Taiwan Semiconductor Manufacturing posted better than expected second quarter results July 18. They affirmed guidance to the higher end of expectations and also its capital expenditures for the full year of between $30-$32 billion. The world’s biggest foundry is confirming that semiconductors fuelled by AI demand isn’t going anywhere.

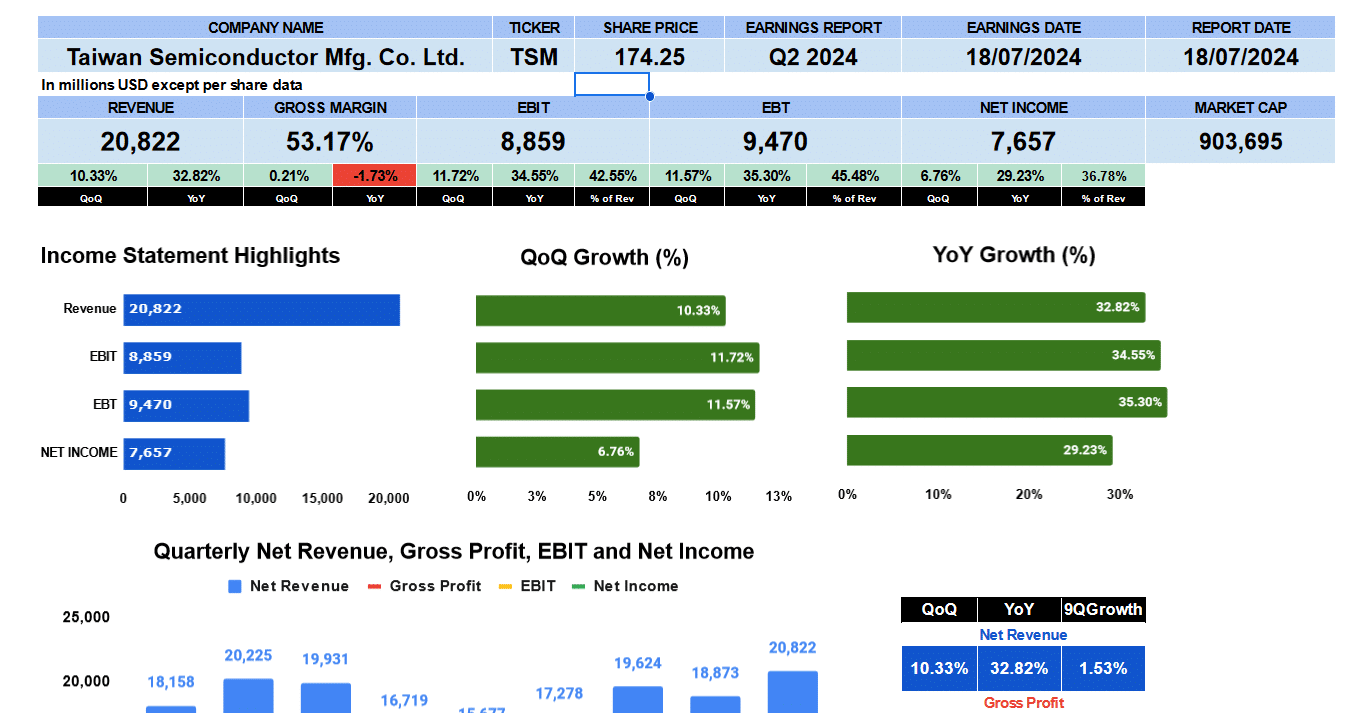

Revenue was $20.8 billion up 10% quarter over quarter, and 33% year over year. Gross margins were 53%. Slightly better sequentially, but down 173 basis points year over year. Operating profit was $8.9 billion up 11.7% from Q1 and 35% from Q2 2023. This gives us an operating margin of around 42.5%. Net income was shy of $7.7 billion up 6.8% quarter over quarter and 29% year over year which is a net income margin of almost 37%. Good, solid results.

Taiwan Semiconductor Quarterly Revenue

The 9 quarter income statement chart shows us net revenue has been growing by 1.5% since Q2 2022. Gross profits have also been growing by 36 basis points. Operating profit is basically, flat however, but net income is slightly lower by 57 basis points.

Taiwan Semiconductor Revenue By Technology

Revenue by technology for Taiwan Semiconductor publishes their data as a percent of revenue so we don’t have exact numbers but we can see here in blue the 3 nanometer business is starting to pick up to about 15% of total revenue growing 67% quarter over quarter. The 5 nanometer technology continues to be 35% of revenue slightly down quarter over quarter but up 17% year over year and it’s been growing by 5.8%. The seven nanometer business is slowly declining where it was once 30% of revenue in 2Q 2022 is now just 17% this quarter contracting 10% sequentially, 26% year over year and 6% in the last nine quarters. The 16 nanometer business is also contracting having been 14% in 2022 down to 9% this quarter. No change sequentially but down 18% year over year and it’s been contracting by 4.8%. Taiwan semiconductor has other nanometer data but we chose not to publish them given they are just less relevant.

Taiwan Semiconductor Revenue By Platform

Let’s look at revenue by platform. High performance computing which is the backbone of generative AI grew 13% quarter over quarter up 18% year over year and it’s been expanding by 2%. High performance computing comprises 52% of total revenue a testament to the on-going investment in machine learning. Smartphone chips were 33% of total revenue down 13% quarter over quarter, no change year over year and down 156 basis points since Q2 2022. It’s possible the absolute revenue number has grown but a sign that perhaps iPhone demand is soft. Internet of things was 6%. No change quarter over quarter, down 25% year over year and it has been contracting by 3%. The automotive, digital consumer electronics and other didn’t add much to the overall Taiwan Semi bottom line so we left them out.

Taiwan Semiconductor Revenue By Geography

Let’s go to revenue by geography. We can see here in blue, North America is TSM’s biggest market with 65% of total revenue. Down almost 6% sequentially and 152 basis points from Q2 2023. Remember overall revenue grew 10% this quarter and 32% year over year so actual numbers are likely up. China’s revenue market share grew to 16%. It’s not clear if China is buying chips to fulfil contracts with their global customers or for internal use but that segment is growing. APAC made up just 9% of revenue. That’s up from last year but down sequentially. Japan and EMEA were 6 and 4% of total revenue, respectively

Taiwan Semiconductor Fundamental Valuations

What are the fundamentals looking like. Per share values are based on the ADR which is 5 TSM shares. Earnings per share was $1.48 up 6.8% and 29% year over year. The PE for Taiwan Semi is 30.7 and the SP500 is 29.20. Compared to the semiconductor market at large this is a low PE.

Check out our semiconductor industry comparables report for more information.

Sales per share were $4.01 better by 10% and 32%. That’s a price to sales of 42 times. Book value increased to $22.70 better sequentially and year over year. Price to book value is then 7.6 times. Cash per share is $10.70 cents also improved, giving us a price to cash of 16 times. TSM has some marketable securities giving us $12.16 per share including cash and a price to cash plus marketable securities of a 14 multiple.

Leverage ratios put the debt ratio at 0.16, equity 0.25 and interest coverage 43 times. Liquidity ratios are strong with the current ratio 2.47, the quick ratio at 2.15 and cash showing 1.72. Good solid liquidity. Return on assets was 16.6% and return on equity 26%. The equity multiplier of TSM is 1.6. Return on capital employed is 21%. Return on invested capital 26% where the effective tax rate of TSM is 15.6% producing a NOPAT of $37.2 billion and the average debt plus equity is $142 billion.

Cash flows are the six month figures. Operating cash flow is $25.5 billion up 41%. Investing outflows were $11.2 billion. Financing out flows 5 billion and free cash flow to the firm stands at $56 billion. Not too shabby. Price to free cash flow is 15.7 times

TSM pays a dividend of $0.54 which is a 1.26% yield, growing 20% paying out close to 37%. The firm’s enterprise value is $862 billion which is a 11 times multiple to revenue, 16.5 times multiple to EBITDA, a 27 times multiple to EBIT and 15 times free cash flow.

Taiwan Semiconductor Guidance

Taiwan Semiconductor provided guidance that was improved. They’re expecting revenue to come in between $22.4 to $23.2 billion with the gross margin of between 53.5 to 55 1/2%, operating margins between 42 1/2 to 44 1/2% giving us an EPS between $1.53 and $1.66 giving and a forward PE of 29.

Taiwan Semiconductor Rating

Key takeaways from the report. The pro side shows the chip industry is still growing and there is a lots of demand with increased revenue and capital expenditure both up at TSM. The company has a lot of cash and free cash flow. The dividend is good and there is room to increase it. On the con side the US China trade dispute could be problematic for TSM and semiconductors as a whole. The US put tariffs on electric cars from China, integrated circuits could be next. Other than that we didn’t see much else wrong with Taiwan Semiconductor. That being said we are giving TSM a buy rating. We have no exposure to this company.

Like and subscribe