Apple’s third quarter saw lower iPhone sales but that was offset by service revenue, wearables and iPad beating revenue expectations. iPhone sales are expected to pick up with the release of version 16 incorporating artificial intelligence. iCloud, Apple Pay and Apple TV as part of the service segment, beat expectations, making for the possibility of accelerating revenue in Q4 and the Christmas quarter.

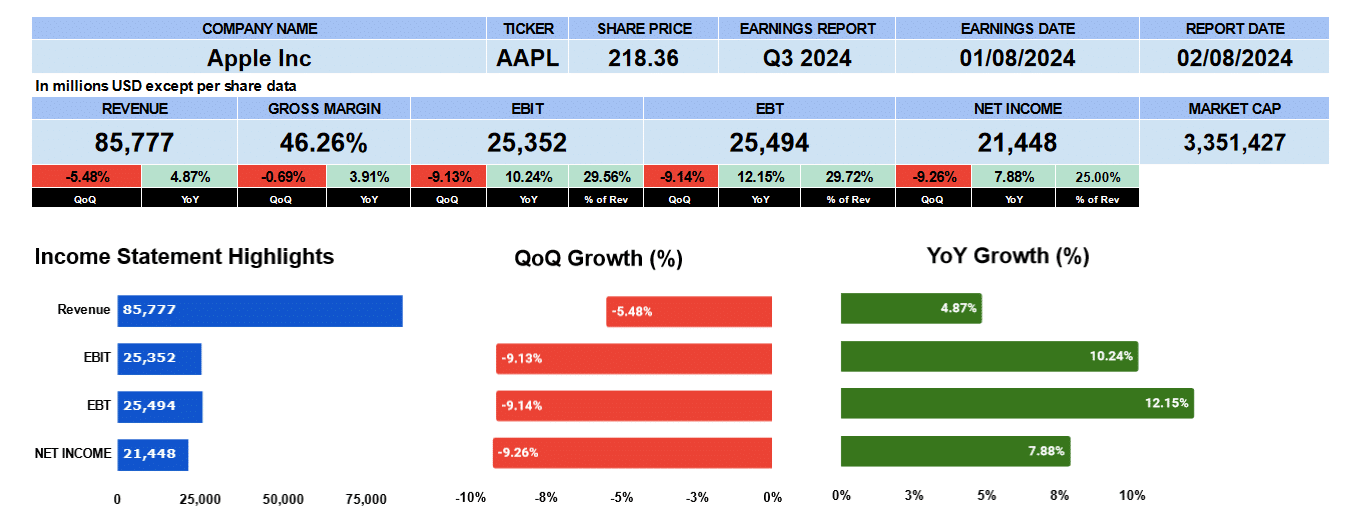

Revenue was the highest third quarter to date at $85.8 billion down 5.5% sequentially but up 5% from Q3 2023. Gross margins remained strong at 46.3% slightly lower quarterly but up 4% annually. Operating profit was more than $25 billion lower by 9% from last quarter but up 10% yearly. This is an operating margin of 29.6%. Net Income was $21.4 billion again lower sequentially but up 8% from Q3 2023. Net profit margin is 25%.

Apple Quarterly Revenue

Looking at Apple’s quarterly income statement revenue we can see how cyclical their revenue is. Net revenue has been growing by 37 basis points in the last nine quarters. Gross profit by 112 basis points. Operating profit by 105 and net income 110 basis points. Apple continues to improve.

Apple’s Revenue by Business Unit

Let’s look at Apple’s revenue by business unit. iPhone in blue generated $39.3 billion or 45.8% of revenue. This is down 14.5% sequentially and 94 basis points from Q3 2023. Growth in the last 9 quarters has been lower by 38 basis points as their flagship product struggles. iPhone 16 release should help boost this segment in the coming quarters, however. Services in orange one of the bright spots of the earnings report continues to grow earning a record $24.2 billion or 28.2% of total. That’s up 1.5% quarterly and 14% annually. Growth since Q3 2022 has been 2.4%. The earnings call revealed that their are more than 1 billion paid subscriptions in Services. The green area represents wearables, home and accessories which was up 2.3% quarter over quarter but down 2. year over year earning slightly more than $8 billion and 9.4% of sales. Overall growth has been flat. iPad in yellow has been performing well since the new iPad Pro and Air launch. Sales jumped to more than $7.1 billion up 29% sequentially and 24% year on year though overall growth has been flat. This segment represents 8.3% of revenue. The Mac segment continues to struggle posting $7 billion shown in red or 8.2% of total sales. It was down 6% from last quarter but up 2.5% from last year but has been contracting by 57 basis points in the last nine quarters.

Apple’s Revenue By Geography

Revenue by geography for Apple shows the Americas, in blue, as the biggest market and the only one that grew this quarter earning $37.7 billion. That is 43.9% overall. Americas was also up year over year by 6.5% but with no growth since Q3 2022. Europe, shown in red, is the second largest generating less than $22 billion down by over 9% from last quarter though up 8.3% from last year. Overall revenue expansion is 1.4%. Yellow is the greater China geography posting $14.7 billion down by over 10% and 6.5%, respectively. The earnings call indicate that foreign exchange was partly to blame for the lower revenue. Japan, in green, is Apple’s smallest market representing 5.9% of sales. They reported just over $5 billion down 18.6% quarterly but up 5.7% annually. Sales overall were trending lower by 73 basis points. APAC at $6.4 billion or 7.4% of revenue was down 5% sequential but up 13.5% year over year. Growth in that market has been just 43 basis point overall.

Apple’s Fundamental Valuations

Let’s see what the fundamental valuations show. Earnings per share was $1.40 beating expected of $1.34. Apple’s PE is 33.2 compared to the S&P500 at 28.46. The PEG ratio is -1.42. Sales per share were $25.12 giving us a price multiple of 8.7. Book value is $4.35. Apple has a relatively low shareholder equity. The company trades at a 50 multiple. Cash per share is $1.67 and if you include marketable securities that jumps to $4.03 per share. Apple also has $91 billion in long term investments. Price to cash ratio is 131 or 54.

The debt ratio is 0.21 and debt to equity is 1.34. Apple is carrying more than $86 billion in debt on the balance sheet though that is down $5 billion from last quarter. Apple’s current ratio is 0.95, quick ratio 0.64 and cash ratio 0.19.

Return on assets were an impressive 31% and return on equity was 152%. Return on capital employed was 60% and return on invest capital was 62%.

Apple’s cash flow is no slouch either. Operating cash flow at $91 billion, investing in flow was $1.5 billion and financing outflow was $97 billion. They bought $70 billion worth of common stock last quarter. Free cash flow to the firm is $85 billion or a 39.5 multiple to price.

Apple paid a 25 cent dividend yielding 46 basis points and growing at 3.8%. This is a pay-out ratio of 18.2%

Apple’s enterprise value is $3.4 trillion. This give us 9 times multiple to revenue, 26.4 times EBITDA, 28 times to EBIT and 40 multiple to free cash flow.

Apple’s Q4 2024 Guidance

Apple provided guidance in the earnings call expecting revenue to grow by the same amount year over year as this quarter or about 4.9%. Gross margins are expected to come in at between 45.5 to 46.5%. Operating expenses around $14.3 billion. They gave 16.5% as the tax rate where we arrived at an earnings per share of $1.57 or a forward PE of 33.

Apple’s Rating

Key takeaways from the report on the Pro side the revenue was good, growing year over year. Margins continued to be strong. They have a lot of cash and great cash flow. The services segment, as a high margin business continues to grow along with iPad and Wearables. They lowered their debt. On the Con side the multiples seem rather high but a premium stock commands a premium price. They are putting their hopes into iPhone 16 launch. How well will it be received? Foreign exchange is expected to cost 1.5% of revenue going forward.

We give Apple a neutral rating. We see services revenue expanding but the iPhone 16 is the wild card. We have no exposure to this company.