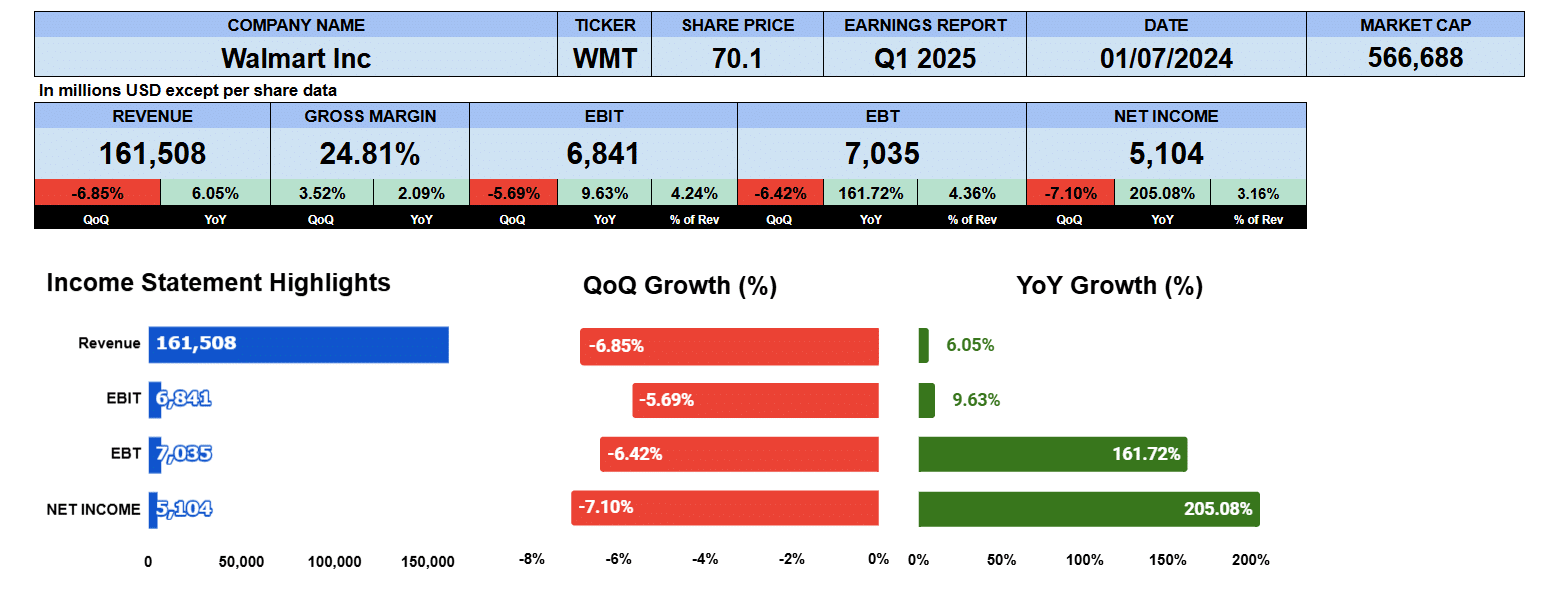

Walmart reported their Q1 2025 earnings on May 16th. Forecasted earnings were looking for $0.52 but, bargain hunters trying to avoid inflation, helped the retailer earn $0.63 per share much to investors delight.

Revenue for the quarter was $161.5 billion down 7% quarter over quarter, but up 6% year over year. Gross margins were 24.8% better both sequentially and year over year. Operating profit was lower to $6.8 billion down 5.7% from last quarter but up 9.6% year over year giving us a 4.2% operating margin. And the bottom line was $5.1 billion down 7% quarter over quarter but up 205% year over year helping the shares move higher. Profit margin was 3.26%. The reason the quarter over quarter data looks worse is because last quarter was the Christmas quarter.

Walmart Quarterly Revenue

The quarterly income statement data from Q1 2023 shows net revenue has been steadily growing on a compound quarterly basis of 1.5%. Gross profit has also been growing at 1.6% rate. Operating profit at 2.8% shows that management continues to focus on costs and efficiencies. Net income was better by an impressive 10.6%. Consumers are turning to Walmart looking for value with inflation making everything more expensive.

Walmart US Revenue and Comparables

Now let’s look at the business segments. The graphs may seem a little confusing but revenue is on the left and same store comparables on the right. Walmart US sales are in blue back to Q1 2023. You can see that sales in the US have been growing at 1.3% and the red bar is the EBIT or the operating profit and that’s been growing at 2%. The 3 curvy lines are the comparables data. The green line is comparable sales which grew rapidly to a peak of 8.3% in Q4 2023 though continued to expand at a lesser rate to finish the last quarter up 3.8%. Good results.

Transactions, in black, have steadily been increasing at a more rapid rate finishing Q1 2025 at 3.8%. Lastly, average ticket, in yellow, has come off its Christmas high of 6.3% in 2023 but growing more slowly where in Q4 2024 and this quarter have seen no increase in ticket size at all. Consumers are doing more transactions but the transaction dollar amount is flat to lower.

Walmart Sam’s Club Revenue and Comparables

Looking to Sam’s Club sales they are growing at a 1% compound quarterly growth rate since Q1 2023 and has a slightly better operating profit at 3.3%. The comparable sales in green were very strong in 2023 but have come off their peak of Christmas 2023 to finish at a Christmas 2024 low of 3.1% and have since recovered to 4.4% but always growing. Transactions in black have also continued to grow and have been accelerating since Q1 2024 low of 2.9% to finish Q1 2025 at 5.4%. Average ticket sizes in yellow have been a bit of roller coaster with no growth in early 2023 to reach a peak of 5.2% in Q4 2023 (Christmas) but have since declined to unchanged in the last 3 quarters.

Walmart International has being growing at a 2.6% compound quarterly rate since Q1 2023 and operating profit is doing well better by 8%, the highest operating margins among the three business segments of Walmart.

Walmart Fundamental Valuations

Turning to some ratios, shares outstanding were down 19 million or about 0.23% on a fully diluted basis. As we said, earnings per share was $0.63 down quarter over quarter but up over 206% year over year. Sales per share showed $20 up 6% and 6.4% year over year. Cash was lower by 4.5% and 10.8% sequentially and year on year, respectively. Book value ended at $10.90 slightly lower quarter on quarter but up 11.5% year over year. Walmart has a PE of 25.7 based on 63 cents per share annualized with the SP 500 to 27.38. Walmart’s PEG ratio is 0.13. Looking at the leverage ratios we can see the debt ratio is only 0.14, debt to equity at 0.4, interest coverage is 11.5 times. All Looking good. Liquidity ratios show the current ratio at 0.8, the quick ratio 0.19 and cash at 0.1.

Walmart’s equity multiplier is 2.88. Return on assets are 8% annualized and return on equity is a solid 23%. Return on capital employed on a trailing 12 month basis was 17.5 and also return on invested capital was 16.1%. Walmart has an effective tax rate of 25% giving us a NOPAT of 20.8 and their average debt and equity is $129 billion.

Cash flows were a little softer with operating cash flows down 8% to $4.2 billion, investing outflows were $4.4 billion and financing outflows were $321 million with free cash flow to the firm of a solid $9.5 billion though down 11% year over year. Walmart pays a $0.21 dividend which is about a 1.3% yield growing at 9%. That is a payout ratio of 33%.

Walmart’s enterprise value is $530 billion giving it a 0.82 multiple to revenue, a 3.31 to EBITDA and a 56 times to free cash flow.

Walmart Guidance

Turning to the guidance. They improved their guide expecting revenue to be up around 3.5 to 4.5%. Their operating profit between 3 to 4.5%. The Net come income figure we used was the compound quarterly growth rate we presented above so 10.6% giving us an estimated earnings per share for Q2 of $0.70. That gives us a forward PE of 22.9.

Walmart Ratings

Key takeaways the comparables look great dividend is always nice operating margins are improving and management improved their guidance. On the con side the average ticket comparables were flat to lower though transactions growing. Walmart profit is obviously dependent on consumers and their ability to spend money and how that will continue in this inflationary environment. Will the FED raise or cut? Walmart is trading at an all time high which is good to see for investors but might be prudent to wait for a pullback before adding any further position. PE suggests Walmart’s fully valued. Enterprise values suggests Walmart’s undervalued. That being said, we are giving a cautious buy or a positive neutral rating to Walmart. We have no exposure to this company