Amazon reported second quarter earnings on August 1st. Revenue was below what The Street was looking for but EPS did beat consensus. The market wasn’t happy despite the overall growth right across their offering mix, selling the shares down at one point by more than 10%.

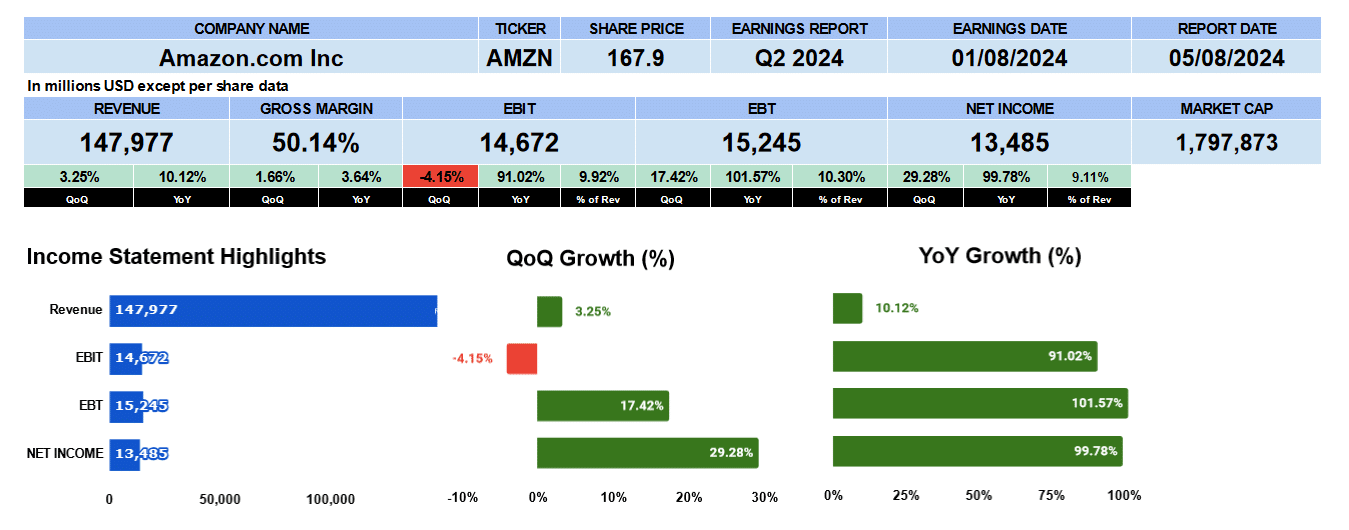

Revenue for the quarter was up 10% year over year and 3% quarterly to $148 billion. Gross margin surpassed 50%, the highest it has ever been. Operating profit reported $14.7 billion down 4% from last quarter as Amazon’s operating expenses increased by $4 billion but was up 91% from Q2 2023. That gives us a 10% operating margin. The bottom line was $13.5 billion up 29% and 100%, respectively or a 9.1% net profit margin. And The Street still wasn’t happy.

Amazon Quarterly Revenue

Quarterly income statement figures show us that net revenue has been growing 2.24% from Q2 2022, gross profit by 3.4%, Operating profit by 18%. In Q2 2022 Amazon lost $2 billion dollars. If we take the last 8 quarters net income has been growing by 21.3%.

Amazon Segment Revenue

Let drill down to the segment revenue. Online Store sales in blue is Amazon’s largest segment. It earned $55.4 billion up 1.3 % sequentially, 4.6% annually and over the last 9 quarters better by 95 basis points. Their 3rd party business in yellow generated $36.2 billion up 4% quarterly, 12% yearly and 3.2% overall. Advertising in green was Amazon’s best growing segment, not AWS, expanding 8% from last quarter, nearly 20% from Q2 2023 and by 4.3% in the last nine quarters. Look out Meta and Alphabet. Their subscription segment in orange has been growing by 1.3% , 9.8% and 2.4 %, respectively. It earned $10.9 billion. AWS, the cloud service, earned a record $26.3 billion up 5% sequentially, almost 19% year over year and by 3.2% overall.

Amazon Revenue By Geography

Amazon’s Revenue by geography shows North America in blue as their principle market earning more than $90 billion in Q2. Growth has been better than 4% sequentially, 9% year on year and 2.1% since Q2 2022. The International business, second in terms of revenue produced $31.7 billion slightly softer from last quarter by 85 basis points but up 6.6% compared to Q2 2023. Expansion overall in this segment has been 1.8%. AWS in yellow, as mentioned above continues to perform well.

Amazon Fundamental Valuations

Amazon’s fundamental valuations show that earnings per share were $1.26 up 28% and 95% respectively. Expected earnings were $1.03. Amazon has a trailing PE 40 times compared to the S&P 500 at nearly 28. The PEG ratio is 0.86. Sales per share were $56 slightly improved. Amazon has a price to sales of just 3. Amazon’s book value is $22 giving us a price to book of 7.6 times. Cash per share is $6.65 and with marketable securities it $8.32 giving us a price to cash somewhere between 20 and 25.

Leverage ratio have the debt ratio at just 0.1, debt to equity at 0.23. Interest coverage is 25 times. Liquidity ratio have the current at 1.1, the quick at 0.88 and the cash at 0.45. Return on assets were 8%. Amazon added a record $17.6 billion to its property plant and equipment this quarter. Return on equity was 18.8%. Return on capital employed was almost 14% and return on invested capital 16.7%. Amazon’s effective tax rate is 17.75%, which puts NOPAT at $44.7 billion and they have an average debt and equity of $267 billion.

Amazon’s cash flows look good. Operating cash flow was $25.3 billion. Investing outflows were $22 billion primarily from property, plant and equipment we mentioned earlier and $8.4 billion of share buybacks. Financing outflows were $4.5 billion. Free cash flow to Amazon is $7.6 billion. This is a price multiple of 234 times.

Amazon doesn’t pay a dividend.

The enterprise value of Amazon is $1.78 billion which is only 3 times revenue, 17 times EBITDA, 33 times EBIT and 232 times free cash flow.

Amazon Guidance

Amazon provided third quarter guidance with revenue expected to be somewhere between $154 to $158.5 billion. Operating income of around $13.3 billion. We used the effective tax rate above of 17.8% to come to an EPS $1.02 which gives us a forward PE of 39.

Amazon Rating

Key takeaways from their report. The revenue growth was good across all services. Margins were improving. The fundamentals look favourable. The PEG ratio below 1 shows earnings are growing faster than the price. Price to sales, cash and book value multiples look cheap. On the con side there wasn’t much other than the PE which makes the stock a little expensive. The capital expenditure, like most firms trying to capitalise on AI, might not justify future returns. Time will only tell.

We are giving Amazon a buy rating. We have no exposure to this company