Crowdstrike reported Q1 2025 back in June but given the spotlight on the company we thought we’d take a look at their financial statements. In short, despite having Nvidia, Amazon, Microsoft and others as customers the shares are over priced even after the sell off.

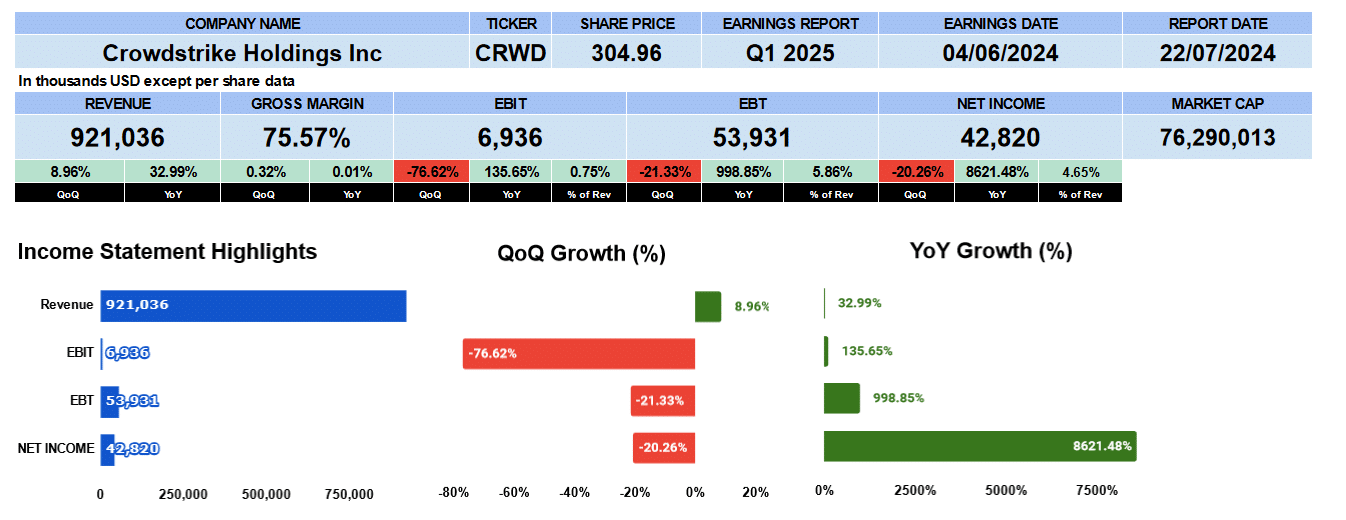

First quarter revenue was $921 million up both quarterly and annually and they have a solid gross margin of 75.6%. Operating profit was $7 million down 76% sequentially. In the comparative quarter last year they earned a loss. A closer look at the operating expenses shows they added to their salesforce last quarter. They are spending as a percent of revenue around 38% on sales and 25% on R&D. Net income was nearly $43 million. Crowdstrike has been investing their cash and have realized interest income of almost $46 million this quarter yielding about 1.1% making them seem more profitable than they are.

Crowdstrike Quarterly Revenue

The 9 quarter income statement bar chart shows just how steadily they have been growing and that they have only recently turned a profit. Revenue has been growing by 7.3% since Q1 2023 almost doubling in 2 years, a credit to the sales force. Gross profit is up 7.6%. Operating profit and net income growth aren’t meaningful. Crowdstrike is pushing out there product as fast as they can and not worrying about profits.

Crowdstrike Revenue by Geography

The revenue by geography shows the US as the biggest segment in blue earning $630 million. That’s up nearly 10% quarter over quarter, 33% year over year and growing by almost 7% overall. EMEA, in red, earned more than $141 million up 7% sequentially and 35% from the comparative quarter last year with a 9 quarter growth rate of 8%. APAC in yellow earned $93 million up nearly 8% from last quarter, 29% from Q1 2024 and 7.8% from Q1 2023. The Other markets in green earned $56 million growing by a similar rate.

Crowdstrike Fundamental Valuations

Shares outstanding grew by 2.2 million putting earnings per share at 17 cents. Crowdstrike’s PE even after the sell off is just about 600. They have $13.13 of sales per share and 23 times price to sales. A bit too expensive. Book value is $10.27 or a 30 times multiple of the share price. Crowdstrike holds nearly 4 billion in cash or $14.80 per share. That is a 20 times multiple of price. They have a debt ratio of just 0.11, debt to equity of 0.29 and an interest coverage of just 1 times. Not really a concern given all that cash. Further support of their short-term liquidity are the current ratio of 1.8, quick 1.6 and cash at 1.4. Crowdstrike is in good shape.

Because they spend all their revenue on the sales team and R&D, ROA and ROE are not impressive at 2.5% and 6.7%, respectively. Return on capital employed of just 0.6 and a similar return on invested capital of 0.7. Crowdstrike is a growth stock.

Their operating cash flow was $383 million, investing outflow of $51 million, financing of negative $2.5 million with a final free cash flow of $3.7 billion up 30% year over year. Price to free cash flow is almost 21 times.

No dividend from Crowdstrike but not surprising. The enterprise value of the firm is $73 billion. That is a 22 multiple to revenue 164 time EBITDA, 3000 multiple of EBIT and 20 times free cash flow. Further evidence that Crowdstrike is a growth stock.

Crowdstrike Guidance

Crowdstrike provided non-GAAP guidance which is almost always better than GAAP. Revenue for the next quarter will be $960 million, with an operating in come of $209 million and EPS of 98 cents per share. That gives us a forward PE of 206. There full year guidance expects a non-GAAP EPS of $4 per share which is a 75 yimes PE.

Crowdstrike Rating

Our key takeaways from this report on the Pro side are the strong revenue growth and it should keep continuing, gross margins of 75% are good. Crowdstrike has a lot of cash to support its growth going forward. They have customers such as Alphabet, Amazon and Nvidia, heavy investors in AI. We think they have a bright future. On the con side the valuations don’t justify its share price. PE too high even the full year forward PE. The stock is trading at 23 times sales. The share price doesn’t justify the current business. ROA and ROE are very low. There are less risky stocks producing higher returns. The outage might make it more difficult for the sales team to continue growing sales like they have been. Their reputation has taken a hit. That being said we give Crowdstrike a neutral rating. We have no exposure to this company.