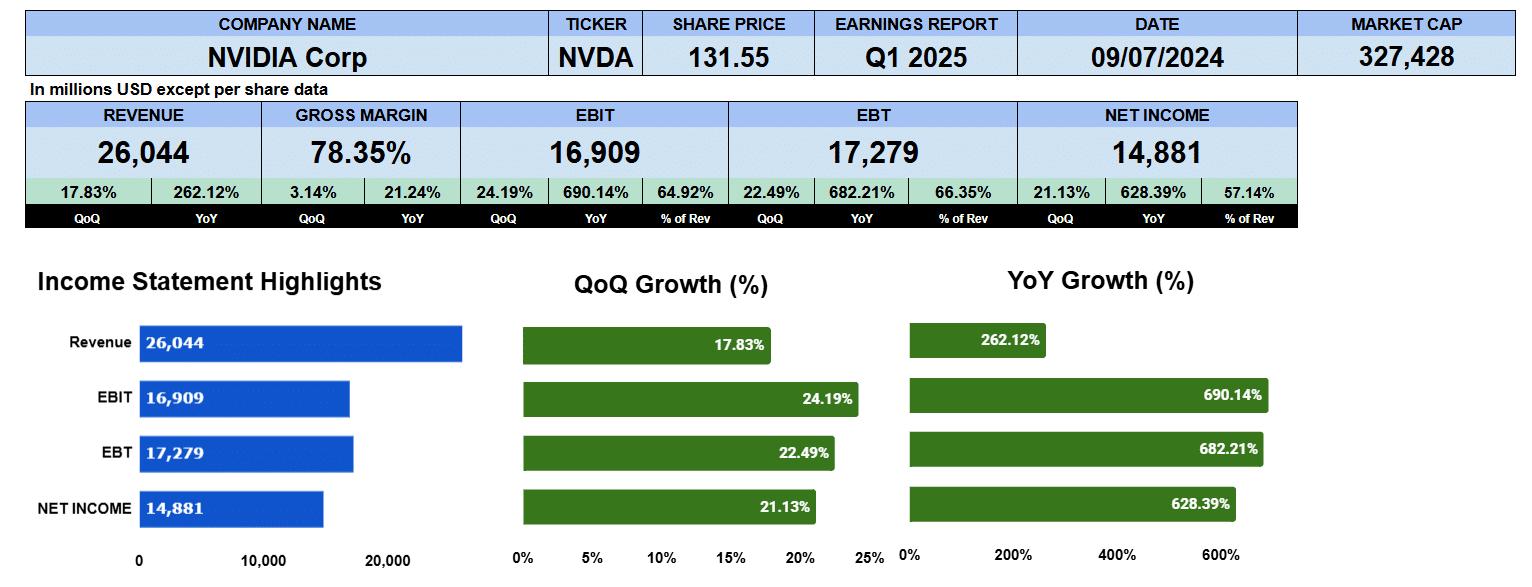

The much hyped and most anticipated earnings report since perhaps the Dot-Com era was Nvidia’s first quarter of 2025. They didn’t disappoints. Bloomberg said analysts were expecting $5.65 on $24.7 billion of revenue with last quarter guidance of $24 billion and around $5.10 per share. They reported $26 billion and $5.98 of EPS on a GAAP basis. The shares were up 4% in after hours trading.

Revenue was up 18% quarter over quarter and 262% year over year. Gross margins hit a high of 78.4% better by 3% from Q4 2024 and 21% from last years earnings report . Operating income was just shy of $17 billion up 24% and 690% from last year. Profit margin was 65%. The bottom line was $14.9 billion up 21% from last quarter and 628% year over year or 57% of revenue.

Nvidia Quarterly Revenue

The quarterly income statement shows just how much the various lines have been growing since Q1 2022. Revenue has been growing on a quarterly compound basis of 13.6%, gross profit by 15.8%, Operating profit at 27.7% and net income posting 28%. Nvidia is really at the heart of generative AI.

Nvidia Segment Revenue

Turning to segment information, Data Center has been growing at a 22% rate earnings $22.6 billion which is 86.8% of total revenue up from $3.8 billion or 45.2% of revenue. Gaming continues its decline lower by 3.6% since Q1 2022. They posted $2.6 billion in revenue or 10% of total. Gaming used to be 43% of revenue. Professional visualization lower by 4% but Automotive has been growing by 10% but just $329 million. Nvidia is all about its data centers now.

Nvidia Revenue by Geography

Revenue by geography wasn’t provided in the press release so these are our estimates and we’ll update the data is provided. All geographies are growing with USA and Other which is largely Singapore showing the largest uptake to 25% and 29% respectively. The US well over $14 billion in revenue and Other above $ 4 billion. Taiwan grew by 7.3% earnings $5.3 billion. China growing by just 1% to $2.3 billion. It’s about 9% of total revenue. We’ll be watching this market as the trade war heats up with the People’s Republic.

Nvidia Fundamental Valuations

Shares outstanding were lower by 1 million. As an aside Nvidia will split their shares 10 for 1 from June 10. As mentioned earnings per share was $5.98 up 21% sequentially and 630% year over year. Sales per share were $10.50 up 18% quarterly and 262% yearly. Cash per share was $12.63 up 332% and 520% respectively. Book value continues to grow to $19.74 up 14% sequentially and 100% year over year.

Nvidia’s PE is 39.7 where the S&P500 is 27.56. A premium stock commands a premium price. The PEG ratio for the firm is 0.06. The leverage ratios show debt at 0.11, debt to equity of 0.17 and interest coverage of 264 times. Liquidity ratios are strong with the current at 3.53, quick of 2.88 and cash at 2.07.

The return on assets of Nvidia is 77% and return on equity at 121%. Impressive. The return on capital employed is 77%. Return on invested capital at 87%. Exceptional numbers.

The cash flow is another telling indicator of Nvidia’s success. Operating cash flow up 427% to $15.3 billion. Investing out flows were $5.7 billion. Financing outflow was $9.4 billion mostly due to share buybacks. Free cash flow to the firm was up 50% to $7.6 billion.

Nvidia is paying a small dividend of 4 cents per share. Just yielding 0.02%. They announced an increase to 10 cents per share paid June 28.

The enterprise value of the firm is $2.3 trillion which is 22 times revenue, 28.6 times EBITDA and 307 times cash flow. Hefty valuations suggest that Nvidia is fully valued.

Nvidia Guidance

Guidance provided was $28 billion in revenue for Q2 2025. They are also expecting lower margins by 300 basis points. This will hurt the next quarter results. Operating expenses are projected to be $4 billion up 17% from Q1. We came to an EPS of $5.62 without share buybacks which is 6% lower than this quarter . This gives us a forward PE of 42.

Nvidia Rating

Key takeaways from their first quarter were the terrific line growth across the income statement. The margins are growing and healthy. Free cash flow continues to grow and the demand that the industry is clearly putting on Nvidia’s products. On the con side we found their guidance to show growing revenue but higher costs which should slow growth. The PE and Enterprise value valuations indicate Nvidia is well priced. The demand for their products will make it difficult to deliver to customers. China and the trade war heating up could impact a portion of their business.

The shares are trading at an all time high and with the 10 for 1 stock split will push the shares higher but we should be able to buy them back lower. We can’t chase the shares at these prices and we are giving a neutral rating to Nvidia looking for future opportunity to buy lower.

We have no exposure to this company.