Netflix reported second quarter earnings that we thought were strong, and were above what LSEG Data & Analytics expected. Shares were lower but we think it was more from the overall profit taking in tech stocks. LSEG was looking for $9.53 billion and EPS of $4.74.

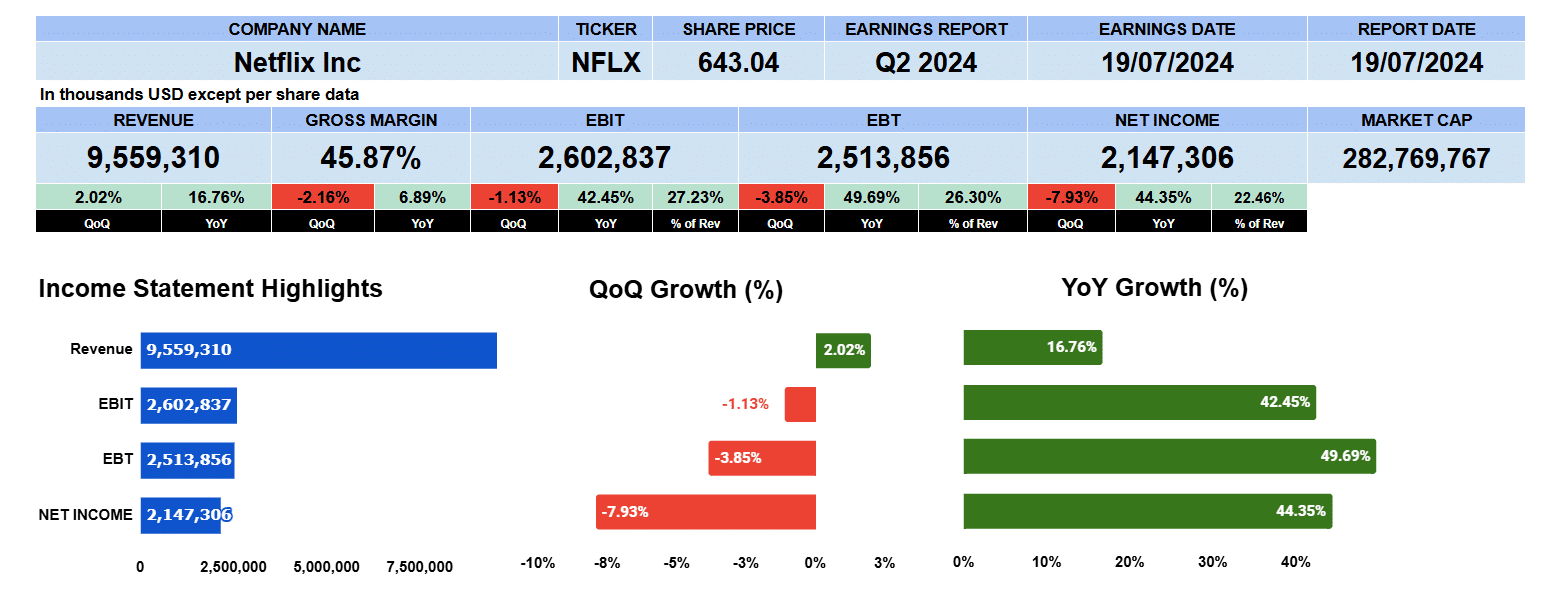

Netflix reports their financials in thousands rather than millions. We used both so our charts wouldn’t look so cluttered. That being said Netflix reported revenue of almost $9.6 billion up 2% quarter over quarter and 16.8% year over year. Gross margins were 45.9% slightly lower sequentially, but up nearly 7% year over year. Operating profit breached $2.6 billion. Softer by a 113 basis points from last quarter but up 42% year over year. That gives us an operating margin of 27%. Income was $2.15 billion down 8% sequentially but up 45% year over year. Net profit margin is 22.5%.

Netflix Quarterly Revenue

Looking at our quarterly income statement data of the last nine quarters, revenue is up 2% from Q2 2022, gross profits have been growing by 3.3%. Operating profits by 5.7% and net income better by 4.5%. Solid steady growth.

Netflix Segment Revenue and Subscribers

Netflix added over 8 million paid subscribers this quarter so lets look at the revenue by segment to find out where. US and Canada or UCAN saw membership rise to more than 84 million. That’s up just about 1.8% quarter over quarter and 11% year over year. Overall growth has been 1.5% since Q2 2022. This geography reported $4.3 billion in revenue and that’s an improvement of 1.7% quarter recorder, 19% year over year and 2.2% in the last nine quarters.

EMEA had a similar result though on lower revenue but more subscriptions. It earned $3 billion up 1.7% quarter over quarter and 17% year over year. It’s been growing at 2.3%. Total membership in Europe almost reached 94 million expanding by 2.4% and 17% annually reaching almost 3% growth since Q2 2022. There are lower margins in Europe.

The LATAM business saw revenue of $1.2 billion up 3.6% quarter over quarter, 11% year over year and it’s been growing since Q2 2022 by 1.75%. Membership reached 49 million growing by 3.2%, 16% and 2.5% overall. APAC is Netflix’s smallest market, but its fastest growing in terms of membership. Earnings topped $1 billion up 2.8% sequentially and 14% in the comparable quarter last year. It’s been growing at 1.7% since Q2 2022. Membership surpassed 50 million up 6% quarter over quarter, 24% year over year and expanding 4.2% overall. Netflix and chill is a real thing.

Netflix Fundamental Valuations

Let’s look at some fundamental valuations. Earnings per share was $4.88 7.5% softer quarterly, but up 48% year over year. The trailing PE of Netflix is 41. The SP500 PE is around 29. Sales per share was $21.74. Better quarterly and yearly. Investors are paying 29.6 time sales. Book value hit $50 slightly better quarterly but lower year over year which is 12.8. Cash per share was $15 lower overall which is about a 43 multiple of price.

Leverage ratios show the debt ratios 0.25, debt to equity 0.55 and interest coverage 15 1/2 times. On the short-term liquidity side, the current ratio is 0.95, quick 0.66 and cash 0.65. Return on assets yielded 17.5% and return on equity 38.9% both better year over year. They have an equity multiplier of 2.2. Return on capital employed was 22.2% and return on invested capital was 21%. Netflix has an effective tax rate of 13.33%. We’ll use this in our EPS for next quarter later on. They have a NOPAT of $7.5 billion. And their average debt plus equity is close to $36 billion.

What do the cash flows tell us? Operating cash flow was lower to $1.3 billion. Investing outflows were just $78 million. Financing outflows $1.5 billion with free cash flow to the firm of $6.6 billion. Giving us a price to free cash flow of almost 43 times. A little bit expensive no?

Netflix doesn’t pay a dividend. Enterprise value of Netflix is $288 billion giving us an 8 times multiple to revenue. 12 times multiple to EBITDA, 33 multiple to EBIT, and 43 1/2 times free cash flow.

Netflix Guidance

The company provided guidance indicating that revenue for the quarter would be up 14% year over year. The operating margin figure is what they’re expecting for the annual. But we used that for the next quarter calculations. We used the effective tax rate above of 13.3% giving us an earnings per share of $4.99 which is a forward PE of 36.

Netflix Rating

Key takeaways from the report. Revenue continues to grow. Margins are strong. The members keeps growing. They have lots of cash. Seems to be a good business model. On the con side the, PE is a bit lofty and the share price is near its all time high. Competition from YouTube and Amazon could squeeze margins and impact membership. We are cautious on our rating giving it a neutral. We have no exposure to this company.