revenue, 6.2 times EBITDA and 24.6 times free cash flow .

Intel Q2 Guidance

Intel provided Q2 guidance with revenue between $12.5 and $13.5 billion dollars and earnings per share of a negative $0.05. Not very impressive.

Intel Rating

Key takeaways on the pro side are free cash flow, though was down, still was good. Enterprise value multiple and price to book value multiple suggest perhaps Intel is undervalued. Maybe a potential takeover target though we’d need to check the shareholder structure and any poison pill provisions. Intel has been investing billions in foundries and looks to be preparing for the future. McKinsey expects the semiconductor industry to grow by 7% to 2030 and perhaps Intel does too. Share price is trading just above the 2023 lows and this could be an interesting entry point. On the con side revenue, gross margins are contracting, their Client computing revenue, Intel’s bread and butter continues to decline. The AI business unit shows that Intel isn’t participating in this industry boom. Given where the share price is we wouldn’t sell it if we owned it but we’re giving it a neutral rating.

We have no exposure to this company.