Broadcom reported Q2 2024 earnings on June 12. Though year over year revenue was up 43%, the other line items were down but the market overlooked that and sent the shares to all time highs. Demand for AI products continued to surge and a 10 for 1 stock split was announced propelling the stock price even higher.

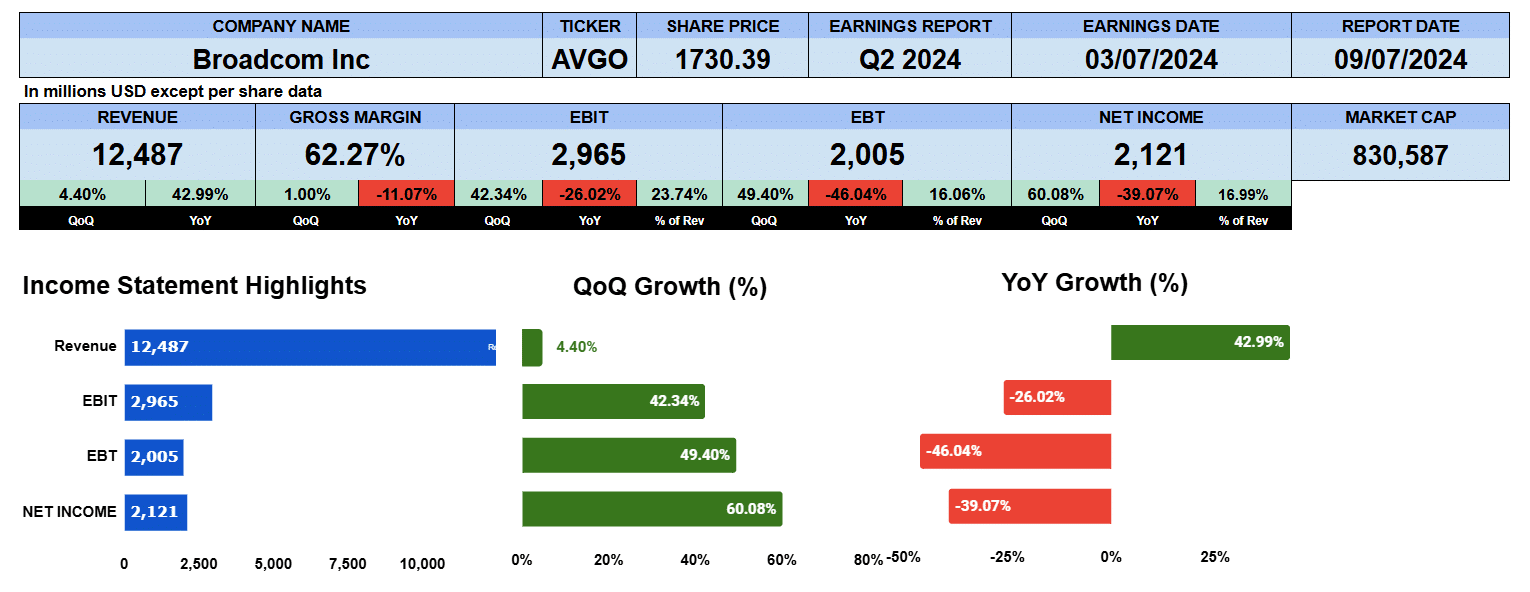

Q2 revenue was $12.5 billion up 43% year over year and 4.4% quarter over quarter. Gross margins were slightly improved sequentially but down 11% year over year to 62.3%. Their guidance calls for even lower margins to 61%. We’ll look at that later. Operating profit was just shy of $3 billion or about 24% of revenue lower by 26% year over year but up 42% quarter over quarter.

Net income reported $2.1 billion down 39% year over year but better by 60% quarter over quarter. That’s about 17% of revenue. The improved quarterly numbers reflect the impact the VMware acquisition has had on the income statement particularly with lower restructuring expense.

Broadcom Quarterly Income Statements

Looking at our quarterly income statement bar chart we can see net revenue has been growing by 5% and gross profit by 4%. However, operating profit has contracted by 1.5% and net income down 1.9%. Broadcom still has some work to do digesting VMware.

Broadcom Segment Revenue

Turning to the segment data, the Semiconductor Solutions business in blue reported $7.2 billion down slightly quarter over quarter and representing nearly 58% of revenue. However, their Infrastructure Solutions, in red, earned nearly $5.3 billion or 42.3% of revenue up 168% in the last 2 quarters as demand for AI products continues. This segment has been growing by 12.2% since Q22022.

Broadcom Fundamental Valuations

Let’s look at some ratios. We see here that shares outstanding on a fully diluted basis grew by 13 million shares. Earnings per share for Broadcom was $4.40 up 55% sequentially but down 45.8% year over year. Sales were $26 per share up by 2% quarterly and up 27% year over year. Cash per share was worse to $20.44 down both quarterly and year over year. Book value came in at $145.75 slightly down sequentially but up 182% year over year. Broadcom added a great deal of goodwill and intangible assets to its balance sheet with the acquisition of VMware. The current PE is 103.47 with the S&P500 at 28.44. The peg ratio is negative 7.5 as earnings haven’t been growing in the last 4 quarters. Looking at the leverage ratios, the debt ratio is 0.4, debt to equity 1.0 and interest coverage at 2.8. Broadcom took on over $30 billion of debt to purchase VMware. The liquidity ratios have the current ratio at 1.25, the quick ratio at 0.76 and the cash at 0.49.

The return on assets were just 4.8% and return on equity 12.1%. Broadcom’s equity multiplier is 2.5. Return on capital employed was 8.5% and return on invested capital was 12%. Broadcom’s effective tax rate is 6.1% giving us a NOPAT of $12.3 billion and they have an average debt and equity of $103.7 billion.

Free cash flow was still good though lower year over year. Operating cash flow was $4.6 billion, investing outflows were $706 million and financing outflows nearly $6 billion giving us a free cash flow to the firm of $9.8 billion down 15% year over year.

Broadcom pays a dividend of $5.09 which is a 1.1% yield growing at 13.6%. This is a payout ratio of 115%. They’re paying out more in dividends than they are earning per share. Broadcom’s enterprise value stands at $940 billion which is 18.8 times revenue, more than 30 times EBITDA and 96 times free cash flow. A little on the high side in our opinion.

Broadcom Guidance

The company did provide guidance for the full year so we have shown annual data here instead of the quarterly data. They increased their guidance and expect revenue of $50 billion and a gross margin of 61%. Their gross margins for the past several quarters have been in the high 60s so this is lower. We weren’t able to provide a forward PE given that we didn’t have enough data to come to an income per share.

Broadcom Rating

Key takeaways from the pro side, obviously the revenue is good and growing, free cash flow is still strong though weaker year over year. The share split of 10 to 1 will improve liquidity but stocks always go down after a split. The dividend for Broadcom is good though the payout ratio is not sustainable. Debt levels are high but management is taking steps to reduce that. On the con side, though they did raise the guidance, we didn’t think that the gross margins were impressive. The PE suggests share prices are too high, the enterprise value multiples are too high. Gross Margins as we said with their guidance at 61% isn’t as good as it was before though 61% is still a strong number. We will wait for the share price to settle after the split. Our rating for Broadcom is neutral.

We have no exposure to this company.