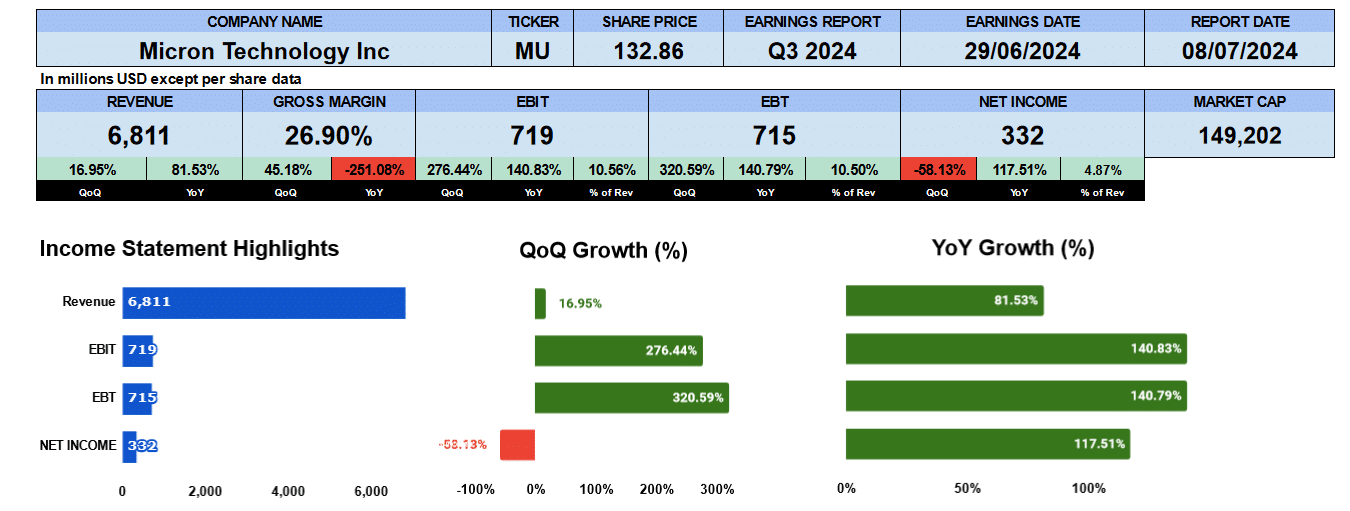

Micron Technology reported third quarter earnings June 26. Revenue beat consensus of $6.7 billion and was at the top end of company guidance. The market sold off on the news by 7% despite the positive results, but at a forward PE of 56, we think Micron is fully priced and needs some consolidation as these levels.

Revenue was above $6.8 billion up 17% quarter over quarter and 82% year over year. Gross margins came in at 27% better by 45%, sequentially. The year over year comparison had a negative gross margin, a testament to how poorly Micron was performing a year ago and how much it has improved today. Operating profit was $719 million up 276% quarter over quarter and 140% year over year. Producing an operating margin of 10.6%. The bottom line was $332 million down 58% quarter over quarter and up 117% year over year. In Q2 2024 Micron realized a tax benefit of $660 million inflating earnings last quarter.

Micron Technology Quarterly Revenue

Turning to the quarterly income statement bar chart, we can see the wilderness that Micron has recently emerged from. Starting in Q2 2023 to Q1 2024 Micron lost nearly $7 billion. AI demand will keep Micron on its current trajectory of profitability. Net revenue is down 2.6% on a compound quarterly basis from Q3 2022. Gross profits down 8.4%. Operating profit down 15% and net income by almost 21%. Next quarter, however, should see these growth rates turn positive.

Micron Technology Revenue by Business Unit

Looking at the revenue by business unit compute and networking in blue generated nearly $2.6 billion in revenue, or about 38% of total sales down from $3.9 billion or 45% in Q3 2022 growing by negative 4.5% though year over year nearly doubling. Their mobile business in red, reported almost $1.6 billion or 23% of revenue in this quarter, down from nearly $2 billion or 23% in Q3 2022. This unit has been contracting by 2.4%. They’re embedded business reported $1.3 billion or 19% of revenue showing here in yellow down from $1.4 billion in Q3 2022. Embedded has bean contracting by 114 basis points. The storage business is one of the bright spots for Micron. It has been growing by 10 basis points. Their solid state drives (SSDs) are in demand across artificial intelligence development and training. This segment grew 50% quarter over quarter earning nearly $1.4 billion though is only about 20% of total revenue. We’ll be watching how much Storage will contribute to the business in the future.

Micron Technology Revenue by Technology

Turning to revenue by technology. DRAM reported $4.7 billion or 69% of revenue down from $6.3 billion or 72.6% in Q3 2022. Their NAND business has also contracted 113 basis points though increased 20% quarter over quarter earning close to $2.1 billion or 30% of revenue.

Micron Technology Fundamental Valuations

Let’s look at some ratios. Shares outstanding actually grew by 9 million. Our reports are on a fully diluted basis making our estimates conservative. Earnings per share was $0.30 down 58% quarter over quarter and up 117% year over year. Sales per share were up to $6.10 better 16% sequentially and 77% year over year. Cash per share at $6.80 slightly lower. Book value not much change at $39.40. Micron has a PE of 116. Very high. The S&P500 PE is 28.77. The debt ratio is just 0.19 and debt to equity is 0.29. Interest coverage is 4.8 times.

The liquidity ratios look good. 3.4 for the current ratio, 2 for the quick and 1.1 for cash. Return on assets, however, we’re just 2% and return on equity only 3%. Return on capital employed negative 3% return on invested capital negative 3%. Some negative values are distorting these numbers, however.

Cash flow data is based on 9 months. Operating cash flow was $5.1 billion much improved from Q32023. Investing outflows were $4.7 billion. PPE investment was $1 billion lower than the comparable period. Financing outflows were $1.4 billion and free cash flow to the firm was down 18% to $7.7 billion mostly due to Micron having issued $6.7 billion in debt boosting last years free cash flow. Micron pays a dividend of $0.11 yielding 33 basis points with slightly negative growth because there’s more shares outstanding. The pay-out ratio is 39%. The enterprise value of Micron is $159 billion. That’s 5.8 times revenue, 12 times EBITDA and 20.8 times free cash flow.

Micron Technology 4th Quarter Guidance

Micron provided guidance for the next quarter. They’re expecting revenue to come in between $7.4 and $7.8 billion with the gross margin of 32.5 to 34.5%. Operating expenses to be $1 billion to $1.4 billion with the earnings per share between $0.53 to $0.69. Taking the midpoint of $0.61 annualized that gives us a forward PE of 56. Micron is fully valued.

Micron Technology Rating

Key takeaways are the solid revenue growth. Micron appears to be back on its feet including improving margins and fundamentals. They have lots of cash. The AI revolution is going to see growing demand for their high bandwidth memory products. On the Con side, the PE makes Micron expensive. Return on assets and return on equity are not very impressive. There are other companies

that have higher returns with the same sort of risk. Micron is trading near all time highs and we are reluctant to buy at these prices. Despite Microns position to reap the rewards of AI we feel the share price needs a correction so we’re giving Micron a neutral