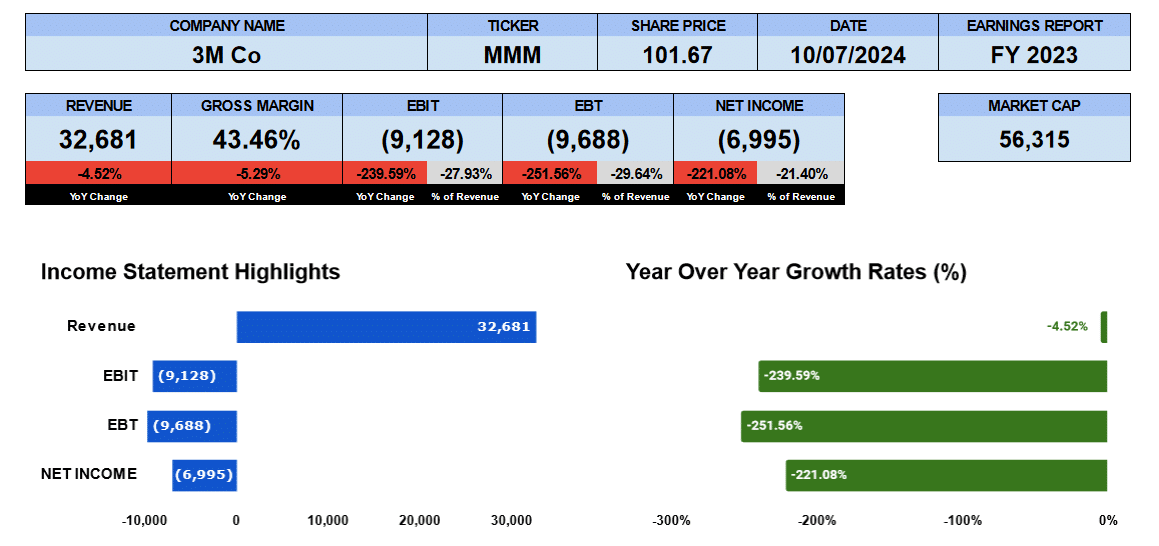

3M (NYSE:MMM) or Minnesota Mining and Manufacturing reported full year 2023 earnings January 23. The results reflect the full weight of settled litigation regarding combat earplugs used in the military and polyfluoroalkyl or PFAS chemicals found in drinking water. We’ll first look at he Income statement highlights then remove these 2 significant charges to get a clearer performance picture of 3M.

Revenue was down 4.5% to $32.7 billion. Gross margins were slightly lower to 43.5%. For operating income we start to see the impact of the one-time charges. EBIT was -$9.1 billion, pretax income was negative $9.7 billion and net income earned a loss of $7 billion. The market cap for 3M is $53 billion

The release from the company provided details of the impact of the write-off going back to full year 2022 where adjusted Earnings per share would have been $9.24 in 2023 and $9.88 in 2022. And operating margins at 20.3 % and 21.1% respectively. Let’s see what that looks like.

We can that operating margin and net income were lower by around 8.5% year over year.

3M Annual Revenue

The 5 year income statement shows revenue peaked in 2021 with a 5 year compound annual growth of just 34 basis points. Gross profits over that 5 years contracted by 1% reflecting inflation hitting cost of goods sold. Operating profit and net income have been growing at 144 basis points and 253 basis points respectively as 3M would be improving operational efficiency over those 5 years. The three year compound annual growth rates tell a different story however with post COVID growth declining across all line items from their peak in 2021. Perhaps a truer reflection on the impact of inflation.

3M Business Segment Revenue

Looking at the business segment revenue over the 5 year period the Health Care segment has been growing at 2% while the other 3 business lines, safety and industrial, transportation and electronics and consumer all contracting from 240 basis points to 40 basis points. We can see here during the 2021 revenue peak that all business lines were performing well. The 3 year growth rates haven’t been all that impressive with contraction between 3 and 5%. Perhaps firms and consumers are not so eager to buy from 3M given the recent litigation problems.

3M Fundamental Valuations

Now we turn to financial ratios. please keep in mind that these ratio are based on the extraordinary costs from the military earplugs and public water systems charges being removed form the respective financial statements.

First of all 3M retired 13.7 million shares or about 2.4% last year. Earnings per share came in at $9.24 down 6.5%. Sales per share are $59 slightly lower year over year. Cash per share was up 66% to $10.71. Book value was down 66% to $8.79. Equity took a big hit from the legal settlements and will remain going forward so it wasn’t backed out in the calculations. The PE of 3M is only 10.4 compared to the S&P500 with a PE of 26.40. The PE growth rate stands at -1.6

The debt ratio improved to 0.26 with long term debt falling by $ 1 billion and total assets increasing by $4 billion partly due to higher cash. Debt to equity took a big hit to 2.7 with equity down by $10 billion. Interest coverage was worse due to lower operating incomes and higher interest expense though 11.8 is a healthy number. Liquidity ratios have a good current ratio at 1.07, the quick ratio at 0.7 and cash ratio at 0.39.

Return on assets were 10% lower by 16% year over year. Return on equity is distorted by the write-offs. Return on capital invest was 18.8%. Return on invested capital was 8.6%

The cash flow data is quite good. Operating cash flow was up 20% to 6.7 billion. Investing outflows were 1.2 billion while financing outflows were $3.1 billion. Free cash flow to the firm was up 62% to nearly $6 billion. 3M paid $6 in dividends in full year 2023 yielding 6.2% with a growth rate of 0.7%. Enterprise value stands at $60 billion which translates into 1.85 revenue multiple and a 10.2 to free cash flow. Market cap to net income is 10.4 X

3M Guidance

3M’s guidance was that sales would be 0.25 to 2.25%. we conservatively used 1% in our 2024 estimate. They also said the EPS would be between $9.35 and $9.75 per share. We used the mid-point or $9.55 in our estimate and 2023s outstanding shares to arrive at net income. We used the 5 year average of 45.8% to calculate gross margin and the operating margin average of 20.7% to complete our estimate for 2024. 3M is currently trading at a 10.06 multiple using our $9.55 as earnings.

3M Rating

Key takeaways on the pro side is that 3M has a low PE, good cash flow, its litigation problems are behind it and the dividend yield is still good. On the con side revenue and margins have been contracting over the past 5 years and more so in the last 3. It’s our contention that the nature of the legal disputes, public water contamination and faulty equipment for the military, have brought some reputation risk to Minnesota Mining and Manufacturing. The health-care business spin-off leaves removes the best performing business from 3M

Our rating for this company is a neutral to a buy. The share price is at 10 year lows. How much lower can it really go? But we think the share price will need to consolidate at this price range. For dividend hunters the yield is quite good.

We have no exposure to this company.