Palo Alto Networks, the cybersecurity firm, reported better than expected earnings and revenue on August 19. These were adjusted earnings as the company had a large tax provision in their favour which makes year over year growth look exceptionally large. Guidance for Q1 2025 was also better. The market was happy sending the share price up over 7%.

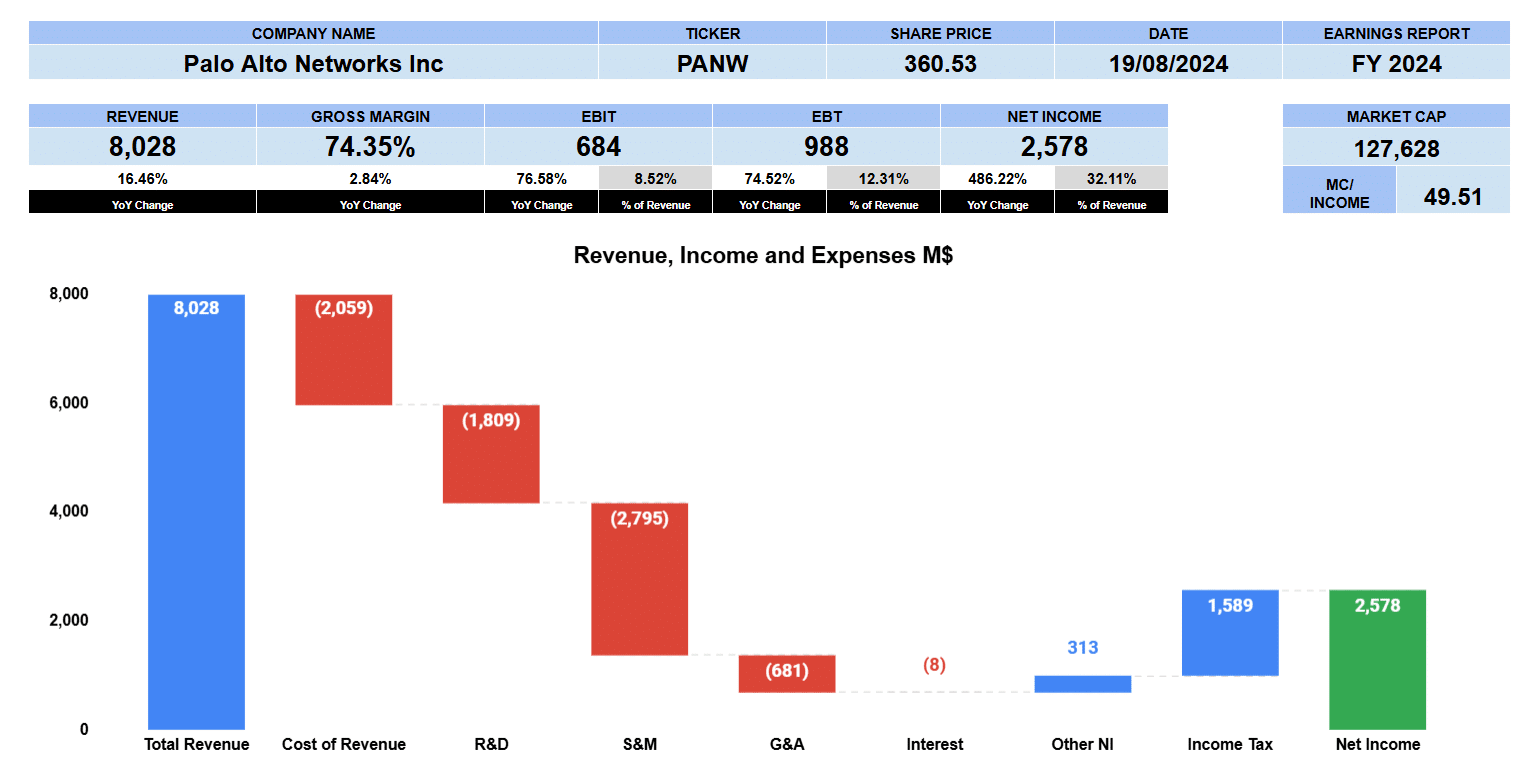

Full year revenue for Palo Alto was $8 billion up 16.5% year over year. Their gross margins also improved 2.8% coming in at 74.4%. Operating profit was $684 million up 77% giving us a margin of 8.5%. Net Income, primarily from a $2 billion tax credit was almost $2.6 billion or a 32% margin. Palo Alto’s market cap is around $130 billion which is about 50 times income.

The waterfall graph for Palo Alto shows where the costs and gains affected the bottom line. Cost of revenue was just over $2 billion. Research and developments was $1.8 billion. Sales and marketing is their biggest cost at $2.8 billion. General and administrative was $681 million. There was a small interest expense. Other income was $313 million. Income tax received was $1.6 billion pushing the bottom line up to $2.6 billion.

Palo Alto Networks Segment Data

Palo Alto segment data for the last five years shows us where the company growth has been the strongest. Its subscription revenue, in red, reported $4.2 billion up 24% in the last 5 years from $1.4 billion and 18% in the last 3 years. Support revenue in yellow is the second largest segment earnings $2.2 billion up 19% over the last five years and nearly 12% since 2022. Product revenue reported $1.6 billion up just 1.6% from last year growing 8.5% since 2020 and 5.6% since 2022.

Palo Alto Networks Fundamental Valuations

Let’s look at some fundamental valuations for Palo Alto Networks. Shares outstanding grew by 3.4%. GAAP earnings per share fully diluted were $7.28 up almost 500% but bear in mind the bottom line is inflated from that tax provision. This gives us a trailing PE of 50.6 compared to the S&P 500 at 29.24. The PEG ratio at 10.8 has earnings growth distorted. Sales per share was up 12.5% to $22.68 giving us 16 multiple of price. Book value grew quite alot year over year to $14.60. Price to book value is 25 times. Cash per share is $4.34 and cash plus marketable securities is $7.28 per share giving us a price multiple between 85 and 50.

The leverage ratios show debt ratio at just 0.05 and debt to equity of 0.19. Interest coverage is 82 times. Liquidity ratios show current at 0.89, quick ratio at 0.68 and cash at 0.34.

Palo Alto had a return on assets of 13% and return on equity of 50%. Return on capital employed is 5.6%. The effective tax rate was not realistic but if we look at their presentation they provided 22%. NOPAT is $533 million with debt and equity of $6.1 billion.

Let’s look at the cash flows. Operating cash flow was almost $3.3 billion. Depreciation and amortization was $283 million and stock based compensation of nearly $1.1 billion. Investing outflows were $1.5 billion with 156 million on PP&E. Financing outflows were $1.3 billion. Palo Alto spent $566 million on share buybacks. Free cash flow to the firm was up 18% to $3.1 billion. Price to cash flow is 42 times, Free cash flow yield is 2.4% and free cash flow margin is 38.6%. We think free cash flow is the best way to evaluate Palo Alto Networks and these valuations seem a little on the high side.

Palo Alto pays no dividend.

Their enterprise value is $128 billion or a 16 multiple to revenue, 133 times to EBITDA, 188 multiple of EBIT and 41.5 times free cash flow. We think these valuations are rather high.

Palo Alto Networks Guidance

Palo Alto Networks provided first quarter and full year guidance. They are expecting full year 2025 revenue to be $9.13 billion or up 13.5% year over year. Operating margin of 27.8% where it is just 8.5% in this report. Earnings per share are non-GAAP of $6.25 which gives us a forward PE of 59.

Palo Alto Networks Rating

Key takeaways from the report are the growing annual recurring revenue Palo Alto has on the books. The improved gross margins up 3%. They have lots of cash and are accelerating their share buyback next year.

The tax benefit they received might drive in buying from uniformed investors who look simply at the headlines. We think the Free cash flow and enterprise value multiples for Palo Alto are a little on the high side fully pricing in future growth and earnings.

We are giving Palo Alto Networks a neutral to a cautious buy rating. We have no exposure to this company.