Advanced Micro Devices reported second quarter earnings on July 30th. Revenue beat expectations of $5.7 billion on the back of its MI300X AI microchip. Even raising their second half forecasts. Shares were up over $10 in after hours trading but despite the good news AMD is still only a shadow of the industry leader Nvidia.

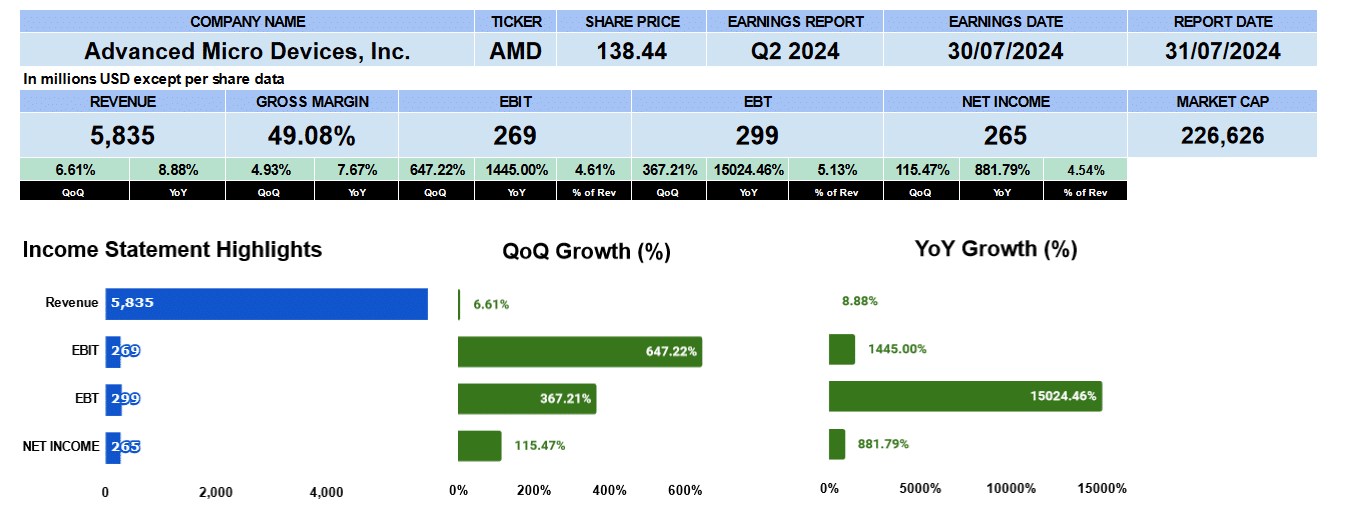

Revenue was better than $5.8 billion up 6.6% sequentially and almost 9% year over year. Gross margins broke 49%, better by 5% last quarter and 7.8% year over year. Operating profit was $269 million. In the comparable quarter in 2023 EBIT was negative so growth figures aren’t meaningful. Net income was $265 million up 115% from Q1 2024 and 880% from Q2 2023 giving us a profit margin of 4.5%.

Advanced Micro Devices Quarterly Revenue

Advanced Micro Devices revenue chart shows that over the last 9 quarters revenue was down 1.3%, gross profit 62 basis points, operating profit 7.2% and net income 5.6%. Not exactly the AI growth story investors perceive.

Advanced Micro Devices Segment Revenue

Looking at revenue by business, data center, in blue, has been the principal growth driver reporting $2.8 billion or 48.6% of total revenue. Growth numbers are impressive up 21% sequentially, almost 115% from last year with a 7.5% growth in the last 9 quarters. Their client business, shown in red, refers to chips sold in PCs, reported nearly $1.5 billion or 25.6% of revenue, up 9% from Q1 and 50% year over year. Gaming revenue continues to slide earning just $648 million or 11% of sales down from 25% in Q2 2022. This is down 30% sequentially, 59% year over year and 10% overall. Embedded revenue, in green, reported $861 million, nearly 15% of total. It was slightly better from last quarter but down 41% from last year though up 4% in the last 9 quarters.

Advanced Micro Devices Segment EBIT

Lets look at the operating profit of the business segments. The line in blue is Data Center EBIT. It makes up the lions share of the bottom line. It’s been growing by more than 5%. Up 37% sequentially and more than 400% annually. The Client segment in red has seen an improvement in the last year to move from a loss to a gain up 3.5% since Q1 and 229% since Q2 2023. Gaming operating profit in yellow, as can be expected, is lower overall. The embedded business, shown in green, is a high margin business but operating profits have been declining in line with revenue.

Advanced Micro Devices Fundamental Valuations

Lets’ look at some fundamental valuations. Earnings per share was just 16 cents up 115% quarter over quarter and almost 900% year over year. In Q2 2023 AMD earned just $27 million dollars. Non-GAAP earnings were 69 cents per share. This gives us a trailing PE of 166 based on GAAP earnings where the S&P500 is just 28.41. AMD may be benefiting from AI but that PE is just too high. The PEG ratio is negative 0.81 as earnings growth has been negative, though next quarter that should change. Sales per share was $14.22 marginally better. Price to sales is 9.74. Book value was slightly better to $34.54 giving us a price to book value of 4. Cash per share is $2.51 and cash plus marketable securities is $3.26. That’s a 55 or 42 multiple to price depending what you prefer. Advanced Micro Devices has low debt with the debt ratio and debt to equity of 0.03. Interest coverage is almost 11 times. AMD has good short-term liquidity with current ratio at 2.82, quick at 1.8 and cash at 0.66.

Return metrics aren’t all that impressive with ROA at 2%, ROE 2.4%, Return on capital employed of 1.4% and return on invest capital just 1%. The effective tax rate is skewed as AMD has been receiving tax credits. If we use 13%, as per Q3 guidance, the ROIC is still only 1.3%

Lets look at cash flow. Operating cash flow was up 56% to nearly $600 million. Investing inflow was $386 million. $761 million of short-term investments were sold. Investing outflows were more than -$1 billion where they paid off $750 million of debt. AMD reported a free cash flow to the firm of $439 million this quarter up 7% year over year. This gives a multiple to price of 516. Cash flow is growing but the price multiple is just too expensive.

Advanced Micro Devices doesn’t pay a dividend.

The enterprise value of AMD is $224 billion which is 9.6 times revenue, 55 times EBITDA, 257 times EBIT and 510 times free cash flow.

Advanced Micro Devices Guidance

Guidance for AMD was raised expecting $6.4 to $7 billion in revenue. Gross margins of 53.5%. Operating expenses of $1.9 billion and an effective tax rate of 13%. Giving us an earnings per share between 81 and 98 cents. This gives us a forward PE between 85 and 95.

Advanced Micro Devices Rating

Key takeaways from the report on the pro side we liked the revenue growth and the improving margins. They have lots of cash and low debt load. Guidance appears to show revenue growth will accelerate next quarter largely due to the AI boom underway. On the Con side we thought PE and Enterprise value multiples were excessive. Return on investment and equity make it difficult to invest when there are higher return stocks out there. AMD’s other segments outside Data Centre are not performing very well. They have all their eggs in 1 basket.

We are giving Advanced Micro Devices a neutral rating. We have no exposure to this company.