Adobe reported second quarter earnings June 13. Their record revenue of $5.3 billion topped analysts estimates of $5.29 billion. The market sent the shares up $67 or more than 14% and the stock has kept moving higher despite a Federal Trade Commission into termination fee practices and Adobe possibly using its customer’s work to train its AI.

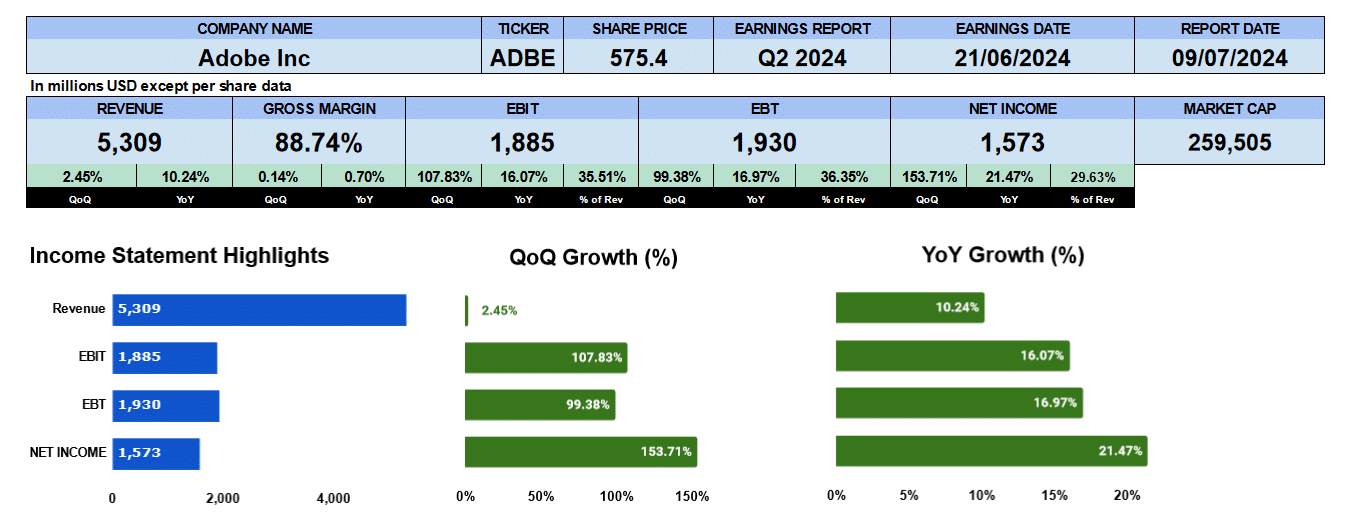

As mentioned, Adobe’s revenue was $5.3 billion. That was up 2.5% sequentially and 10% year over year. Gross margins were a solid 88.7% slightly better quarter on quarter and year over year. Operating profit was almost $1.9 billion up 107% quarter over quarter and 16% year over year. That’s about 36% operating profit. The large quarterly jump was attributed to a $1 billion fee Adobe incurred for the cancelled merger with Figma in Q1. Net income was almost $1.6 billion better by 154% sequentially and 22% year over year which is almost 30% of revenue.

Adobe Quarterly Revenue

Turning to our quarterly income statement bar chart we can see that adobe has been steadily growing since Q2 2022. We can see the dip in operating profit and net income in Q1 from the FIGMA charge. But if you back out that one time charge we can see the smooth and steady growth in those line items. Net revenue has been growing by over 2% on a quarterly compound basis. Gross profits, by 2.3%. operating profits at 2.4% and net income by 3.3%. Solid, steady growth.

Adobe Segment Revenue

Looking at revenue by segment Digital Media, in blue, is Adobe’s principal business line earning $3.9 billion and growing by 2.3%. Digital Experience, shown in red, reported $1.3 billion and that too has been growing slightly better than 2%for the last nine quarters. Their publishing and advertising business has been struggling, however, though just a fraction of overall top line at $74 million.

Digital Media Segment Revenue

A closer look at their Digital Media unit is Document Cloud, in red, their smallest segment, has been growing by 3% to earn $780 million this last quarter while their Creative segment reported $3.1 billion, growing 2%.

Adobe Revenue by Geography

Revenue by geography puts Americas as their biggest region by market share reporting $3.2 billion this quarter growing 2.6%. EMEA Reported nearly $1.4 billion growing 1.8%. And APAC, their smallest geography reported just $760 million expanding by 84 basis points these last nine quarters.

Adobe Fundamental Valuations

Let’s look at some ratios. Shares outstanding were down by 5 million. Earnings per share were a solid $3.49 Up 156% sequentially, and nearly 24% year over year. Sales per share were $11.80 at 3.6% and 12.2% respectively. Cash per share also grew to nearly $17 up 24% quarter over quarter and 43% year over year. Book value didn’t change much, standing at $32.91. Adobe’s PE is close to 40 with the SP500 around 28.38. The peg ratio at 11.97 suggests the earnings aren’t growing fast enough to justify the PE. The leverage ratios have the debt ratio at 0.14, debt to equity and 0.28 and interest coverage at 45 times. Liquidity ratios look good as well. Current ratio above 1 at 1.16, quick showing 1 and cash at 0.81. Return on Assets of 21% and return on equity at 42%. Very good. Adobe has an equity multiplier of 2.02. Return on Capital employed is 30%. Return on invested capital is 24.8%. Adobe’s effective tax rate is 21% giving us a NOPAT of $4.9 billion with an average debt and equity of $19.8 billion.

Looking at the cash flows, operating cash flows were actually lower to $1.9 billion last quarter, investing inflows reported $111 million and financing outflows posted $642 million. Free cash flow to the firm was up 40% to $7.6 billion. Very solid indeed.

Adobe doesn’t pay a dividend. Their Enterprise value is $247 billion which is 11.6 times revenue. 12.81 times EBITDA and 32 times free cash flow.

Adobe Q3 Guidance

The company provided guidance for full year and the next quarter with revenue between $5.33 and $5.38 billion in Q3. Giving us, by our estimate of EBIT around 35.5% and earnings per share of $3.45 to $3.50 takes us to a forward PE of 40.4.

Adobe Rating

Takeaways from the Adobe report are the continued solid gross margins, steady and constant growth, Lots of cash. Instead of paying dividends, the company’s buying back shares. Adobe is participating in the generative AI boom with an uptick in revenue. On the con side, we thought the price earnings multiple was rather large with respect to the market, though a premium stock does command a premium price. We’re high pressed to find anything else wrong with Adobe. Though perhaps, the FTC, investigating Adobe’s cancellation practices and it’s recently updated terms of services agreement that suggests customers work will be used to train Adobe Firefly when your work is placed in to Adobe Stock marketplace. This approach to customers might damage their credibility and trust. That being said along with the high PE we are giving Adobe a neutral rating. We have no exposure to this company.