Alphabet reported first quarter 2024 earnings April 25th topping expectations in total revenue, earnings, advertising revenue and its cloud business. The market sent the shares up over 10 percent. Rosy results but the competition is heating up with titans such as Microsoft, Amazon and late-comer TikTok.

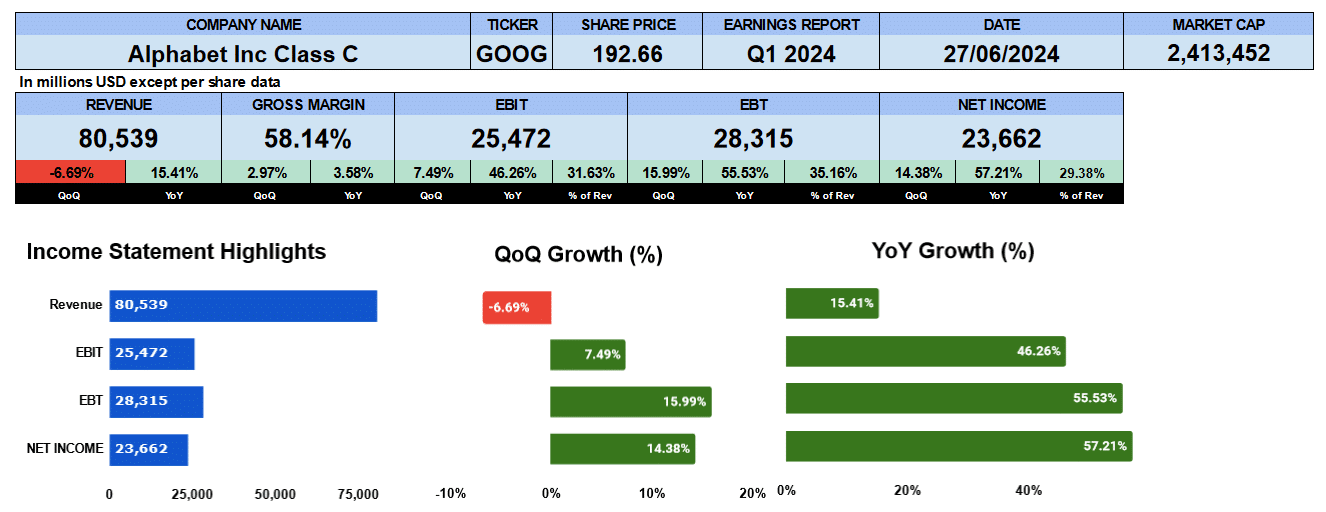

Quarterly revenue was $80.5 billion down nearly 7% quarter over quarter. That’s compared to the Christmas advertising peak Google experiences every year, but was up 15% year over year. Gross margins were 58.2%. A level not seen for quite some time up 3% quarter over quarter and 3.6% percent year over year. Operating profit was $25.5 billion up 7.5% quarter over quarter, and 46% year over year. Giving an operating margin of 31.5%. The bottom line was $23.6 billion up 14.4% quarter over quarter and 57% year over year or about 29.4% of total revenue.

If you’re curious, our full year 2023 report on Alphabet is linked below.

Alphabet Quarterly Revenue

Moving to our quarterly income statement bar chart we can see net revenue has been growing on a nine quarter compound basis by 1.9%. Profit has been growing at 2.2%. Operating profit at 2.7% and net income at 4.1%.

Alphabet Segment Revenue

Turning to the segment revenue we can see Google advertising is the primary business of Alphabet finishing the quarter at $61.7 billion. Which is about 77.1% of total revenue in Q1 2024 where in Q1 2022 Google Advertising was 81.2%. That’s been growing at a 1.4% compound rate. Next in red is Google subscriptions. It’s been growing at 2.8 percent to finish the quarter at $8.7 billion or 10.9% of revenue up from 10.1%. And lastly Google Cloud has been expanding at a 5.7% rate here in yellow reporting $9.6 billion or 12% of total revenue up from Q1 2022 where it was $5.8 billion or 8.7% of revenue.

Google Advertising Business

A more granular look at the Google advertising business shows Google search as the primary channel for advertising reporting $46.2 billion in the quarter or about 75% of Google advertising revenue. It has been growing 1.7% and is up from 72.5% in Q1 2022. YouTube Ads in red reported just over $8 billion or 13.1% of revenue up from 12.6% growing 1.8%. And Google Network in yellow earned $7.4 billion or 12% of revenue down from 15% in 2022 contracting by 1% on a quarterly basis.

Alphabets revenue by geography shows the United States in blue as their biggest market. It generated $38.7 billion or about 48% of revenue and has been growing at a 2.2% rate since Q1 2022. Next is EMEA in red. They reported $23.8 billion or 29.6% of total revenue. It’s been growing at a steady 1.8% clip. APAC has been growing around 1.3% finishing the quarter at 13.3billion or 16.5 percent of revenue. And finally, Other Americas, their smallest segment, has been growing by 2.2% and earned $4.7 billion.

Alphabet Fundamental Valuations

Well, let’s look at some valuations. Shares outstanding were down 75 million on a fully diluted basis. Earnings per share came in at $1.89 up 15% quarter over quarter and 61% year over year. Sales per share were $6.40 down 6% quarter over quarter but up 18% year over year. Cash per share came at $1.96 better both quarterly and year over year. Book value increased as well to $23.40 up 4% and 17%, respectively. Google’s PE is 22.7 but that was annualized using their $1.89 earnings and it is slightly higher. The SP500 is 26.92. The PEG ratio is 0.37. Alphabet has very little debt as we can see in the leverage ratios. Debt ratio 0.03, debt to equity 0.05. With low debt comes big interest coverage. That just means that their interest payments are covered 271 time by operating profit. Alphabet has lots of short-term liquidity. Current ratio 2.15, quick ratio 1.98 and cash at 0.32.

Return on assets 23% and return on equity of 32% give us an equity multiplier of 1.39. Return on capital employed was 7.7%. Return on invested capital 7.6%. All very good. Like most of the technology Titans cash flow is great. Operating cash flow came in at $29 billion. Investing outflows were $8.6 billion. Financing outflows, 19.7 billion mostly due to share buybacks and free cash flow to the firm stands at $24.5 billion. Looks good. Well, alphabet doesn’t pay a dividend, but that is about to change. They are going to pay $0.20 per share on June 17th. That is about a 11% payout ratio. The enterprise value of alphabet is $2.1 trillion based on that 6.6 times revenue, 11.4 times EBITDA and 86.8 free cash flow.

Alphabet Rating

Key takeaways. The gross margins are very strong. The best we’ve seen in quite some time. And the cloud business continues to be profitable and growing. Operating income more than quadrupled to $900 million in that segment. As always, free cash flow is strong. Google announced a $70 billion share buyback. And the dividend. Which is always good for shareholders and share price. On the con side, Google is in an increasingly competitive market. Amazon, Microsoft in the cloud space. TikTok and META in the video advertising space which could eat away at margins. Google has always had some legal headwinds on competitive market practices. But it seems all the big tech players have the same anti competitive issues.

As for our rating. we are giving a neutral to cautious buy. Shares are trading at an all time high, and we don’t like to chase shares. We’ll look for a pullback at some point. Remember the old saying, “Go away in May”. We have no exposure to this company.