Arm Holdings reported Q4 2024 earnings on May 8th. Initially, the market wasn’t as impressed as Q3 but the shares have rallied more than 50% since then. Arm’s low power processors are used by many leading technology firms and will continue to do so as it rolls out its ARMv9 processors but it’s current share price fully reflects its future potential.

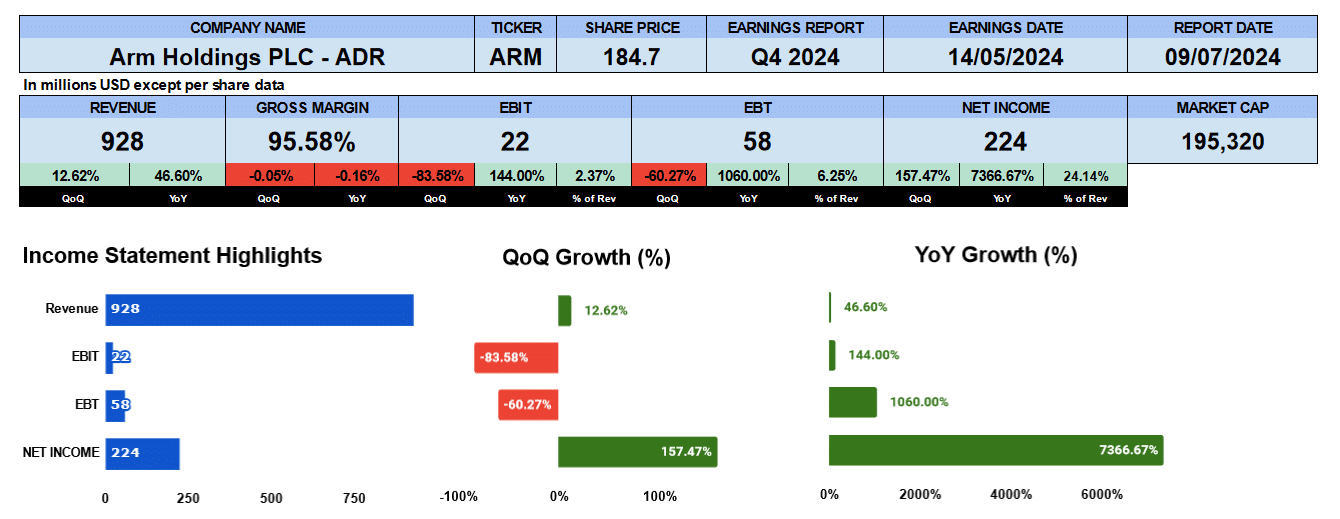

Q4 revenue was $928 million up 12.6% quarter over quarter and 47% year over year. Gross margins are an impressive 95.6% which has been about the average for the last 12 quarters. Operating profit was just $22 million down 84% quarter over quarter as they ramped up Research and Development in Q4 but was up 144% year over year though not really meaningful as the comparative quarter reported a loss. Net income was $224 million up 157% quarter over quarter and more than 7000% year over year which is about 24% of revenue.

Arm Holdings Quarterly Income Statements

Looking at the quarterly income statement bar chart. We can see one year ago Q4 2023 revenue was $633 million and hence the year over year growth numbers. Net revenue has been growing by 4% since Q4 2022 and gross profits up also 4%. You can see this red line that’s the gross margin almost at the top around 95%. Operating profit and net income growth have been negative but we’re starting from a negative value in Q4 2022.

Nvidia’s Quarterly Income Statements

Here’s a snapshot Nvidia’s growth for comparison. It’s not even close. The link to the Nvidia report we published is below.

Arm Holdings Revenue by Segment

Turning to revenue by segment, Arm earns revenue through royalties and licensing fees. Their royalty business in red earned $514 million or better than 55% of revenue down from 64.5% in Q4 2022. It has been growing by 2.2%. License revenue has been growing by 6.6%. They reported $414 million or 44.6% of total revenue in Q4 up from $233 million or 35.5% in Q4 2022.

Arm Holdings Quarterly Chip Shipments

This next chart is the chips they have shipped every quarter. The Y-Axis on the left is in billions and corresponds to the bars in blue of chips shipped per quarter. They shipped 7 billion chips in Q42024 down 9% sequentially and 10% annually. Compound quarterly growth is just 12 basis points.

The yellow and red spaghetti lines are sequential change in yellow and annual change in red with the Y axis on the right side. Arm shipped more chips in 2023 than they did in 2024 as indicated by the red line trending lower. The company indicated that Internet of thing chip volume has been lowered. These chip have high volume but are low margin with little impact on revenue.

Arm Holdings Fundamental Valuations

Let’s look at some ratios. Shares outstanding increased by 9 million. Earnings per share was $0.21. Sales per share $0.90 up 12% sequentially and 43% year over year. Cash per share is $1.82 up 23% and 20.4%, respectively. Book value is $5 up 5% quarter over quarter and 27% year over year. Arm’s PE is 193 with the SP500 at 28.63. The market has been rather enthusiastic with prospects for Arm holdings in the AI business. The peg ratio is 9.64. Numbers under 1 is preferred. Arm holdings has no debt. Liquidity ratios are very solid. The current ratio is 2.79 quick ratio 2.46 and cash 1.28. Return on assets were 11.3% and return on equity 16.9% Return on capital employed was 1.7%. Our return on invested capital number wasn’t meaningful as the pre-tax profit was negative this quarter.

Turning to the cash flows, operating cash flow is up 47% to $1.1 billion, investing outflows were $516 million financing outflows were $208 million. And free cash to the flow was up 23.4% to 1.9 billion. Good numbers.

Arm doesn’t pay dividend. The enterprise value of Arm is $171 billion giving it a 46 multiple to revenue, 48 times to EBITDA and 89 times to free cash flow. Rather expensive in our opinion.

Arm Holdings Q1 Guidance

The company provided guidance for Q1 2025 and for the full year. Revenue is expected to be $875 to $925 million in Q1 with an operating profit of $425 million. The earnings per share from 32 to 36 cents. Based on based on that number annualized that gives us a forward PE of 117. And the full year EPS gives us 105. Too expensive.

Arm Holdings Rating

Key takeaways from this report solid margins at 95%. No debt. The company has good free cash flow and it’s growing. The royalty revenue growth will continue. It has industry leading customers such as NVIDIA, Google, Amazon, Apple. etc. On the con side, the PE and Enterprise value multiples are just too expensive. The share price is near all time highs. Some of the management team are taking advantage of that by selling shares at these prices. Because Arm needs fabs to produce its chips getting access to them could be difficult and/or create bottlenecks. We think Arm has a great future going forward as the AI market evolves but at these prices and valuations we are giving it a sell rating. We have no exposure to this company.