PepsiCo reported Q2 2024 earnings. Revenue was slightly lower than expected but earnings per share were higher as the company improved gross margins. Business Insider reported that results were softened by Quaker Foods but that segment just makes up 2.5% of total revenue. They also said their North American business was also weaker, which it was, but Pepsi, Europe and LatAm gains more than made up for that weakness.

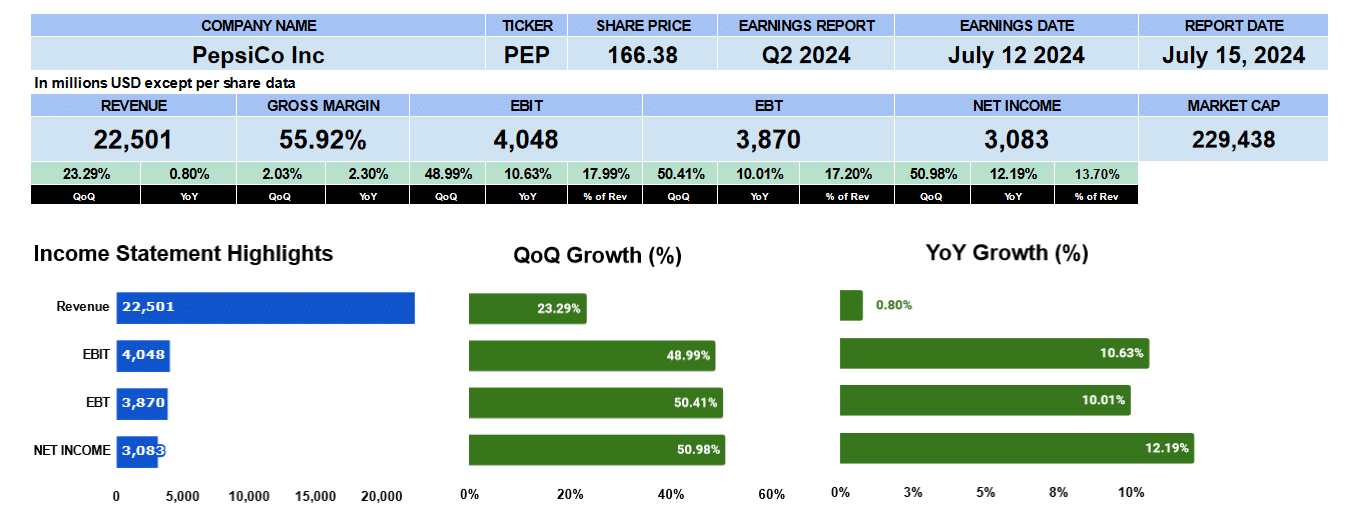

Total revenue at Pepsi was $22.5 billion up over 23% quarter over quarter and 80 basis points year over year. Gross margins were 55.9% better by 2%. Operating profit was up 49% sequentially and 10.6% year over year which is about 18% revenue. Net income was above $3 billion up 51% sequentially and 12% year over year or about 13.7% of revenue.

Pepsi Quarterly Revenue

Turning to our quarterly income statement data we can see revenue has been growing by about 1.2% since Q2 2022. Peak revenue is during the Christmas quarter then ramps up again in the summer. Gross profit has been growing by 1.7%, operating profit by 7.7% and net income by 8.9%. Solid steady growth.

Pepsi Segment Revenue

Looking at our segment revenue, which is a little bit messy. Frito-Lay North America, their second largest business line in blue, reported $5.9 billion in revenue or about 26% of total revenue. This segment was up 3.5% quarter over quarter though slightly lower by 50 basis points year over year. This is the soft spot in Pepsi’s overall earnings but growth has been 1.4% since Q2 2022. Pepsico beverage, their biggest business segment in yellow, reported $6.8 billion in revenue or 30.3% of total. PepsiCo improved by 16% sequentially and 83 basis points year over year growing by 1.2% in the last 9 quarters. Their 3rd largest segment in orange, the European market, reported $3.5 billion about 15.6% of revenue better by 82% quarter over quarter and 2.5% year over year, growing by 1.7% overall. Latin America in Green earned $3 billion in revenue or 13.5% of total grew by 47% QoQ and 6.6% year over year. The last nine quarters saw growth of 2.6%. Between Pepsi, Europe and LatAm the softness in the Frito-Lay segment is more than offset in our opinion. Quaker foods in red was also a soft spot for Pepsi’s earnings according to Business Insider. We can see revenue in red is just $561 million or 2.5% of revenue. Not very significant.

Pepsi Segment Operating Profit

If we look at our operating profit by segmentation Frito lay in blue is the primary income generator for the Pepsi, up 2.5% sequentially though down 3.3% year over year but has been growing at a steady 106 basis points. PepsiCo, the yellow line was up 94% sequentially and 36.5% year over year. And it’s growing by 4.7%. Europe, this orange wavy line has quite volatile returns when it comes to its operating profits. This segment’s saw 206% and 30% year over year improvement. Again, Quaker Foods is struggling, but it is a very small segment. Latin America in green relatively steady operating profits, growing 31% quarter over quarter, 7.6% year over year, and at a steady 4.7% since Q2 2022. Again, Frito-Lay’s softness is offset by Pepsi, Europe and LatAm growth. For your reference, you can see the EMEA and APAC data for yourself.

Pepsi Fundamental Valuations

Turning to the ratios, earnings per share was $2.24 up 51% quarter over quarter and 12.5% year over year. Pepsi’s trailing PE is 24.13 with the SP 500 at 29.34. The peg ratio we can ignore. The starting and ending quarters are the same value, give or take a few pennies, so this ratio is not meaningful. Sales per share was $16.32 up 23% quarter over quarter but up only 117 basis points year over year. Price to sales is 10.2 time. Book value is $14.20 better by 2% sequentially and 10% year over year and that gives us a price to book value of 11.72. Cash per share is $4.61 lower by 20% but up 4% year over year giving us a price to cash of 36. We included cash plus marketable securities as many companies have large marketable securities balances. We thought this would be a relevant data point but we can see here that it’s only $4.84. Pepsi prefers cash on hand to investing in short term securities.

Leverage ratios have debt at 0.37, debt to equity 1.87 with an interest coverage of 17.3 times. Liquidity ratios look fine. Current ratio 0.83, quick 0.6 and cash at 0.2. Return on assets were 12.4% and return on equity 63% giving us an equity multiplayer 5. Return on capital employed by our calculations is 18.2%. Return on invested capital was 15.75%. Effective tax rate of Pepsi is 19.1% giving us a NOPAT of $10 billion and they have an average debt and equity of $64 billion.

Operating cash flow was lower year over year to $1.32 billion, investing outflows were nearly $1.5 billion, with financing outflows of $2.9 billion. Leaving a free cash flow to the firm of $6.4 billion giving us a price to free cash flow of 35.75.

Pepsi pays a good dividend of $1.26 yielding 3% and growing 10%. The payout is 56%. The enterprise value of Pepsi’s $260 billion just 2.8 times revenue, 13.4 times EBITDA, 20.8 times EBIT and 40.5 multiple to free cash flow.

Pepsi Guidance

Pepsi provided full year guidance and they’re expecting full year revenue to be 4% higher than 2023 which is about $95.1 billion. The gross margin and operating expense calculations we just used the average from the income statements and they expect an earnings per share of $8.15 which gives us a forward PE of 20.4.

Pepsi Rating

Key takeaways. Steady revenue growth, gross margins are improved, the dividend is good, forward PE based on guidance suggest Pepsi has some upside. Good segment growth to offset weakness in Frito-Lays. On the con side, the Frito-Lay segment is struggling. We couldn’t really find much else wrong with Pepsi. Based on that we’re giving Pepsi a buy rating. We have no exposure to this company.