Microsoft reported Q4 and full year 2024 earnings on July 30th. Revenue and earnings per share expectations were surpassed yet the market wasn’t satisfied. Quarterly growth of 29% in Microsoft’s AI business, Azure, wasn’t enough to keep analysts from questioning their CapEx investment.

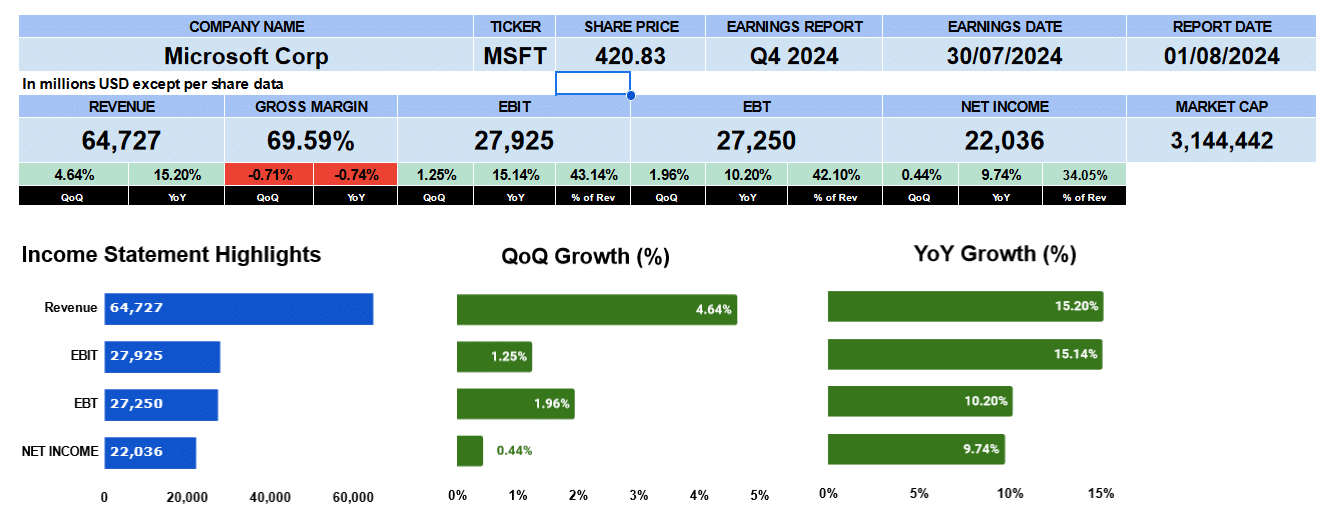

Fourth quarter revenue was almost $65 billion up 4.6% from last quarter and more than 15% from last year. Gross margins were slightly lower to 69.6%. Operating profit was close to $28 billion up 125 basis points from Q3 and 15% from Q4 2023 giving us an operating profit margin of 43%. The bottom line reported $22 billion up 44 basis points sequentially and 9.7% annually. Net profit margin is 34%.

Microsoft Quarterly Revenue

Microsoft’s quarterly revenue shows that net revenue has been growing for the last 9 quarters by 2.5%, gross profits by 2.7%, operating profit by 3.5% and net income to 3.1%. Steady, scalable growth.

Microsoft Revenue by Segment

Revenue by business unit has Intelligent Cloud in red, Azure and AI primarily, reporting $28.5 billion or 44.1% of revenue. This segment grew by 6.8% from Q3, 19% from last year and by 3.6% in the last 9 quarters out pacing the other revenue channels. Productivity and Business Processes shown in blue earned $20.3 billion up almost 4% sequentially, 11% annually and 2.3% overall. This segment is 31.4% of total revenue. In yellow we have More Personal Computing generating almost $16 billion or 24.6% of revenue. This is slowest growing business line up 2% from last quarter, 14.3% from Q4 2023 and up just 106 basis points overall.

Microsoft Operating Profit By Segment

Turing to operating profit by segment we can see the that Intelligent Cloud is bring in $12.9 billion growing 2.8% quarterly, 22% annually and 4.3% overall. Productivity and Business Processes in blue earned $10.1 billion the same as last quarter. I double checked it. It was up 12% year over year and better by 3.8% overall. More Personal Computing is the lowest margin business of Microsoft. Its operating profit was just $4.9 billion almost the same as last quarter but up 5.3% from Q4 2024. Its been growing by 103 basis points these nine quarters.

Microsoft Fundamental Valuations

Let’s look at some fundamental valuations. Earnings per share was $2.95 up both quarterly and annually. The street was looking for $2.92. Microsoft’s trailing PE is 35.5 where the S&P 500 has a PE of 28.77. The PEG ratio is negative 9.67 as the earnings per share were $2.98 in the starting period but $2.95 in the ending period. Sales per share improved to $32.81 giving us a price to sales of 12.75 times. Book value was also better at nearly $36. That is a price multiple of 11.64. Cash per share was lower with CapEx and debt repayment largely as the culprits. Microsoft has a large marketable securities balance. Put with cash its $10.11. Chose your multiple of 170 or 41 to price.

Microsoft has more than $49 billion in debt but their assets are $512 billion and equity $268 billion giving us a debt ratio of 0.1 and 0.18, respectively. Interest coverage is 41.4 times. The liquidity ratios are fine with current at 1.27, quick at 1.06 and cash of 0.15.

Microsoft had a return on assets of 17.2% and return on equity of nearly 33% these past 4 quarters. Return on capital employed was 28% and return on invested capital was 29%. Microsoft has an effective tax rate of 18.2% giving us a NOPAT of $89 billion and an average debt and equity of $308 billion.

Cash flow numbers look good with operating cash flow of $37.2 billion. Investing outflows of nearly $15 billion primarily due to CapEx. Financing outflows of $23.6 billion came from debt repayment, common stock repurchase and dividends. Free cash was up 17.6% to $23.3 billion. This is a price to free cash flow multiple of 134.

Microsoft paid 75 cents in dividends yielding 71 basis points. Growth is 10% and they are paying out 25%.

Enterprise value of Microsoft is $3.15 trillion giving the following multiples. 12.9 times revenue, 26 times EBITDA, 29 times EBIT and 135 times free cash flow.

Microsoft Guidance

Microsoft provided guidance for Q1 2025 expecting revenue of $63.8 billion to $64.8 billion. Gross margin will be around $44.3 billion giving us an EPS of $3.08. That is a forward PE of 35.

Microsoft Rating

Key takeaways from the report on the Pro side is strong revenue growth, good margins and lots of cash. Return on assets and return on equity were good for a $3 trillion company. All in all Microsoft is a solid firm. On the con side we think the PE and Enterprise value multiples are too high. We think share price might have gotten away from reality around the AI fervour. Capital expenditure continues which may be good or bad. Will AI uptake pay off or is Microsoft betting too aggressively? We shall see.

We are giving Microsoft a neutral rating. We have no exposure to this company.