Delta Airlines reported second quarter earnings July 11th. The market wasn’t happy even though revenue beat expectations. It was their earnings per share that missed the target as the catalyst for the sell-off as higher fuel prices and salaries hit the bottom line.

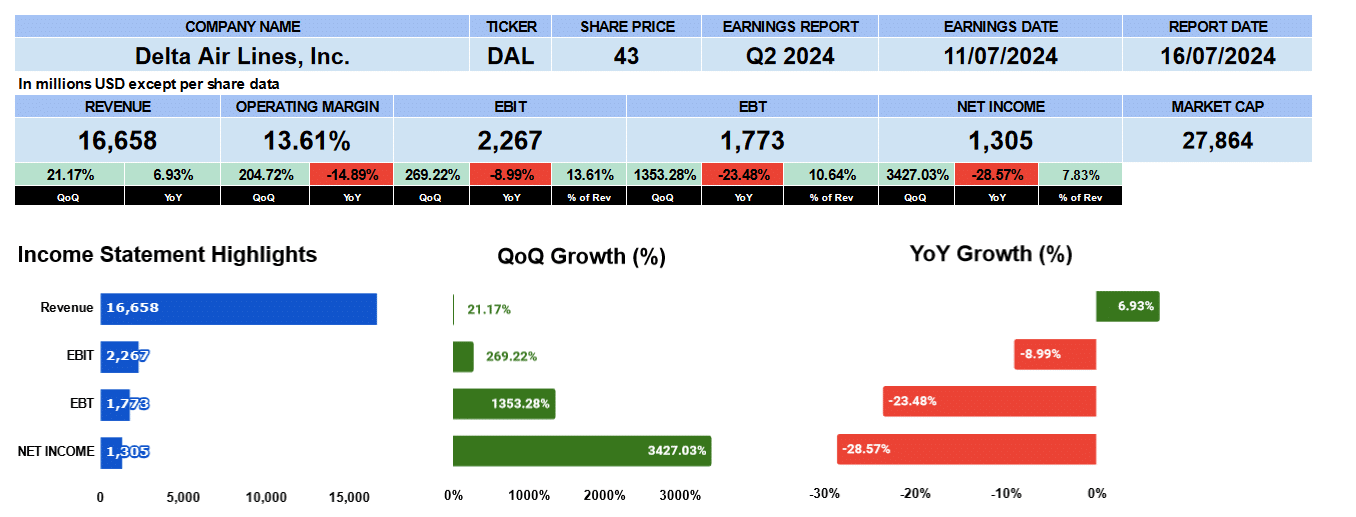

Second quarter revenue was $16.7 billion up 21% quarter over quarter and 7% year over year. Operating margins were 13.6% better by 200% sequentially, but down 15% year over year. This is where the fuel prices and salaries weighed on earnings. Operating profit was nearly $2.3 billion Up 269% from last quarter, but down 9% year over year. Net income came in at $1.3 billion, up over 3000% quarter over quarter. Delta earned just $37 million in Q1. Year over year change was worse by 29% or about 7.8% of revenue.

Delta Airlines Quarterly Revenue

Our quarterly income statement data shows that net revenue has been growing by 2.1% since Q2 2022, operating profit by 4.5% and net income by 6.6%. Overall, line item growth has been positive.

Delta Headlines Passenger Revenue Data

Let’s look at some passenger revenue data. Main cabinet ticket sales in blue reported $6.7 billion or about 48.5% of revenue. It’s up 24% quarter over quarter and 33 basis points from the comparable year. Growth since Q2 2022 is 1.9%. Premium product ticket sales shown in red reported $5.6 billion or 40.7% of revenue. That’s up 28% from a year ago and 10% from the sequential quarter. Overall, it’s been growing by 3.6%. Loyalty awards, this small yellow area reported $975 million 7% of revenue better by 15.5% from last quarter, 8% year over year and it’s been growing 3% percent since Q2 2022. In green, is Travel-Related Services Delta’s smallest passenger business line. It reported $517 million of revenue or 3.7% overall. This segment is growing too, up 14% quarter over quarter, 9% year over year and expanding by 1.8% in the last nine quarters. Solid steady growth.

Delta Airlines Passenger Miles and Seats

The Revenue Passenger Miles and the Available Seats are in millions. Revenue passenger miles, in blue, hit a record of 65.2 billion or about 400 round trips to the sun was up 24% quarter over quarter and 33 basis points from the year ago period. This metric has been growing by 1.9%. Available seat miles, this red line, came in at 74.7 billion up 28% over quarter and 10% year over year, growing at a steady 3.6%.

Delta Airlines Revenue and Cost Per Seat Mile

This next graph is revenue per seat mile, cost per seat and cost per seat excluding fuel. All are in cents. The cost per seat without energy removes the volatile price of fuel to provide a better analysis of the other costs associated with servicing passengers. The spread between the red and yellow line is the cost of fuel. Total Revenue Per Available Seat Mile or TRASM was 20.64 cents this quarter growing 7.7% but year over year it was down 2.6% with basically flat growth from Q2 2022. Cost per seat was 19.28 cents lower sequentially 3.8% but up 1.6% from the year ago period. Though costs are trending lower by 89 basis points. The yellow line is the costs ex-fuel and it was down quarterly by almost 7% but slightly higher year over year with a 9 quarter growth rate of 33 basis points. About 100 basis points of fuel costs were paid by Delta this quarter with respect to Q2 2023.

Delta Airlines Fundamental Valuations

Turning to some valuations shares outstanding group by 3 million. Earnings per share came in at $2.01 up over 3000% quarter over quarter but down 29% year over year. Delta’s trailing PE is just 6.2 with the S&P 500 at 29.42. The PEG ratio is 1.6. Sales per share were $25.71 up quarterly and year over year. Share price to sales is 1.7 times. Book value was $19.11 up 11% sequentially and 50% year over year. Delta is trading at 2.25 times book value. Cash per share is $6.34 up 5.5% and 52%, respectively, giving us a 6.8 times price to cash ratio. Delta doesn’t have much in the way of marketable securities and this ratio is not much different than cash.

Leverage ratios have the debt at 0.2, debt to equity at 1.21 and interest coverage at 12. Liquidity ratios are rather tight with current ratio at 0.4, quick at 0.28 and cash at 0.14. Delta’s return on assets was 7% down 30% year over year but their return on equity was 42% down 53% year over year because book value was up 50%. Delta has an equity multiplier of 6. Return on capital employed registered 13.3%. Return on invested capital at 20.5%. Delta’s effective tax rate is 21% giving us a NOPAT of $6.2 billion and their average debt and equity is just over $30 billion.

Cash flows now. Operating cash flow was slightly lower to $2.5 billion investing outflows $809 million, financing outflows $1.5 billion with free cash flow to the firm standing at $4.5 billion up 60% year over year. Delta is trading at a 6.2 times free cash flow.

They are paying 10 cents in dividends yielding 0.9%. It hasn’t been growing and is a pay-out ratio of just 5%. The enterprise value of Delta is just shy of $39 billion. Enterprise to revenue is just 0.65 time. Enterprise value to EBITDA 4.5 times, EBIT 6.3 times and free cash flow 8.6 times.

Delta Airlines Guidance

Deltas guidance for Q3 was revenue is expected to be higher by 2 to 4% with operating margins between 11% and 13%. They’re estimating earnings per share between $1.70 and $2. Based on these valuations we have a forward PE of just over 6.

Delta Airlines Rating

Key takeaways from this report on the pro side Delta for the most part is showing steady growth in passenger revenue. We like the low PE and EV multiples. Delta has good cash and cash flow. Though debt is high they are paying it down. On the Con side are the costs. Inflation and Fuel costs are making it challenging to turn a profit. If energy prices can come down Delta is well positioned for the future. That being said we are giving Delta a buy rating. We have no exposure to this company.