Tesla reported their Q1 2024 April 23 and missed estimates. The shares hit a 52 week low the day before but shares were up on the news. In fact, the stock has been on a bit of a roll since with Tesla announcing a deal with China on self-driving cars and then the rebuilding of the Supercharger unit that had mysteriously been cut 2 weeks ago. We suspect management bringing them back at lower salaries to rein in costs.

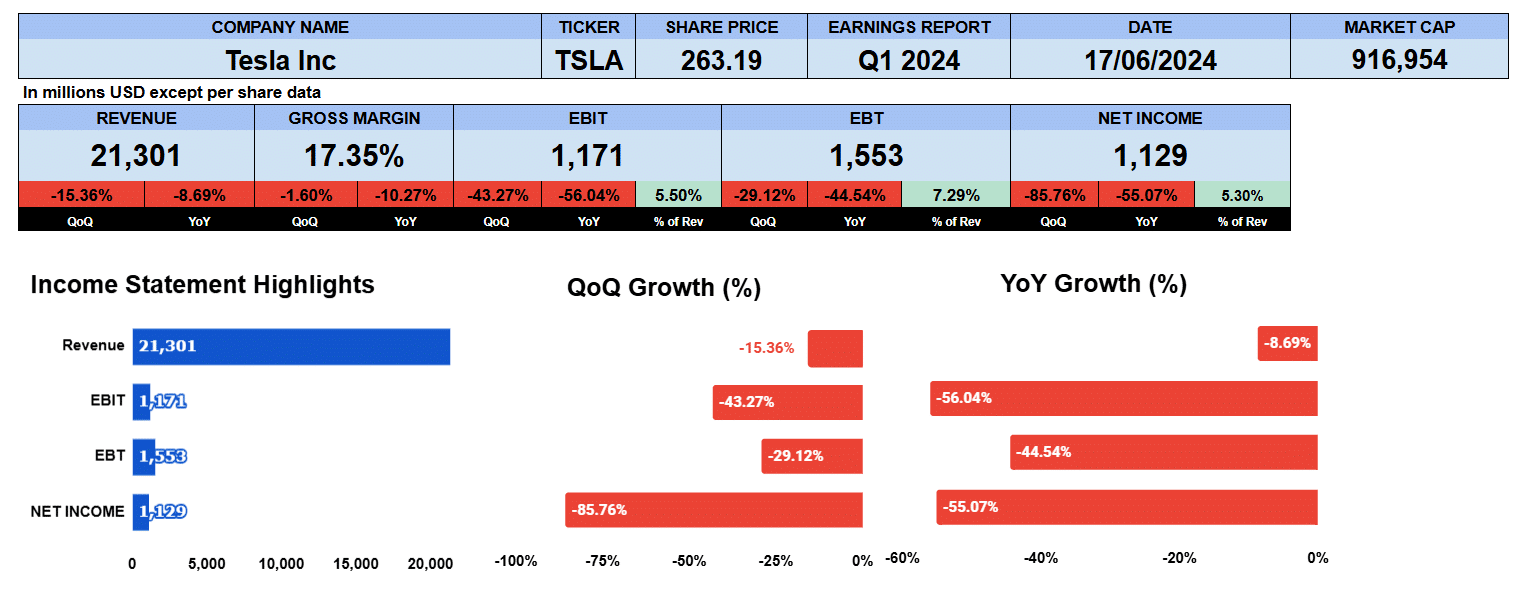

First quarter revenue was $21.3 billion that was down 15% quarter over quarter and almost 9% year over year. Gross margins continued lower contracting to 17.4% slightly down quarter over quarter but down by over 10% compared to Q1 2023. Operating profits were down by 43% quarter over quarter and 56% year over year. That gives us an operating margin of 5.5%. The bottom line was $1.1 billion down 85% quarter over quarter and 55% year over year. I think you would agree not terribly impressive results.

Tesla Quarterly Revenue

Looking at the quarterly Income Statement data since Q1 2022 we can see that revenue has been growing though margins and profits have been shrinking. Despite revenue being down on the quarter it has been growing at a 1.4% compound quarterly basis since Q1 2022. Gross profits, however, have contracted 4% while operating profit and net income are both down by 11%. We can see here the net income ticked up at the end of full year 2023 in the 4th quarter. The company realized a $5.7 billion tax benefit. Funny how that came at the end of the quarter when they’re reporting their full year earnings.

Tesla Business Line Revenue

Well let’s look at some of their business lines. Their model 3Y production was 412,376 units. As you can see that’s down quarter over quarter and less than Q4 2022 production. Other production was almost 21,000 units. Model 3Y production has been growing at a 4% compound quarterly growth rate and other production has been growing as well at 4.4%. Their operating lease business reported 173,000 vehicles, slightly lower quarter on quarter but that comes with a growth rate of 3.4% from Q1 2022. Their storage business showed 4 gigawatts last quarter. That was a large jump from Q4 2023 of about 30% and that unit has been growing at a 19% rate.

Tesla Locations and Mobile Service Fleet have both been steadily growing. Mobile Service Fleet finished at 1900 and Tesla Locations expanded to 1258 growing at a 5% basis and a 3.7% rate respectively. Supercharger stations, which we talked a little bit about earlier has being growing at a steady pace as well. They finished Q1 2024 at 6249 locations and that’s been expanding by 6% and the supercharger connectors business has also been growing finishing Q1 2024 at 57,579 units up 6% since Q1 2022. Outside the car production business the other units have continued to develop.

Tesla Fundamental Valuations

Well let’s look at some valuations. Shares outstanding were down 8 million on a fully diluted basis giving us an earnings per share of $0.32. For Q1, sales per share were $6.10 lower quarterly and annually. Cash per share was $7.71 lower on a quarterly basis but up 20% year over year. Book value improved to $18.50. The PE ratio of Tesla is 138 but that is on a annualized basis of $0.32 per share. The S&P500 PE is 27.17. Tesla’s peg ratio is -2.5. Tesla doesn’t have a lot of debt. The debt ratio is 0.03, debt to equity is 0.05 and interest coverage if 15 times. Tesla has a good deal of short-term liquidity. The current ratio at 1.7, the quick ratio 1.04 and cash at 0.91. The return on numbers show return on assets of just 4%, return on equity only 7%, return on capital employed 1.5%, and return on invested capital of 1.4%. Not very impressive numbers. Tesla has good cash flow though was lower due to higher inventory and AI Capex. Operating cash flow was $242 million down 90% year over year. Investing outflows were $5 billion. Financing inflows were $196 million with free cash flow to the firm of $12.5 billion. Tesla doesn’t pay a dividend. The Enterprise value of Tesla is $600 billion which is about seven times revenue, 40 times EBITDA and 48 times free cash flow.

Tesla Rating

The Key takeaways from the Pro side though the cash flow was lower at over $12 billion it’s still good an indicator. The other segments continue to expand diversifying earnings. Tesla has low debt and we like their ecosystem that supports the up take of electric cars in general. GM and Ford using Tesla’s supercharger network add to the long-term strength of the industry.

On the Con side we like to see revenue increasing and the margins increasing again. We see further margin pressure as the inventory is building up and will need to slash prices to move those vehicles. Return on assets and equity are not all that impressive. Investors seeing these numbers are likely put assets into higher returns for less risk. The market is becoming competitive at home and from China. Lithium is difficult to mine or harvest and hurts the environment. That being said we give Tesla a neutral rating.

We have no exposure to this company.