Home Depot reported Q1 2024 earnings on May 14th. They just missed revenue expectations by $200 million but reaffirmed their full year guidance. In the wake of higher interest rates, consumers have been putting off larger renovation projects impacting the bottom line of the home improvements retailer.

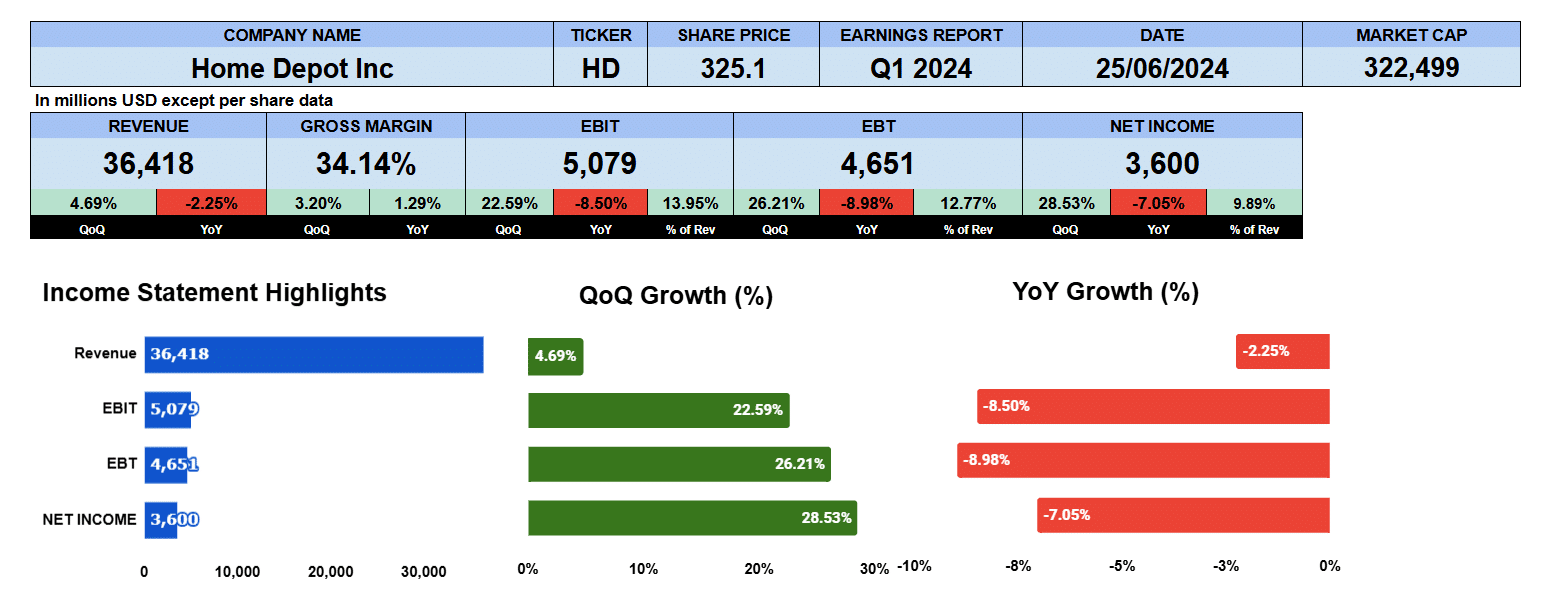

Home Depot reported revenue of $36.4 billion that was down 2% year over year but up 4.7% from Q4 2023. Gross margins were also improved to 34.1% up 3.2% sequentially and 1.3% year over year. EBIT was just over $5 billion down 8% year over year but up 22% quarter on quarter giving us an operating profit margin of 14%. Home Depot finished the quarter earning $3.6 billion dollars up 28.5% percent quarter over quarter but down 7% year over year which is nearly 10% of income.

Home Depot Quarterly Earnings

Turning to our nine quarter income statement bar chart we can see here that sales have been drifting lower with net revenue contracting 73 basis points, gross profits contracting 62 basis points, operating profits 170 basis points with net income 178 basis points. The Home Improvement market is struggling.

Home Depot Comparables

Comparable sales, transactions and average ticket data don’t look so impressive either. Comparable sales in blue continue to see a decline by another 2.8%. Transactions in red may have bottomed as the comparable data point was only negative 1.5%. Average ticket comparable in yellow performed well in 2022 but have struggled to increase these past 4 quarters.

Home Depot Revenue by Geography

Revenue by geography shows the US with the lions share at $33.4 billion but has been contracting by 83 basis points since Q1 2022. Outside the US, however, revenue has been growing by 43 basis points reporting $3 billion this quarter.

Product and Service segments have both been contracting by 73 basis points these last 9 quarters earning $35 billion and $1.34 billion. respectively.

Home Depot Revenue by Major Product

Revenue by major product line shows that building materials have been declining by 1.8% reflecting the housing market in the US. This segment in Blue reported $12.6 billion or 34.6% of revenue. Decor posted #12.3 billion or 33.9% of revenue contracting by 47 basis however. The Hardlines segment in yellow was the only growth segment up 29 basis point to finish the quarter earning $11.5 billion or 31.5% of the top line.

Home Depot Customer Transactions and Average Ticket Size

Customer transaction grew by 86 basis points this quarter to 386.8 million though have been contracting by 66 basis points in the last 9 quarters. The average ticket size was up also to $90.68 better by 2% sequentially but down 13 basis points since Q1 2022. Sales per squarer foot were $572.70 lower by 91 basis points overall but up 5.10% from Q4 2023.

Home Depot Fundamental Valuations

Turning to some valuations we can see earnings per share was $3.63 up 29% quarter over quarter but down 5% year over year. Sales per share were $36.70 up 5% sequentially and basically flat year over year. Cash per share was improved to $4.30 and has been growing steadily during this last year. Book value at $1.83 has also been improving this past year up more that 400%. Home Depot’s shareholder equity is quite low. Home Depot currently has a PE of 22.4 where the SP500 is 27.57. The peg ratio for Home Depot is negative 3.7 as trailing earnings growth has been negative. The leverage ratios show a debt ratio of 0.53 and a debt to equity of 23.11 which means they have $23 of debt for every $1 of equity. Their low shareholder equity makes this ratio rather large. Home Depot has an interest coverage is 10.5 times. The short term liquidity ratios have the current ratio at 1.34 the quick ratio at 0.34 with the cash ratio at 0.18. Return on assets were worse by 10% down to 18.2%. Not too bad. Home Depot’s low equity gives a return on equity of 791%. Return on capital employed is 39% and return on invested capital shows 36.7%. The effective tax rate is 23.6 giving us a NOPAT of $16.2 with an average debt and equity of $44 billion.

Home Depot’s cash flows look good. Operating cash flow was slightly lower to $5.5 billion, investing outflows were 830 million and financing outflows where $4.1 billion leaving free cash flow to the firm of $4.3 billion up 240% year over year. Home Depot pays a good dividend of a $2.25 which is a 2.8% yield growing at 7.5%. They are paying out 62% of net income. The enterprise value of Home Depot is $320 billion which only is 2.2 times revenue and only 6.4 times EBITDA and 75 times free cash flow.

Home Depot Guidance

Turning to the guidance they only have annual guidance so we have here Annual income statement data. Management guided revenue to be 1% ahead of 2023 but they also indicated that there is an extra week with which the company will earn revenue. Gross margins are expected to be 33.9% which is slightly improved. Operating expenses are guided to be 14.1% which gives us an earnings per share of $15.18 and based on today’s price that’s a forward PE of 21.4.

Home Depot Rating

Key takeaways on the pro side are the gross margins are improving. They are keeping costs in check while revenue year over year was lower though quarterly revenue was better. Home Depot pays a good dividend yielding 2.6%. The enterprise value ratio suggests that Home Depot may be undervalued. The $18 billion purchase of SRS Distribution will assist Home Depot to support their more professional clients. On the Con side revenue has largely been stagnant for the last three to four years. Comparable data continues to trend lower. The company has a lot of debt of around $42 billion putting interest costs at around $500 million quarterly. Inflation is keeping consumers from making those big ticket purchases though inflation has been cool. We do like the long term chart of Home Depot as it seems to be in a consolidation or accumulation phase but the home improvements retailer still faces some strong headwinds. That being said we’re giving Home Depot a neutral. We think at its current PE the company is fully valued.

We have no exposure to this company.