Improved gross margins and lowered operating expenses were the catalysts to Amazon beating first quarter earnings expectations. Amazon earned 98 cents per share where Factset was looking for 84 cents.

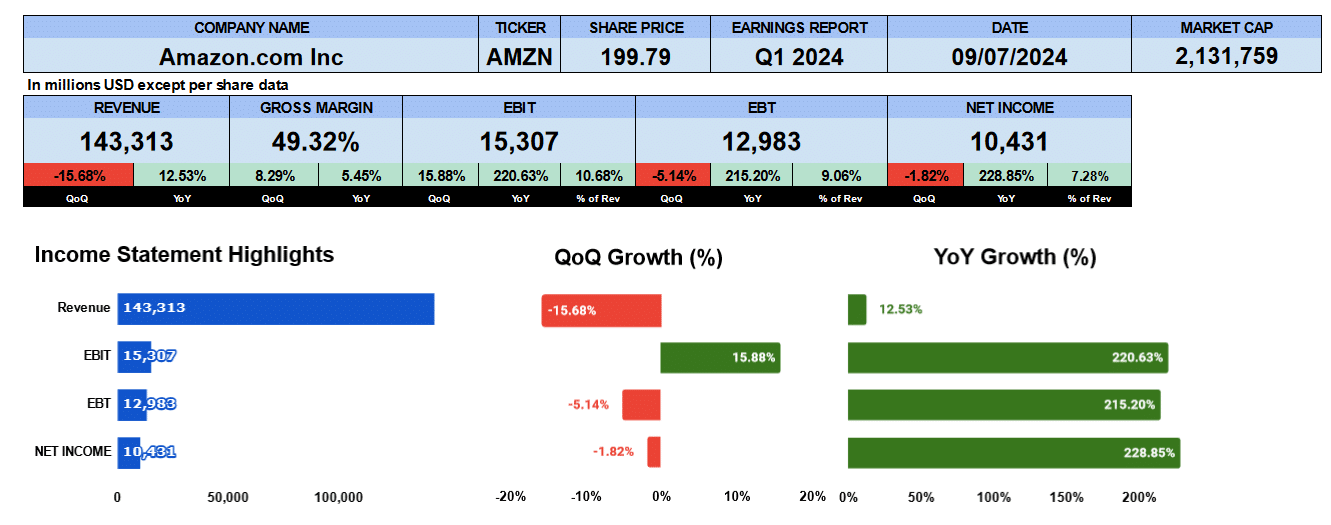

While Q1 2024 revenue was $143 billion up on a year over year basis by 12.5% it did include Leap Year giving them one extra day of sales. Revenue was down from the Christmas quarter by 15.7%. Gross margins were an impressive 49.3%. That was up 8% quarter over quarter and 5.5% year over year. These were the highest margins posted in a very long time. Operating profit was also better to $15.3 billion improved quarter over quarter by 16% and year over year by 220%. Equating to 11% of revenue. The bottom line was $10.4 billion slightly lower quarter over quarter by 2% but jumping 229% year over year or 7% of revenue. Good results.

If you are interested to watch our Full year 2023 report on Amazon I will link it below.

Amazon Quarterly Revenue

Looking at the quarterly data back to Q1 2022 we can see revenue has been growing at a 2.3% compound quarterly growth rate. Gross profits have also been growing by 4%. And operating profits an impressive 17.2% in the last nine quarters. The net income growth rate is skewed due to the fact that Q1 and Q2 2022 reported negative income. But if we remove those two quarters and only consider the last seven quarters net income growth has been 15.4% driven not only by AWS and Advertising but also 3rd party reseller and subscription revenue.

Amazon Revenue By Segment

Looking at the revenue by segment, North America is the dominant market for Amazon. Growth rate has been 2.5% in the last nine quarters reporting $86.3 billion in Q1 2024. The international business has been a bit softer only growing by 1.2% to finish at $32 billion. The AWS business has been growing the most expanding by 3.5% posting $25 billion in this last earnings report.

The headlines are giving all the credit to Amazon’s results primarily from AWS and the AI boom and their Advertising business, but we can see here that third party revenue and subscription revenue has been growing at a similar rate all at around 3.5% in the last 9 quarters. Its worth noting that Subscription, 3rd party, Advertising and AWS made up 52% of total revenue in Q1 2022 to 57.5% in Q1 2024. Clearly, Amazon’s online business is taking a back seat to it’s other business segments as it moves away from traditional retailing. That being said there online business reported $54.7 billion this quarter growing just shy of 1% on a 9 quarter basis. The 3rd party reseller business as the second largest segment posted $35 billion. AWS earned $25 billion this quarter with advertising and subscriptions coming in at $11.8 billion and $10.7 billion respectively.

Amazon Fundamental Valuations

Let’s look at some ratios. Shares outstanding grew in the last quarter by 60 million shares, or about a half a percent of the total float on a fully diluted basis. Earnings per share was 98 cents as we mentioned earlier. Sales per share were $13.4 dollars down 16% from last quarter but up 9% year over year. Cash per share came in $6.83 slightly lower on the quarter, but up 31% year over year. Book value improved to $20.30 both up on the quarter and year over year basis. The PE is 45.78. We annualized that with the 98 cent earnings. The S&P 500 is 27.24. PE growth is 0.21. The leverage ratios look good with the debt ratio at 0.11, debt to equity at 0.27 and interest coverage almost 24 times. Lots of short term liquidity. The current ratio 1.07, quick ratio at 0.87 and the cash at 0.48. Looking good.

The return on assets was 7.9% and the return on equity was 19.3% giving us an equity multiplayer of 2.45. Return on capital employed was 4% and return on invested capital 3.8%. Cash flows show operating cash flow almost 19 billion dollars, investing outflows were nearly 18 billion financing outflows were 1.2 billion with free cash flow to the firm at a solid $73 billion. Amazon isn’t paying a dividend, yet. The enterprise value of Amazon is 1.8 trillion that is 3.2 times revenue annualizing this quarters revenue. 6.5 times EBITDA, again annualized and 25 times free cash flow.

Amazon Guidance

Guidance for Q2 2024 was published in their press release saying that sales are expected to be between $144 to $149 billion or around 7 to 11% growth compared with Q2 2023. They noted that the leap year day added an additional 120 basis points of net revenue or close to $2 billion. Operating income is expected to be between $10 to $14 billion compared with $7.7 billion in the second quarter of 2023

Amazon Rating

Key takeaways from this report, on the pro side. We like the gross margins. At 49.5% its the highest it’s been in a long time. We’re expecting gross margins to continue to improve as Amazon moves into expanding its other businesses outside of online retail. We like the segment growth as each diverse business line continues to expand. $73 billion in free cash flow who can’t like that. The enterprise value valuations would indicate that Amazon is not over valued. Amazon has yet to pay a dividend though that may change with Meta opening the gates. On the con side we think the PE ratio is too high and would look for an opportunity to buy on a dip though a premium company commands a premium price. The leap year overstated revenue for this quarter, which could possibly make next quarter’s revenue look particularly weak. Share price. Amazon broke out to an all time high on April 11th of $189.77 surpassing its pandemic high. We are wary of chasing stocks. If Amazon dipped below 160 would be looking to enter into a position. That being said we’re giving Amazon a neutral to buy rating. Amazon has great future prospects but are cautious as the stock is trading at all time highs.

We have no exposure to this company.