Delta Airlines full year 2023 earnings report beat consensus expectations and boasted a record year but shares ended the trading day lower for the company. The sell off was attributed to lowered 2024 guidance. We think this is a buying opportunity, however. Let’s take a look at the earnings in detail and see why.

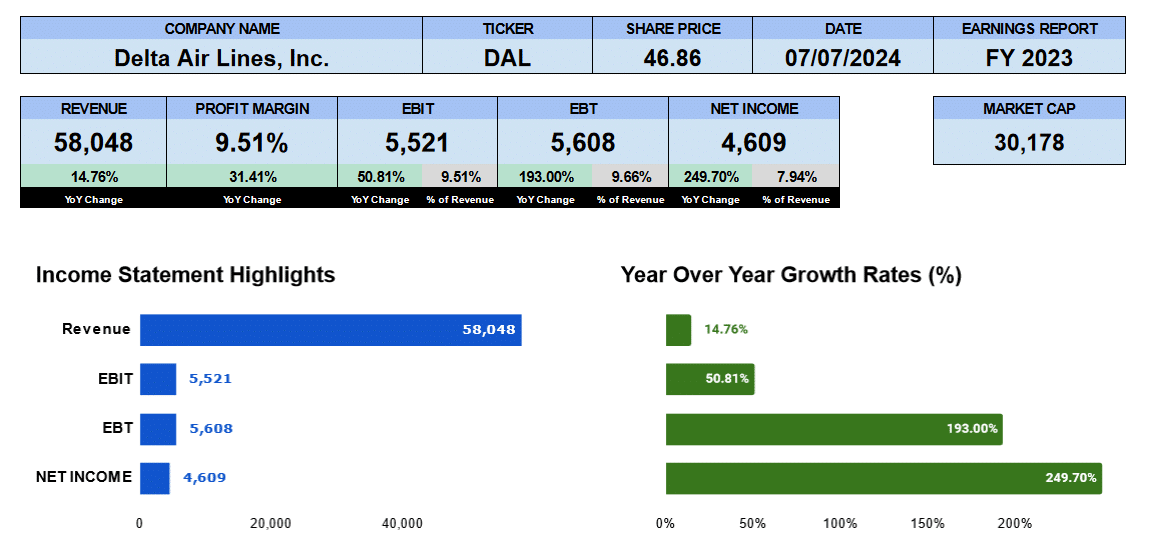

2023 revenue came in at $58 billion up nearly 15% year over year. Profit margin was 9.51 better by 31% or $5.5 billion. Net income was $4.6 billion up 250% from full year 2022.

Delta Airlines Passenger Revenue

Drilling down on passenger revenue ticket sales in the main cabin were up 20% to $24.5 billion. Premium product sales grew by 26% to 19.1 billion. Loyalty rewards revenue grew by 19% to nearly 3.5 billion and travel related services, the slowest growing and smallest revenue segment saw just 9% improvement to %1.85 billion.

Delta Airlines Passenger Data

Some further data provided by Delta Airlines shows that per passenger mile yield was up 2% to 21 cents. Revenue by seat increased 4% to 18 cents though total revenue per seat was lower by 2% to 21.34 cents. Cost per seat was down 4% to 19.31

Passenger seat miles jumped 19% to 232.2 billion miles year over year and available seat miles improved by 17% to 272 billion miles. The airlines sold more seats at higher ticket prices amid lower fuel costs in 2023 compared to 2022.

Delta Airlines Fundamental Valuations

Turning to the per share ratios. The number of shares outstanding increased by 3 million which will have a slightly worse impact on these multiples. Earnings per share jumped 248% to $7.16. Sales per share were $90 better by 14.2%. Cash per share increased by 21% year over year to $4.26. Book value came in at $17 per share up 66%. The PE ratio is 5.4 compared to the SP500 just shy of a 26 multiple.

Leverage ratios were much improved too. The debt ratio came in at 0.23 better by 19%, Debt to equity improved by 50% to 1.56 and the interest coverage ratio at 6.62 shows that Delta is more than able to coverage its interest payments.

Liquidity ratio were all improved with the current ratio at 0.38, the quick ratio at 0.26 and the cash ratio coming in at 0.1

The equity multiple at 6.7 indicates that Delta is using a large amount of debt to finance operations. The firm took steps to reduce its debt load last year by $2.6 billion. We’ll keep an eye on this ratio going forward. Return on assets were improved to 6.27% and return on equity was good at 42%

Operating cash flow was $545 million, investing cash outflow we only $535 million last year and financing cash flow was $416 million. Free cash flow to the firm was a healthy $3.4 billion.

Delta Airlines started to pay a dividend of 10 cents yielding 0.26%. Always a good sign that future prospects for company are positive.

Delta’s enterprise value is $38 billion which is 0.67 multiple of revenue and 11.5 multiple of free cash flow. Market capitalization to net income is 5.4 times.

As mentioned the company lowered guidance and are expecting a non-GAAP earnings per share of between $6 and 7$. If we assume $6.5 per share the company has a forward PE of 5.9. Free cash flow is expected to be between $3 and $4 billion.

Delta Airlines Rating

Key takeaways from this report show that the financials overall are strong, the dividend re initiated is a good sign for the future, the low PE is attractive and the leverage situation is improving. On the con side, however, the debt is still quite exposing the company to interest rate fluctuations, the PEG ratio is below one. Economic factors and geopolitical tension make Delta Airlines susceptible to higher costs and lower passenger revenue.

We give Delta Airlines a buy rating. We have no exposure to this company.