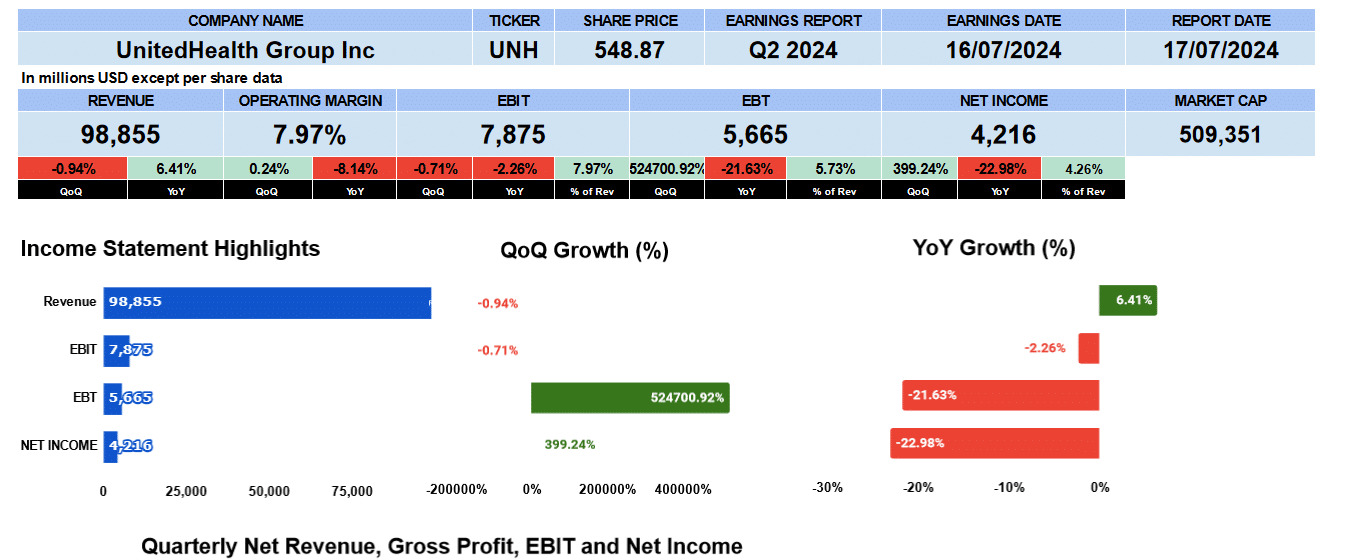

UnitedHealth Group reported second quarter earnings on July 16. Investors were happy putting the cyberattack and the cost of exiting Brasil behind them as the firm topped earnings forecasts. The market was expecting $6.66 per share and $98.7 billion in revenue.

Revenue came in just shy of $99 billion slightly down quarter over quarter, but up 6.4% year over year. Operating margins were nearly 8% slightly better sequentially, but down 8% year over year. Operating profit was $7.9 billion slightly lower overall. Net income reported $4.2 billion. Last quarter, UnitedHealth Group earned a loss of $1.4 billion so sequential data not meaningful but was down 23% year over year, which is about 4.3% of total revenue.

UnitedHealth Quarterly Revenue

Looking at the quarterly income statement data from Q2 2022 we can see net revenue has been growing by 2.3%. Operating profits by 1.1%. But net income is contracting 2% in the last nine quarters.

UnitedHealth Segment Revenue

Segment revenue of UnitedHealth Group are Optum and UnitedHealthcare, the two principal segments. United Healthcare in blue reported $74 billion in revenue, or about 54% down 1.7% quarter over quarter, but up 5.5% year over year. The segment has been growing around 2%. Optum, in red reported close to $63 billion or about 46% of total revenue. Quarter over quarter the segment grew 3%, 11.6% year over year and 3.8% in the last nine quarters.

Looking at the operating profit of these segments we can see quarter over quarter, UnitedHealthcare was down 9% as they’re experiencing rising medical costs. Year over year was also down 8% but overall, however, the business is growing by 44 basis points. Operating profit in Optum was up 10% quarter over quarter 4.7% year over year and it’s been growing by 1.9%. Optum continues to perform well.

UnitedHealth Optum Segment Revenue

Now Optum breaks down into further segments: Optum Health, Optum Insight, and Optimum Rx. Optum Health in blue is their second biggest segment reporting better than $27 billion which is 42.3% of revenue. This segment grew by 1.2% quarter over quarter, 13% year over year and it’s been expanding since Q2 2022 by close to 5%. Optum Insight, the smallest segment in yellow, reported $4.6 billion just 7% of revenue. This was the segment that bore the brunt of the cyberattack. As we can see, quarter over quarter revenue only grew by 91 basis points and down 2.8% from Q2 2023. It has been growing overall by 3.7%. Optum Rx in yellow, the biggest business within Optum reported $32.4 billion or 50.6% of Optum revenue. The segment has been their best performer up 5% sequentially, 13% annually, growing 3% since Q2 2022.

A closer look at the Optum segment operating profit. Optum health has the largest margins earning almost $2.1 billion or 44.7%. Growth has been good at 9.5% sequentially, 36% annually and 4.5% in the last 9 quarters. Optum Insight saw its operating profit jump back close to $1.2 billion with the cyberattack event behind it. Quarter over quarter was up 138%, 20% since Q2 2023 and steadily growing by 3.7%. Incidentally, UnitedHealth realized $1.1 billion of cyberattack costs in this quarter. Optum Rx improved as well earning $1.4 billion up 23% sequentially and almost 17% year over year 3.4% from Q22022.

UnitedHealth Fundamental Valuations

Let’s look at some fundamental valuations. Shares outstanding were up by 6 million. Earnings per share were $4.54 down 400% quarter over quarter, and 22% year over year. But without the cost of the cyberattack and the Brazilian write-down of $7 billion, adjusted earnings were $6.80. PE is 36.37 and that’s with the $4.54 earnings with the S&P500 at 29.61. We have a peg ratio of negative 4.4 as earnings growth contracted. Sales per share were $106 and a half dollars. Slightly lower quarterly but up 8% year over year giving us a price to sales of 5.2 times. Book value is $102 slightly better with a price to book value of 5.4 times. The earnings release from UnitedHealth Group didn’t provide marketable securities data but lumped it all into cash instead. So cash per share is $33.75 giving us a price to cash and marketable securities of 16.3 times.

Leverage ratios have the debt ratio at 0.22, debt to equity 0.67 and interest coverage at 8 times. Liquidity ratios show the current ratio at 0.88, the quick at 0.52 and cash at 0.30. Return on assets were 5.9% and return on equity 17.8%. UnitedHealth’s equity multiplayer is 3. Return on capital employed is 17.65%. Return on invested capital shows 14.6%. The firm’s effective tax rate is 26% giving us a NOPAT of $23.6 billion and their average debt and equity is $161 billion.

Looking at the cash flows, operating cash flow was down 40% to $6.7 billion, investing outflows were $7.4 billion and financing outflows $1.2 billion giving us free cash flow to the firm of $23.5 billion or a 22 times multiple to price. UnitedHealth pays a dividend of $2.09 yielding 1.5%, growing 12.2% and paying out 46%.

UnitedHealth’s enterprise value is $540 billion. That’s 1.4 times revenue, 13 times EBITDA, 17 times EBIT and 23 times free cash flow.

UnitedHealth Guidance

The company provided guidance, simply earnings per share for the full year. They’re expecting $15.95 to $16.40. Adjusted earnings, though without the cost of the cyberattack and the Brazilian write off, of $27.50 to $28 per share. Depending on which earnings per share you like the adjusted or the actual, the forward PE ranges from 34.4 to 16.

UnitedHealth Rating

Key takeaways. Revenue is growing, the PE and enterprise value, at least on the adjusted basis, look favourable. UnitedHealth pays a good dividend. They have lots of cash and free cash flow. On the Con side, however, the medical costs are weighing down the United Healthcare unit and they will need to improve margins. But that being said, we are giving UnitedHealth group a buy rating. We have no exposure to this company.