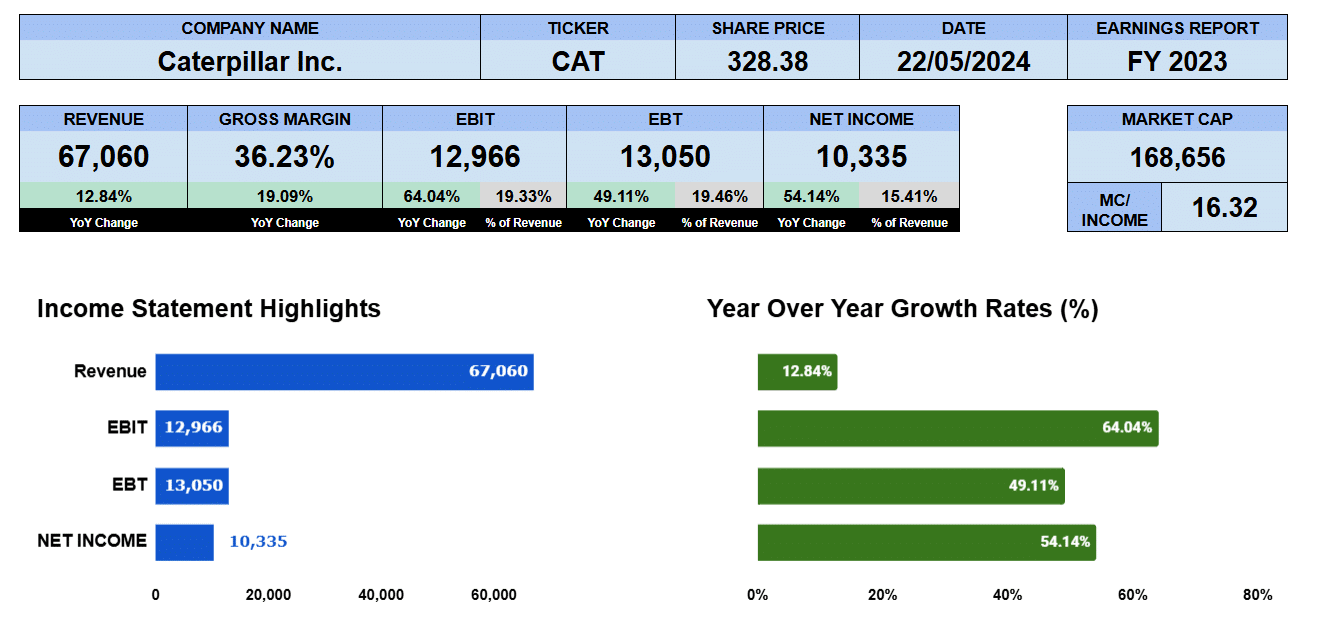

We saw a few headlines recently about Caterpillar (NYSE:CAT) so we thought we would take a look ourselves. Caterpillar reported their Full year 2023 results on January 31.

Revenue was up 13% year over year to $67 billion. Gross margins were 36% up from 30% in 2022, a huge improvement and a big boost to the bottom line as we will see. Operating profit was up 64% year over to $13 billion. Boosted by the improved gross margin, operating margin was further impacted with higher efficiency as revenue grew faster than operating expenses. Caterpillar was doing more with less. Net income was $10.3 billion up 54% year over year. Good results and the market seems to appreciate it too. Caterpillar’s market cap stands at $180 billion or a 17.5 multiple to income.

Caterpillar Annual Revenue

The 5 year bar chart illustrates how the company has been improving its efficiency. Revenue grew at 4.5% in the last 5 years and almost 10% in the last 3. Gross profit was up over 7% and 16% in the 5 and 3 year periods respectively despite the inflation. Operating profit really shows how the company has added efficiencies to the business. with 5 year compound annual growth of 9% and 3 year CAGR of 23.5%. Granted, 3 year figures are reflecting the pandemic lows. Net income grew 11% and nearly 17% in the 5 and 3 year period.

Caterpillar Segment Revenue

Where is the revenue growth coming from? Looking at the segment chart for the last 5 years. Resource industries and Energy & transportation have been the standouts with the former in red up 5.7% and 11.5% in the 5 and 3 year periods to end 2023 at $13.6 billion. And the latter in yellow, reporting $28 billion, up 5% and 11%. We put the data for Energy & transportation at the bottom so it wouldn’t compete with the data in blue, construction industries which reported revenue of $27.4 billion up 4% in the 5 year period and 7.5% in the 3 year. Financial products segment, caterpillars smallest segment at $3.8 billion, has been growing by 4% and 7%.

Caterpillar Revenue by Geography

We took a snapshot of 2023 revenue by geography. The blue sections are North America and is Caterpillars largest market. In red is Latin America which is the smallest market. Depending on the business, Asia Pacific in green does a lot business in resource industries but Europe, Africa and middle east are players Energy & transportation.

Caterpillar Fundamental Valuations

Lets look at some of ratios. Share’s outstanding were down about 17 million or 3.2%. That’s on a fully diluted basis. Earnings per share were up 59% to $20.12. Sales per share were up 16.5% year over year, to $130.60. Cash per share was up slightly by 3% to $13.59. While book value increased 26.8% to almost $38 a share. Price earnings for Caterpillar is 17.5. And that compares with the S& P 500 at 27.95. PE growth or the PEG ratio for Caterpillar is 0.3. Leverage ratios. We can see the debt ratio is 0.28. Debt to equity is 1.25. and interest coverage is 25 times. Debt servicing seems solid. liquidity ratios. The current ratio 1.35. The quick ratio is 0.47 and the cash ratio 0.2.

Looking at our “return on” ratios we see assets were 11.8%, return on equity was up to 53%. Return on capital employed at 24.6% and return on invested capital showing 18%, all improved year over year. Caterpillars equity multiplier is 4.49. Operating cash flow was $12.9 billion. Investing outflows were almost six billion with finance receivable jumping nearly $2 billion. Financing outflows were $7 billion mostly from share buybacks and dividend payments. and free cash to the flow to the firm stood at 7 billion no change from 2022. Caterpillar paid dividend of $5 yielding 1.42%. That’s a growth rate of 3.3% and a payout ratio of 24.8%. Enterprise value for Caterpillar is 198 billion in terms of valuations that gives a 3 times multiple to revenue, 8.2 times multiple to EBITDA and a 28 times multiple to free cash flow.

Caterpillar Guidance

Turning to the guidance. Guidance provided was somewhere around same level as 2023 in terms of revenue. Adjusted operating expenses were 17 to 21% in the higher range. Adjusted operating expenses are non-GAAP measure and we focus on GAAP data but we wanted to provide some data in this section. M,E&T free cash flow, That’s machinery energy and transportation, which is the main business of Caterpillar is expected to generate a cash flow from between five and 10 billion. Kind of a broad range in our opinion. We didn’t want to speculate to net income given the vague guidance, so we are not able to give a forward PE.

Caterpillar Rating

Key takeaways from the report. There were many good ones. The revenue growth was good, the improved margins were great, good strong dividend. The firm has positive free cash flow. The return multipliers, return on assets, return on equity, return on capital employed and return on invested capital were all good. On the Con side we felt the guidance was a little soft. The company seems to be improving the bottom line from operating efficiencies rather than revenue as it’s not expected to grow in 2024. They do expect their services business to improve however. Based on flat revenue for 2024 we’re giving Caterpillar a rating somewhere between neutral and buy. We think the valuations have more upside, the stable dividend for the income hunters but the stock is trading at an all time high and we are inclined to wait for a pull back before we’d take a position. We have no exposure to this company.