Schlumberger announced first quarter 2024 earnings on April 19. Year over year results were positive continuing to grow, but quarter over quarter results were lower. Depending which media you consume earnings beat consensus expecting $0.75 or $0.69 per share. We’ll first look at the quarterly revenue breakdown, then revenue by segment and by geography. We’ll examine the fundamentals and valuations. Present Schlumberger’s guidance and then provide our rating at the end.

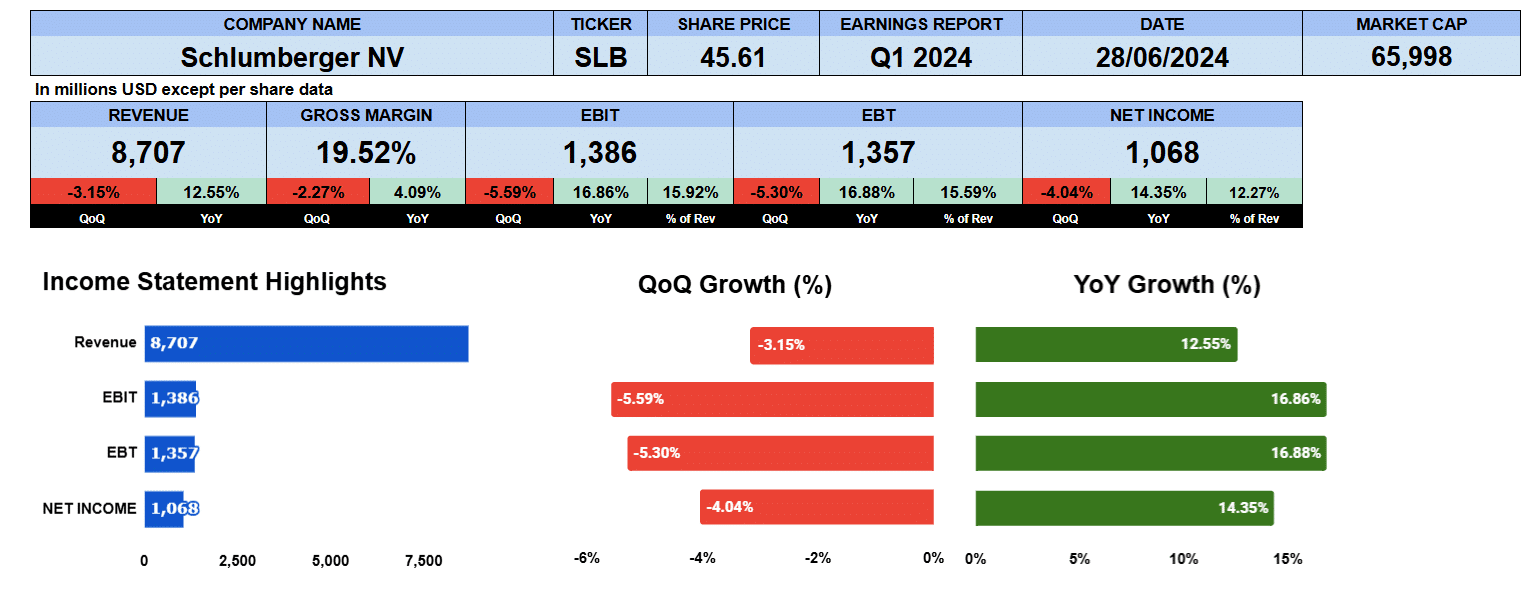

Revenue for the quarter was $8.7 billion. That was down 3% quarter over quarter, but up 12.5% year over year. Gross margins were slightly softer down 2.27% quarter over quarter to 19.5% though improved 4% year over year. Operating income was $1.4 billion down 5.6% quarter over quarter but up 17% year over year representing about 16% of revenue. Finally, income reported was over a billion dollars down 4% quarter over quarter but up 14.4% year over year or about 12.3% of total revenue. As we mentioned earlier the quarterly growth was all lower but the year over year growth was all higher.

Schlumberger Quarterly Revenue

Looking at our historical quarterly net revenue we can see that has been definitely uptrending. The latest quarter was softer at $8.7 billion. But, we can also see here in Q1 2023 that quarter was softer as well with respect to Q4 2022 indicating a seasonal or cyclical downturn. Net revenue has been growing at a 4.3% compound quarterly growth rate. Gross profits by 6.69%. operating profits up 7.7% and net income growing at 8.6%. Since Q1 2022. Good results. Good results.

Schlumberger Revenue by Segment

Turning to revenue by segment. We can see well construction in yellow has been Schlumberger’s big revenue earner ending Q1 2024 slightly lower to $3.4 billion. That’s a compound quarterly growth rate of nearly 4%. Production systems in green has been there largest growing business line expanding by 6.5% in the last nine quarters earning $2.8 billion. Reservoir performance in red expanded at a 4% clip finishing the quarter at $1.7 billion. And digital integration shown in blue, Schlumberger’s smallest business line, reporting 950 million growing only by 1.2%.

Schlumberger Revenue by Geography

Revenue by geography has the Middle East and Asia in green as the largest market reporting. just over $3 billion for Q1 2024. It’s been growing by 4.8% in the last nine quarters. Europe and Africa in yellow is their second largest geography by revenue reporting $2.3 billion growing by 5.8%. Latin America in red grew by 3.6 percent since Q1 2022. Earning nearly $1.7 billion. And North America, Schlumberger smallest geography here in blue yielded $1.6 billion and has been expanding by 2.5%.

Schlumberger Fundamental Valuations

Let’s look at some ratios. Shares outstanding grew by one million And that’s on a fully diluted basis. So all of our per share earnings numbers are based on that. Earnings per share came in at $0.74 down by 4% quarter over quarter, up 14% year over year. Sales per share were lower quarter over quarter by 3% and up 12.5% annually. Cash was $1.93 per share both slightly lower in the quarter and the year basis. Book value increased to $14.33 improving quarterly and annually. Schlumberger’s PE is 16.7. That’s annualized using the current earnings of 74 cents. This compares to the S&P 500 of 27.7. The PE growth is above one at 1.17 indicating that Schlumberger is over valued.

Turning to leverage ratios. Debt ratio is only 0.22, debt to equity is 0.5 and interest coverage is 12 times. Liquidity ratios look good. Current ratio 1.37, quick ratio 0.9 and cash 0.22 point to no short-term liquidity problems. Looking at the return on ratios, we can see return on assets of 9% was slightly better. Return on equity was 20.6%. Return on capital employed just 4% and return on invested capital at 3.25%. The cash flows show Schlumberger is in a good position with respect to cash. Operating cash flow was $327 million for the quarter, investing outflows were just $151 million. Financing outflows were $267 million with free cash flow to the firm at $2.8 billion year over year improved by 86%. Further reinforcing that Schlumberger has good liquidity. Dividend paid was $0.25. That’s yielding 2% on an annual basis, growing at 43.3%. And that is a payout ratio of 33%. They recently announced an increase in the dividend to 27 1/2 cents for the next quarter. A good dividend demonstrating future confidence in the business by management. Enterprise value for Schlumberger is $68.4 billion. That’s only two times revenue 10 times EBITDA and 6 times free cash flow indicating that perhaps Schlumberger is undervalued.

Schlumberger Guidance

Turning to guidance, the CEO indicated on their earnings call that they expect low single sequential growth. EBITDA is expected to be in the mid teen range. Based on the limited guidance information we didn’t include a net income or EPS estimate for Q2 2024.

Schlumberger Rating

Our key takeaways on the Pro side show strong valuations in terms of PE and enterprise ratios. Schlumberger has good cash flow, they are growing the dividend. We also like the acquisition of Champion X which should see annual revenue grow by $4 billion. The all share purchase will have a negative impact on per share earnings however. On the con side, revenue has been consistently growing but slowing. Oil prices have improved in the last 4 or 5 months but the firm hasn’t been able to capitalize on that. We give Schlumberger a buy rating.

We have no exposure to this company.