Apple reported their second quarter of 2024 on May 2nd. The market was happy but maybe it was counting its chickens before they were hatched. A record share buyback of $110 billion, the promise of their iPad launch dubbed “Let Loose” and the hype around the Worldwide Developers Conference on June 10th cloud the challenges Apple is facing. We’ll examine the latest earnings report, look at their segment revenue and growth, explore some valuations, delve into their limited guidance and cap it off with our rating.

Our Q1 2024 report “Have we reached peak Apple” is linked below.

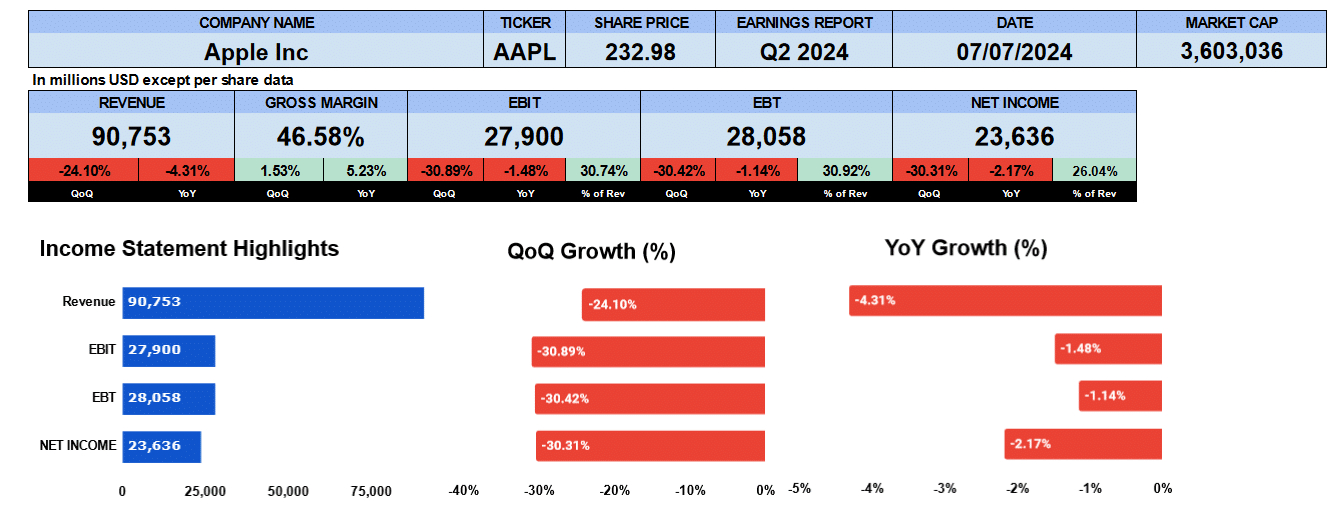

Apples revenues were 90.8 billion down 24% quarter over quarter and 4% year over year. The gross margins, however, were better to 46.6% improved by 1.5% quarter over quarter and 5% year over year. Operating profit was $27.9 billion down 31% quarter over quarter and 1.5% year over year that equates to a 31% operating margin. Apple’s bottom line was $23.6 billion down 30% quarter over quarter and 2% year over year Quarterly sales were down so much due to the Christmas quarter reported in Q1. We should also note that the extra day for leap year added about $1 billion in revenue to apple this quarter.

Apple Quarterly Revenue

Turning to the quarterly breakdown of the income statement we can see net revenue has been contracting by-0.8% over the last nine quarters. Gross profits have been flat, operating profit and net income have both been down 80 and 60 basis points respectively.

Apple Revenue by Segment

Lets look at the revenue by segment we can see that iPhone in blue is the dominant product reporting 46 billion in the quarter contracting 1% since Q2 2022. iPhone made up 52% of total revenue in Q2 2022 down to 50.6% in this quarter. Services in orage was the only bright spot growing 2% to finish the quarter at $23.9 billion. Services were 20.4% of revenue in Q2 2022 to 26.3% in Q2 2024. Next is Wearables, Home and Accessories in green finishing the quarter at $7.9 billion down 1.2 percent Mac computers in red reported $7.5 billion down 3.7% and iPad shown in yellow as their smallest business segment reported $5.6 billion down 3.5% from Q2 2022.

Apple Revenue by Geography

Turning to revenue by geography America’s in blue is the largest reporting $37.3 billion this quarter and is lower by 1% on a compound quarterly basis. Next was Europe in red, Apple’s second largest market. A bright spot, this zone actually grew by 0.4% to $24.1 billion. Greater China in yellow came in at $16.4 billion. Over the weekend all the pundits were worried about competitors and loss of market share in China but they make up only 18% of total revenue. Quarter over quarter was down 21% but was down 25% in Q2 2023 after that Christmas quarter and the shares were up $8 when they reported those earnings. Apple has plenty of upside if it can compete against the local favorites. Though revenue has been softer by 1.3% since Q2 2022. Asia Pacific in orange reported $6.7 billion and it’s down 1/2% since Q2 2022 and finally, Japan in green, their smallest market, reported $6.3 billion down 2.3 percent in the last nine quarters.

Apple Fundamental Analysis

Now lets look at some valuations. Share’s outstanding were down 112 million on a fully diluted basis that give us an earnings per share of $1.53. Sales per share of $5.90 both lower quarter on quarter and year on year. Cash per share was $2.11. Book value increased as well to $4.80. Apple has a PE of 29.8 and that is based on an earnings per share of $1.53 annualized to compare to the SP500 which has a PE of 27.3. Given how much growth has slowed this PE probably isn’t justified and that is supporter in the PEG ratio at 121.

The leverage ratios show debt at 0.27 and debt to equity at 1.24 the latest earnings showed a net interest income so we couldn’t find how much they’re paying out as interest the liquidity ratios look good current ratio 1.04 quick ratio 0.72 and cash at 0.26 turning to the return on ratios return on assets 28% return on equity 127.4% that gives us an equity multiplayer of 4.6 return on capital employed 13% and return on invested capital 11.2% as always Apple has great cash flow numbers operating cash flow was 62.6 billion investing in inflows were 1.6 billion financing outflows or 61 billion largely due to share buybacks in the quarter and free cash flow to the firm stood at 34 billion apples dividend is $0.24 yielding 1/2 a percent growing at 4.4% with a payout ratio of 15.7% they announced that they will increase their dividend to 25 cents a share they also share buyback of 110 billion the largest on record for any company apples enterprise value of 2.8 trillion that’s 7.7 times revenue 16.6 times EBITDA and 82.6 times free cash flow.

Apple Guidance

Turning to the guidance, not much was provided in the press release but we did find an article on CNBC that Tim Cook expects revenue to be in the low single digits for Q3. We can see it here in gray. At 1% growth that would give us $91.7 billion not much else to be said on guidance.

Apple Rating

The key takeaways. We like that the gross margins are up and improving at 46.6%, the most in several quarters. The services business continues to grow and be a larger part of Apple’s total revenue. The free cash flow enough said about that and of course the share buybacks will help the earnings per share share price. On the con side, it’s clear that iPhone is saturated. Whoever has one is going to have one. The growth has lacking for some time but it’s hard to grow a $3 trillion company. Apple has some legal issues the US Department Justice suing monopolistic practices. Europe fined Apple Euro 1.8 billion for anti-competitive practices. Apple faces strong headwinds. That being said we’re giving Apple a neutral rating. We have no exposure to this company.