Alphabet reported second quarter earnings July 23 beating revenue and profit expectations. Google Cloud continues to be the best performing segment with Ad and Subscription revenue building on momentum. With a PE below the SP500 and now paying a dividend, investors still weren’t happy.

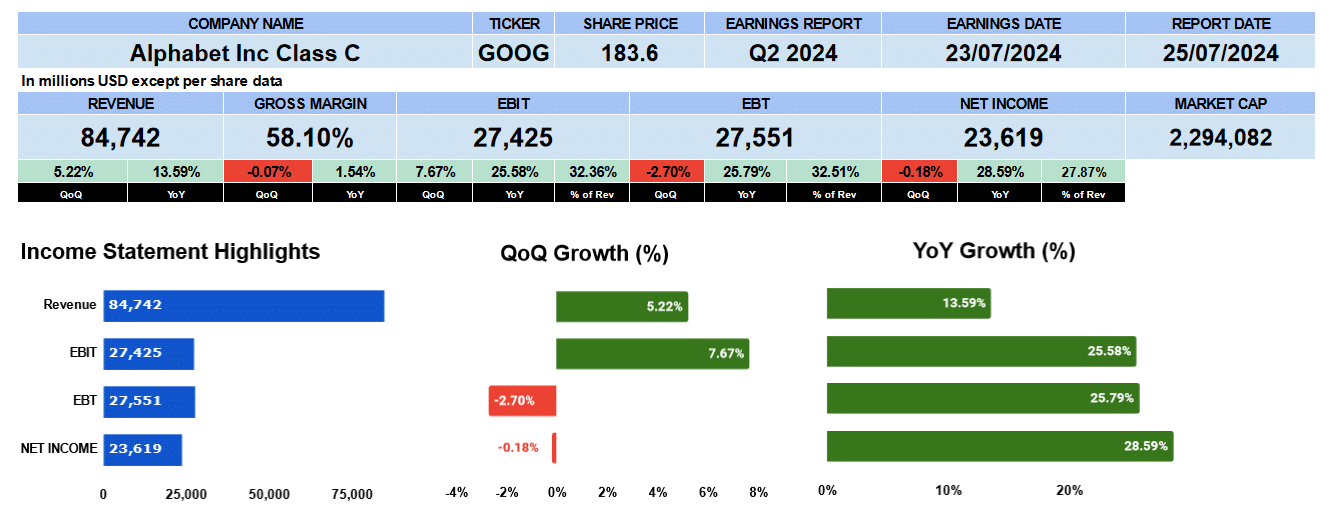

Revenue was almost $85 billion up 5% sequentially and 13.6% from Q2 2023. Gross margins remained buoyant at 58.1% slightly better year over year. Operating profit was $27.4 billion up 8% from last quarter and 25.6% from last year. Operating profit margin is 32.4%. The bottom line came in at $23.6 billion better by 28.6% with a net profit margin of 27.8%

Alphabet Quarterly Revenue

The nine quarter income statement bar chart gives us a nice snapshot of Alphabets steady performance. Revenue growing 2.2%, gross profit 2.45%, operating margin 3.9% and net income 4.4%. Not bad for a $2 trillion company.

Alphabet Segment Revenue

Revenue by segment for the last 9 quarters show Google Advertising, in blue, as the primary breadwinner. They reported $64.6 billion or about 76.7% of total revenue down from 81.4% in Q2 2022. Advertising was up almost 5% quarterly and 11% year over year having grown 1.5% in the last 9 quarters. Google’s subscription business line in red reported $9.3 billion up 6.7% quarter over quarter, 14.4% year over year and 4% overall. Subscriptions are 11% of revenue. Google cloud the best performing business line generated more than $10.3 billion or 12.3% of revenue up from 9.1% in Q2 2022. Cloud was up 8% from Q1, 29% from Q2 2023 and 5.7% overall.

Google Advertising Revenue

A deeper dive into the Google Advertising segment put Google search, in blue, at the top of the list reporting $48.5 billion or 75.1% of the segment up from 72.3% in Q2 2022. Search was up 5% quarter over quarter, 14% year over year and 2% for the last 9 quarters. YouTube ads earned almost $8.7 billion up 7% from last quarter, 13% from last year and 1.9% from Q2 2022. YouTube Ads comprises 13.4% of segment revenue. Google Network has been struggling with just 42 basis points better from Q1 but down 5% from Q2 2023. It is down 1.2% overall. This business line generated $7.4 billion or 11.5% of revenue.

Alphabet Revenue by Geography

The geographic footprint of Alphabet sees the United States, in blue, as the biggest market generating $41.2 billion or 48.7% of total. It’s up 6.4%, 17.5% and 2.6% respectively. EMEA, shown in red, earned $24.7 billion or 29.2% of total revenue. That’s better by 3.8% sequentially, 10.8% year over year and 2.1% in the last nine quarters. APAC in yellow produced $13.8 billion or 16.3% of global revenue. That’s improved by 4% from Q1, 8.6% from Q2 2023 and 1.9% from Q1 2022. Other Americas, in green, the smallest segment almost earned $5 billion about 5.8% of sales. Growth here has been 6.1% sequentially, 9.5% annually and 1.44% overall.

Alphabet Fundamental Valuations

Let’s look at the fundamentals now. Earnings per share were $1.89 when $1.84 was expected. Alphabet’s PE is 26.34 below the SP500 of 29.03 with a PEG ratio of 0.43. Sales per share were $26.27 up 5.5% and 16% giving us a price to sales of 7 times. Book value is $24.07 also improved. Price to book value multiple is 7.63. Cash per share is $2.18 and cash plus marketable securities per share is $8.06. Giving us a cash to price ratio of 22.8. Alphabet has huge short-term investments so it makes sense to include that in the ratio.

The debt ratio is 0.03 as Alphabet has very little debt. Debt to equity is 0.04. Interest coverage is 409 times. Short term liquidity ratios have the current at 2.08, quick at 1.9 and cash 0.35. Return on assets is 21%. Return on equity 29%. Return on capital employed is 29% and return on invested capital is 28%. Alphabet’s effective tax rate is 13.6% giving us a NOPAT of $84.6 billion and has an average debt and equity of almost $301 billion.

Huge cash flows from Alphabet. Operating cash flow at $26.6 billion, investing outflows of $2.8 billion. Cash outflow from financing was $21 billion. Google bought nearly $15.7 billion of stock. Free cash flow to the firm is $27.2 billion which is an 84 multiple to price.

Alphabet paid there first dividend of 20 cents, yielding 43 basis points, paying out 10.44%

The enterprise value of Alphabet is close to $2.3 trillion. This is 7 times revenue, 20 times EBITDA, 23 times EBIT and 83 times cash flow.

Alphabet Rating

Key takeaways from the report. On the Pro side, revenue growth across most businesses continues. Margins were strong. Lots of cash. Buying back more stock. Cloud keeps growing diversifying revenue from traditional advertising. On the con side we really couldn’t find anything weak about Alphabet’s business but perhaps the share price at all time highs and the governments trial on it’s alleged monopoly.

That being said we rate a Alphabet a buy. We do own some shares.