AMD reported their Q1 2024 earnings on April 30th. Results were mixed and not too impressive despite the recent hype of its AI potential. We can’t see it usurping Nvidia. AMD simply doesn’t have the same stripes.

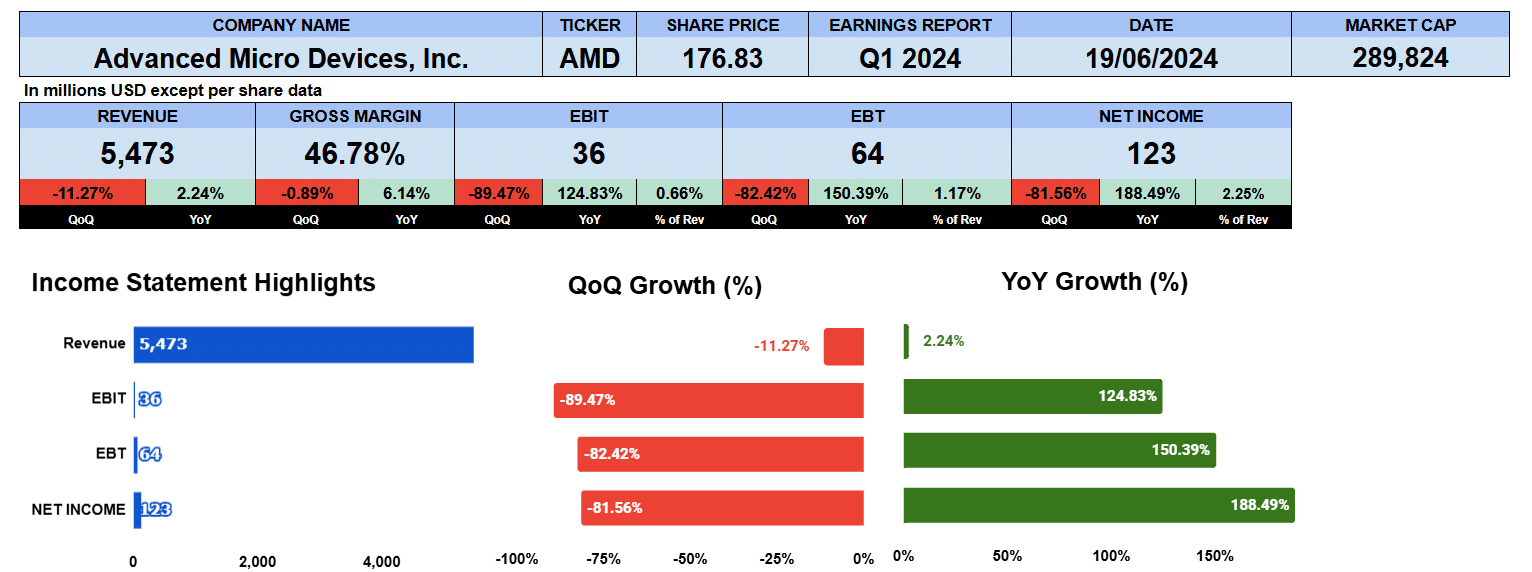

Revenue came in at $5.5 billion. That was down 11% quarter over quarter, but up 2% year over year. Gross margins were 47% softer by 89 basis points quarter over quarter but improved by 6% year over year. Operating profit was just $36 million down 90% quarter over quarter but up 125% year over year where AMD’s EBIT was negative $20 million in Q2 2023. Operating margins at AMD were just 66 basis points. Net income was $123 million down 82% quarter over quarter but up 188% year over year bearing in mind that the comparative quarter lost $139 million. Bottom line results are about 2% of revenue.

AMD Quarterly Revenue

Looking at our quarterly income statement data we can see where the AMD hype was fuelled by the company returning to profitability after 1 year. Q3 2023 and Q4 continued that momentum culminating in the March 8th high of $227.30 but fizzled out this quarter. Net revenue was lower by 81 basis points on a compound quarterly basis from Q1 2022. Gross profit were also lower by 1%. Operating profit down by a whopping 30% over these 9 quarters and net income contracted 18.5%. Not all that impressive for what was one of the supposed AI darlings that would dare to compete with Nvidia.

AMD Segment Revenue

Looking at their segment revenue we can see here in blue the data center business has been growing by 6.8% and lending credence to AMD’s rise in the AI space. Data center finished the quarter at $2.3 billion or nearly 42% of total revenue compared to Q1 2022 where it was only 22%. AMD’s client business in red, was 25% of revenue reporting $1.4 billion but it has been contracting about 5% since Q1 2022 where it was 36% of revenue. The gaming segment, shown here in yellow, has really taken a hit contracting 7.6% only reporting $920 million or about 17% of revenue. They’re embedded business has been cyclical as well, having reached a peak of $1.5 billion in Q1 2023 to end Q1 2024 just at $846 million or about 15.5% of revenue shown growing by 4% but without Q1 2022 data it would be down 4.8%.

AMD Fundamental Valuations

Let’s look at some valuations. Shares outstanding actually grew by 11 million leaving earnings per share to just $0.08. That’s down 82% quarter over quarter and 187% year over year. Sales per share were only $3.30 lower by 12% quarterly and flat year over year. Cash per share is $2.56 improved by 5.8% on a quarterly basis and 7.7% year over year. Book value is $34.29 largely unchanged. AMD’s PE is 547 and that is using annualized earnings of $0.08. The SP500 PE is 27.56. Clearly AMD is overvalued based on that metric alone. The PEG ratio is -2.93 bearing in mind that they earned a loss 1 year ago. AMD has little debt with a debt ratio and debt to equity ratio only 0.03. But interest coverage of 1.44 times. Operating profit margin was only 1% of revenue so interest coverage might seem problematic. Debt levels are low so no need for alarm plus they have good short term liquidity in the current ratio of 2.6, quick ratio 1.7 and cash 0.65. The return on multipliers were not too impressive. Return on assets were just 82 basis points, return on equity was similar at 88 basis points. AMD’s equity multiplier is 1.21. Return on capital employed was flat return on invested capital also flat.

Cash flow is a bright spot with operating cash flow of $521 million up 7%. Investing outflows were only $135 million and financing outflows just $129 million. Free cash flow to the firm stood at $4.2 billion up 9.5% year over year. AMD doesn’t pay a dividend. The enterprise value of AMD is $265 billion which is 12 times revenue, 26 times EBITDA and 59 times free cash flow.

AMD Guidance

Turning to guidance they’re expecting revenue to come in at $5.7 billion. They gave gross margin of 53% but that is Non-GAAP. On a GAAP basis AMD has averaged a gross margin of 45.6%. Operating expenses of $1.8 billion. So we’re expecting earnings per share next quarter of $0.46. That would give us a forward PE of 82.6 still quite high and no where in the league of Nvidia.

AMD Rating

Key takeaways from the report their data centre business is growing as it takes part in the AI boom. The firm has good free cash flow and they’re spending more on research and development which may hurt earnings in the short term, but will pay off in the subsequent quarters. On the con side, revenue is down quite a bit more than we’d like to see and Q2 guidance isn’t all that impressive. The PE ratio is not reasonable. The return on assets return and equity are poor. The other segments of the business seem to be struggling as well with the data centre business as the bright spot. That being said, we’re giving AMD a rating of sell. We like to see a return to profitability and more convincing AI-based revenue. We think that at these prices AMD has benefited from the AI hype rather than reality. We have no exposure to this company