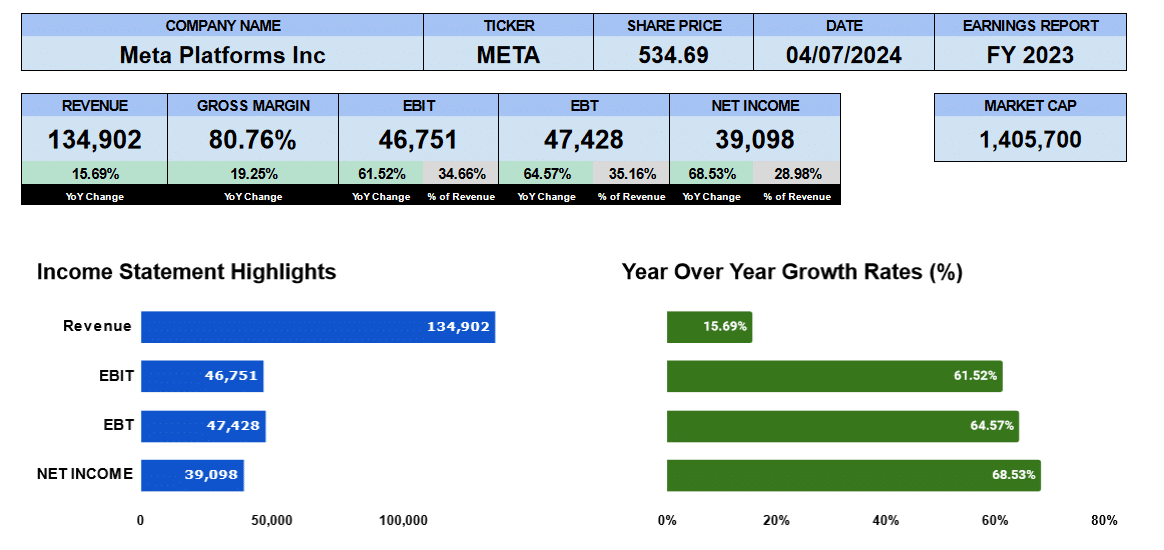

Meta reported their full year 2023 results on February 1. The market seemed rather happy for a number of reasons. First, record revenue of $135 billion up almost 16% from full year 2022, a $200 billion share buyback was announced and probably the most exciting item was that Meta declared a dividend of 50 cents.

Part of the success was that gross margins improved to nearly 81% with cost of revenue almost unchanged from 2022. Operating profit was close to $47 billion up 62% year over year. Net income was $39 billion up 68%. The other part of the successful results were driven by a reduction of sales and marketing expense by $3 billion or 14% year over year. Meta was able to generate more with less.

Meta Annual Revenue

Our 5 year income graph shows the improvement in the results. 5 year growth has been 14% but only 4.6% since the 2021 peak. The red line indicates gross profit and how much its improved since 2022 growing 13.5% since 2019. Operating profit increased by 14% the last 5 years though was flat over the 3 year period. Net income increasing 16% since 2019 but slightly lower when compared to the record net income in 2021.

Meta Revenue by Geography

Turning to their revenue foot print by geography North America reported $52.9 billion. Growth has been slowing as we see 5 year and 3 year compound annual growth rates at just 6.7% and 1% in the 5 and 3 year period respectively. Europe earned $31.2 billion with growth slowing since 2021 to less than 3% and 5 year growth at 12%. Asia Pacific showed strong performance over both the 3 and 5 year periods at 10.6% and 18.5%, respectively posting $36.2 billion in revenue. Its worth noting that China’s contribution to the last 3 years in the APAC geography realized $7.6 billion in 2021 and $13.7 billion in 2023 or 80% growth and 38% of total Asia revenue. The rest of the world sees similar growth as Asia though revenue was $14.7 billion.

Meta Family of App Metrics

Lets drill down to the family of app metrics they publish. They are broken down into Family Daily Active People (DAP), Family Monthly Active People (MAP), Facebook Daily Active Users (DAU) and Facebook Monthly Active Users (MAU).

Daily Active People (DAP) are defined as a registered and logged-in user of Facebook, Instagram, Messenger, and/or WhatsApp who visited at least one of these Family products through a mobile device application or using a web or mobile browser on a given day.

Daily Active Users (DAUs) are users registered and logged into Facebook who visited Facebook through their website or a mobile device, or used their Messenger application (and is also a registered Facebook user), on a given day.

Their Family of Apps as they call it, are Facebook, Instagram, Messenger and WhatsApp. Family daily active people has grown from 2.26 billion in 2019 to 3.19 billion in 2023. We won’t go over the details of every single item but pause the video and study it for yourself. The takeaway is that Meta’s user base is growing and continues to be engaged across all its applications or websites.

Meta Fundamental Valuations

Let’s review the financial ratios. Shares outstanding were down by 73 million shares or 2.7%. This will help boost per share data which is fully diluted. Earnings per share were $14.87 up 73%. Nice. Sales per share were better by 19% to $51.3. Cash per share jumped an impressive 193% to $16 per share. Book value came in at $58.26 up 25% giving the shares a PE of 31.6. The S&P 500 PE is 26.89. All the analysts are upgrading the shares but after the all time high share price META seems to be fully priced. PE growth is just 0.43.

The leverage ratios indicate Meta has low debt. The debt ratio at 0.08 and debt to equity at 0.12. Interest coverage is 28.5 times and the liquidity ratios don’t indicate any liquidity problems either. The current ratio at 2.67, quick at 2.5 and cash at 1.31. They need to something with that idle cash. The buyback and the dividends make sense.

Return on assets is 17% and Return on equity is 25.5% both improved with an equity multiplier of 1.5. Return on capital employed is 24% and return on capital invested is 23%. Meta is not exactly a capital intensive business but interesting to note.

The cash flow numbers are looking good. Operating cash flow is $71 billion up 41%. Investing outflow went to data centres and infrastructure reported $24.5 billion. Financing outflows were $19.5 billion consisting of largely of share buybacks. Free cash flow to the firm was $42.8 billion jumping 175%

The dividend nothing yet but that will change on February 22 when they will pay 50 cents quarterly. At the current share price and paying $2 for the year, yield is 0.004%. Not exactly passive income.

Enterprise value stands at $1.2 trillion which is a 9 times multiple to revenue and a 28 times multiple to free cash flow.

Meta Guidance

First quarter revenue is expected to be in the range of $34.5 billion to $35.7 billion. Using the midpoint that’s down 11% quarter over quarter and up 25% from Q1 2023. Apparently better than expected.

Total expenses for full year 2024 are expected to be between $94 – $98 billion. They cited higher infrastructure-related costs, growth in payroll expenses and operating losses to increase meaningfully in ReailityLabs. Reality labs lost $16.1 billion this year and $13.7 billion in 2022.

Meta Rating

Key Takeaways from the report is revenue was great, margins great, user growth continues so more eyeballs on ads. The dividend is more symbolic than anything but could be the catalyst to get the other big tech firms to start paying dividends. The Con side we think the PE is high relative to the market. Expenses are expected to accelerate with staff and infrastructure investment. ReailityLabs has yet to provide anything meaningful and advertising revenue is shrinking. Meta is subject to it’s advertisers a significant risk to its overall performance.

We rate Meta Neutral. Yes all the analysts are upgrading Meta is firing on all cylinders but are you willing to buy at these prices? The risk to reward is too high. The dividend announcement and the hype around AI we think have over valued Meta in the short-term.

We have no exposure to this company.